Answered step by step

Verified Expert Solution

Question

1 Approved Answer

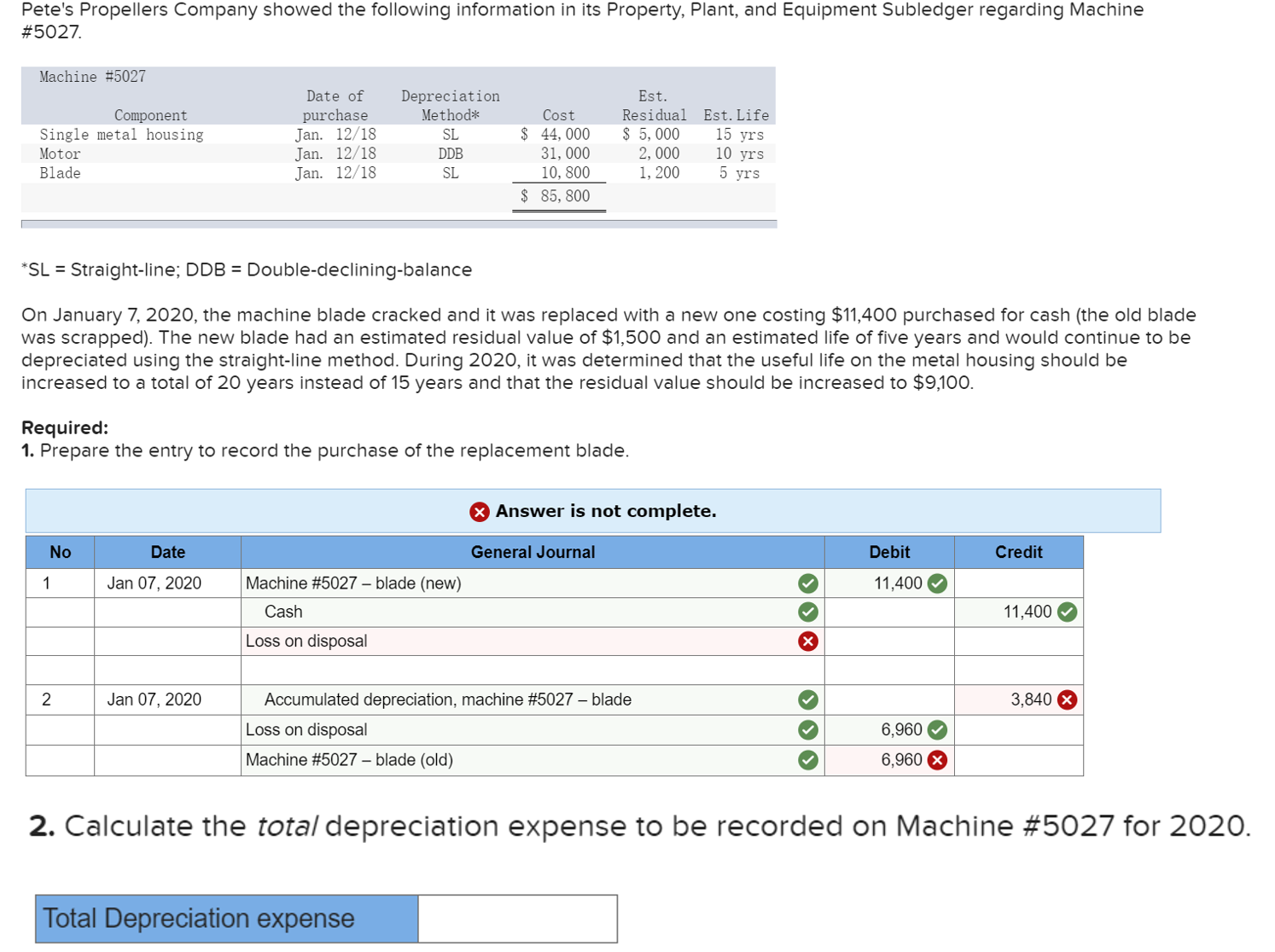

Pete's Propellers Company showed the following information in its Property, Plant, and Equipment Subledger regarding Machine #5027. Machine #5027 Component Date of purchase Depreciation

Pete's Propellers Company showed the following information in its Property, Plant, and Equipment Subledger regarding Machine #5027. Machine #5027 Component Date of purchase Depreciation Method* Cost Single metal housing. Jan. 12/18 SL $ 44,000 Motor Jan. 12/18 DDB Blade Jan. 12/18 SL 31,000 10,800 $ 5,000 2,000 10 yrs 1,200 Est. Residual Est. Life 15 yrs 5 yrs $ 85,800 *SL = Straight-line; DDB = Double-declining-balance On January 7, 2020, the machine blade cracked and it was replaced with a new one costing $11,400 purchased for cash (the old blade was scrapped). The new blade had an estimated residual value of $1,500 and an estimated life of five years and would continue to be depreciated using the straight-line method. During 2020, it was determined that the useful life on the metal housing should be increased to a total of 20 years instead of 15 years and that the residual value should be increased to $9,100. Required: 1. Prepare the entry to record the purchase of the replacement blade. Answer is not complete. No 1 Date Jan 07, 2020 General Journal Debit Credit Machine #5027 -blade (new) 11,400 Cash 11,400 Loss on disposal 2 Jan 07, 2020 Accumulated depreciation, machine #5027 -blade Loss on disposal Machine #5027 -blade (old) 3,840 6,960 6,960 2. Calculate the total depreciation expense to be recorded on Machine #5027 for 2020. Total Depreciation expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started