Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Peters Company leased a machine from Johnson Corporation on January 1, 2024. The machine has a fair value of $13,000,000. The lease agreement calls

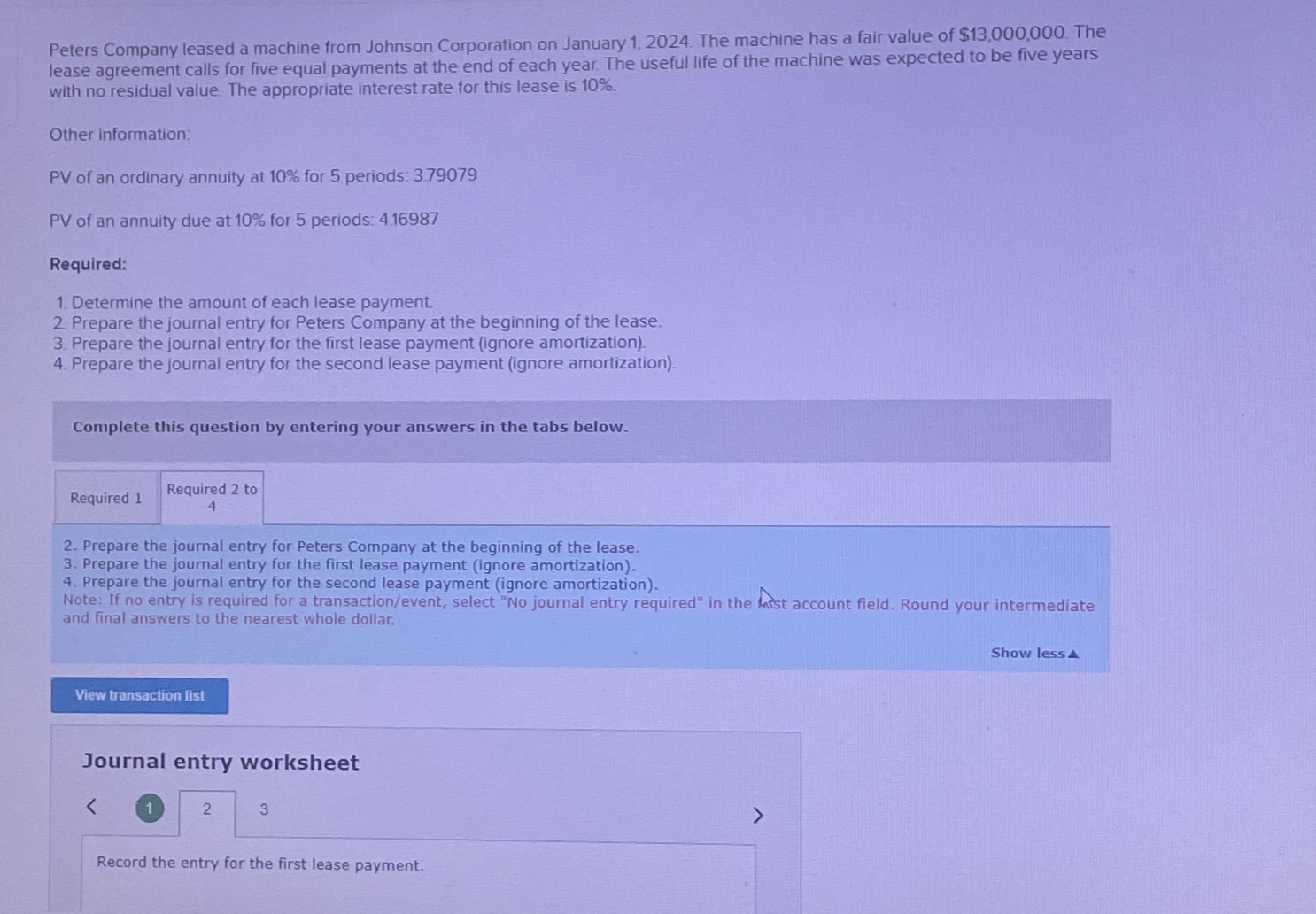

Peters Company leased a machine from Johnson Corporation on January 1, 2024. The machine has a fair value of $13,000,000. The lease agreement calls for five equal payments at the end of each year. The useful life of the machine was expected to be five years with no residual value. The appropriate interest rate for this lease is 10%. Other information: PV of an ordinary annuity at 10% for 5 periods: 3.79079 PV of an annuity due at 10% for 5 periods: 4.16987 Required: 1. Determine the amount of each lease payment. 2. Prepare the journal entry for Peters Company at the beginning of the lease. 3. Prepare the journal entry for the first lease payment (ignore amortization). 4. Prepare the journal entry for the second lease payment (ignore amortization). Complete this question by entering your answers in the tabs below. Required 1 Required 2 to 4 2. Prepare the journal entry for Peters Company at the beginning of the lease. 3. Prepare the journal entry for the first lease payment (ignore amortization). 4. Prepare the journal entry for the second lease payment (ignore amortization). Note: If no entry is required for a transaction/event, select "No journal entry required" in the Asst account field. Round your intermediate and final answers to the nearest whole dollar. View transaction list Journal entry worksheet < 2 3 Record the entry for the first lease payment. Show lessA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Amount of each lease payment PV of annuity of 13000000 for 5 years at 10 13000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dcbcda41c1_962055.pdf

180 KBs PDF File

663dcbcda41c1_962055.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started