Question

Peters Curling Inc. operates several curling centres (for games and equipment sales). The following transactions occurred in the month of October. (a) Peters collected $15,400

| Peters Curling Inc. operates several curling centres (for games and equipment sales). The following transactions occurred in the month of October. |

| (a) | Peters collected $15,400 from customers for games played in October. |

| (b) | Peters sold $10,400 in curling equipment inventory; received $6,600 in cash and the rest on account; cost of sales is $6,400. |

| (c) | Peters received $4,600 from customers on account who purchased merchandise in September. |

| (d) | The curling league gave Peters a deposit of $5,100 for the upcoming fall season. |

| (e) | Peters paid $5,600 for the September electricity bill and received the October bill for $6,160 to be paid in November. |

| (f) | Peters paid $7,600 to employees for work in October. |

| (g) | Peters purchased $2,280 in insurance for coverage from October 1 to December 31. |

| (h) | Peters paid $2,800 to plumbers for repairing a broken pipe in the washrooms. |

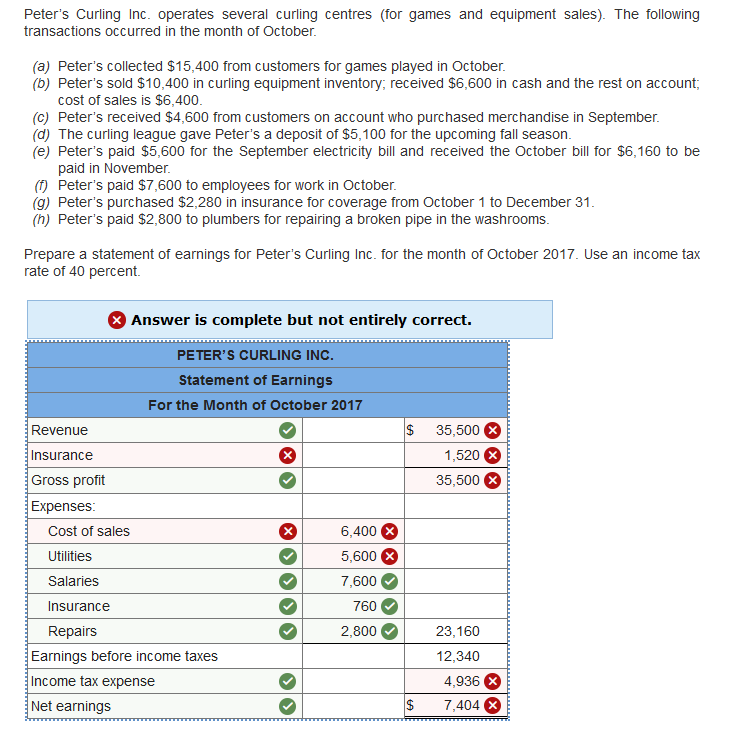

Prepare a statement of earnings for Peters Curling Inc. for the month of October 2017. Use an income tax rate of 40 percent. Here is what I have done : Row 1 : Revenue : 15,400 + 10,400 + 4,600 + 5,100 = 35,500 Row 2 : blank Row 3 : Row 3 forces us to choose either Gross Profit or Gross loss - I chose gross profit but could not get the correct answer Row 4 : Place holder , written as "Expenses :" cannot enter any values either. Row 5 to Row 10 : Listed each expense in it's own row. Row 5 : cost of sales / 6400 unsure why this is wrong Row 6 : utilities / 5600 unsure why this is wrong Row 7 : Salaries / 7600 is correct Row 8 : Insurance / 760 is correct Row 9 : Repairs / 2800 is correct Row 10 : Place holder - Earnings before income taxes / autocalculated to 12,340 is wrong, Row 11 : Income tax expense / 4036 is wrong Row 12 : Net earnings / 7404 is wrong.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started