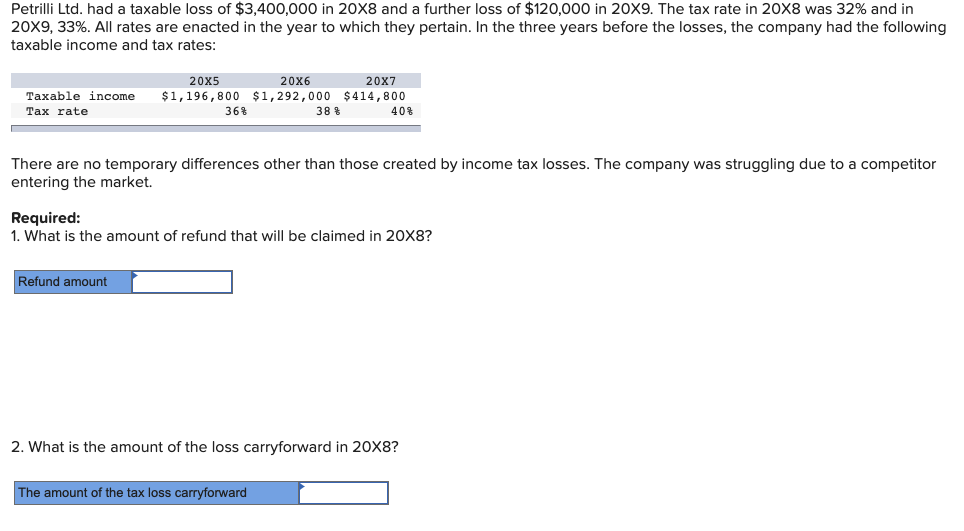

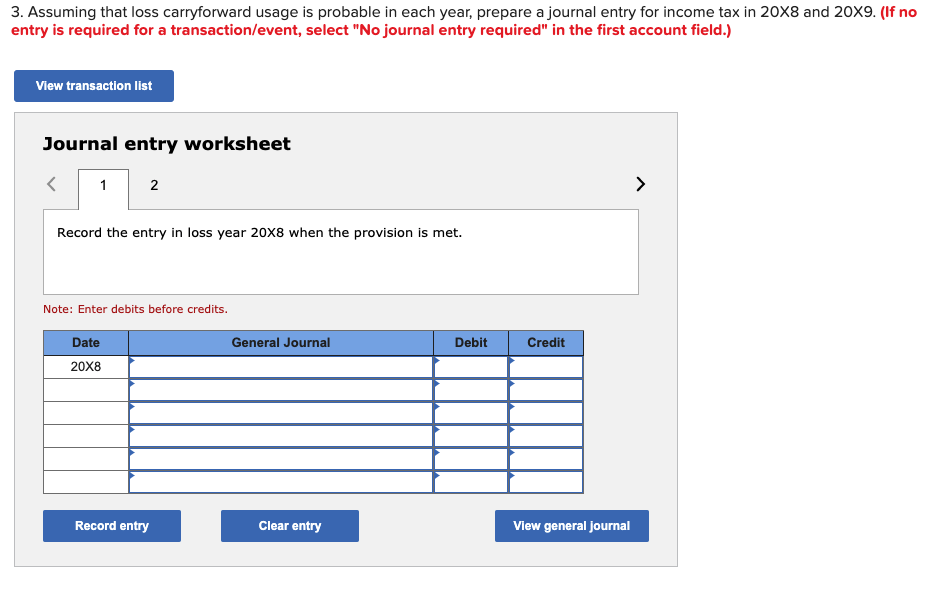

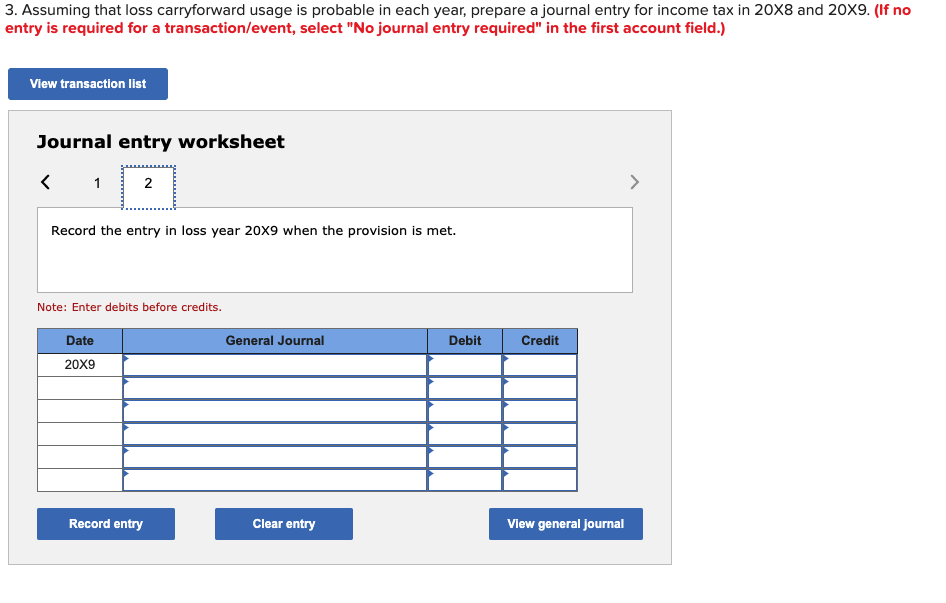

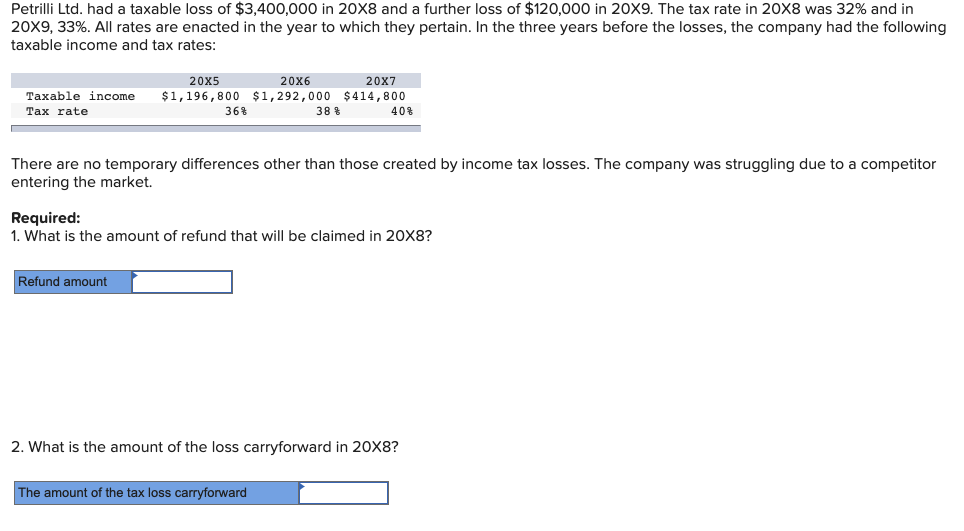

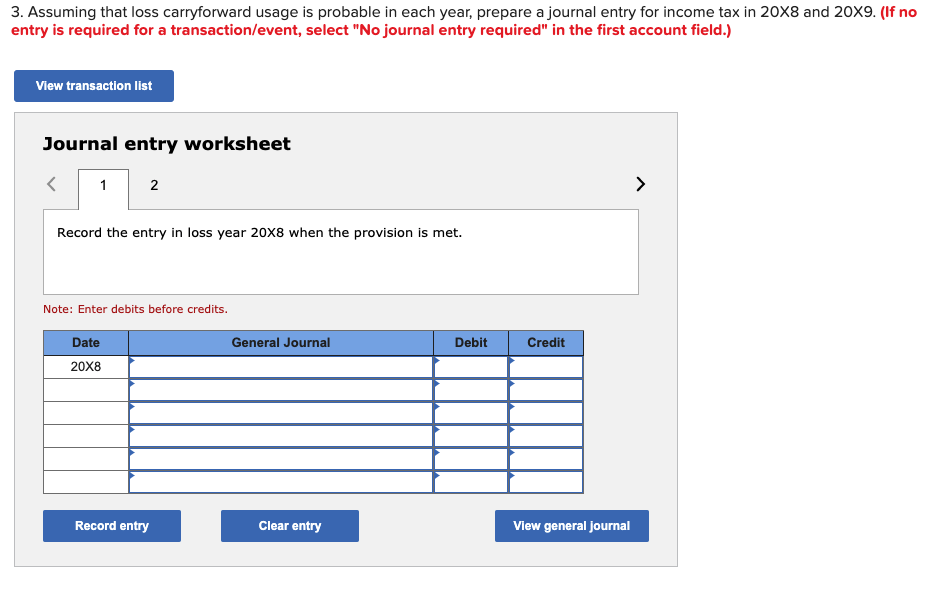

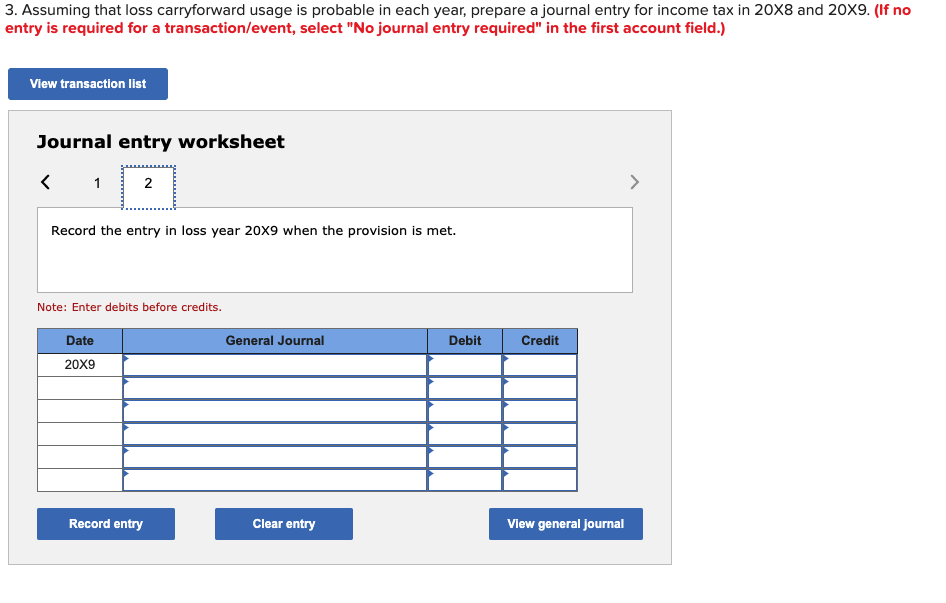

Petrilli Ltd. had a taxable loss of $3,400,000 in 20X8 and a further loss of $120,000 in 20X9. The tax rate in 20X8 was 32% and in 20X9, 33%. All rates are enacted in the year to which they pertain. In the three years before the losses, the company had the following taxable income and tax rates: 20x7 Taxable income Tax rate 20x5 20x6 $1,196,800 $1,292,000 $414,800 36% 38 % 408 There are no temporary differences other than those created by income tax losses. The company was struggling due to a competitor entering the market. Required: 1. What is the amount of refund that will be claimed in 20X8? Refund amount 2. What is the amount of the loss carryforward in 20X8? The amount of the tax loss carryforward 3. Assuming that loss carryforward usage is probable in each year, prepare a journal entry for income tax in 20x8 and 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 12 > Record the entry in loss year 20x8 when the provision is met. Note: Enter debits before credits. General Journal Debit Credit Date 20x8 Record entry Clear entry View general Journal 3. Assuming that loss carryforward usage is probable in each year, prepare a journal entry for income tax in 20X8 and 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 > Record the entry in loss year 20x9 when the provision is met. Note: Enter debits before credits. General Journal Debit Credit Date 20X9 Record entry Clear entry View general journal Petrilli Ltd. had a taxable loss of $3,400,000 in 20X8 and a further loss of $120,000 in 20X9. The tax rate in 20X8 was 32% and in 20X9, 33%. All rates are enacted in the year to which they pertain. In the three years before the losses, the company had the following taxable income and tax rates: 20x7 Taxable income Tax rate 20x5 20x6 $1,196,800 $1,292,000 $414,800 36% 38 % 408 There are no temporary differences other than those created by income tax losses. The company was struggling due to a competitor entering the market. Required: 1. What is the amount of refund that will be claimed in 20X8? Refund amount 2. What is the amount of the loss carryforward in 20X8? The amount of the tax loss carryforward 3. Assuming that loss carryforward usage is probable in each year, prepare a journal entry for income tax in 20x8 and 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 12 > Record the entry in loss year 20x8 when the provision is met. Note: Enter debits before credits. General Journal Debit Credit Date 20x8 Record entry Clear entry View general Journal 3. Assuming that loss carryforward usage is probable in each year, prepare a journal entry for income tax in 20X8 and 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 > Record the entry in loss year 20x9 when the provision is met. Note: Enter debits before credits. General Journal Debit Credit Date 20X9 Record entry Clear entry View general journal