Answered step by step

Verified Expert Solution

Question

1 Approved Answer

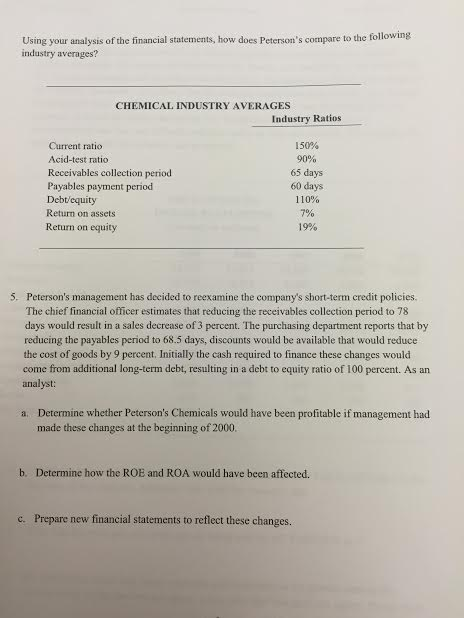

Petersons company had negative net income both in 1999 and 2000. Return on equity reduced from -28.75 in 1999 to -76.99 in 2000. Whereas the

Petersons company had negative net income both in 1999 and 2000. Return on equity reduced from -28.75 in 1999 to -76.99 in 2000. Whereas the industry return on requity is 19%. This shows that Pertersons company is performing at below than average.

5 - A B C

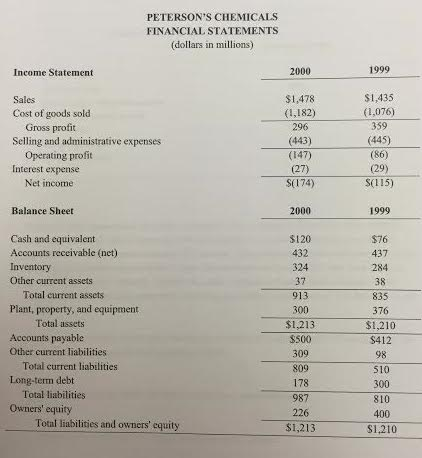

PETERSON'S CHEMICALS FINANCIAL STATEMENTS (dollars in millions) Income Statement 2000 1999 $1,478 (1,182) 296 (443) (147) $1,435 (1,076) 359 (445) (86) (29) S(115) Sales Cost of goods sold Gross profit Operating profit Net income Selling and administrative expenses Interest expense S(174) Balance Sheet 2000 1999 $76 437 284 38 835 376 $1,210 $412 98 510 300 810 400 $1,210 Cash and equivalent Accounts receivable (net) Inventory Other current assets 120 432 324 37 913 300 $1,213 $500 309 809 178 987 226 $1,213 Total current assets Plant, property, and equipment Total assets Accounts payable Other current liabilities Total current liabilities Long-term debt Total liabilities Owners' equity Total liabilities and owners' equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started