Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PetroSol Corporation is a leading producer of oil-based lubricants, focusing on the mid-west to western regions of the United States. These products are used

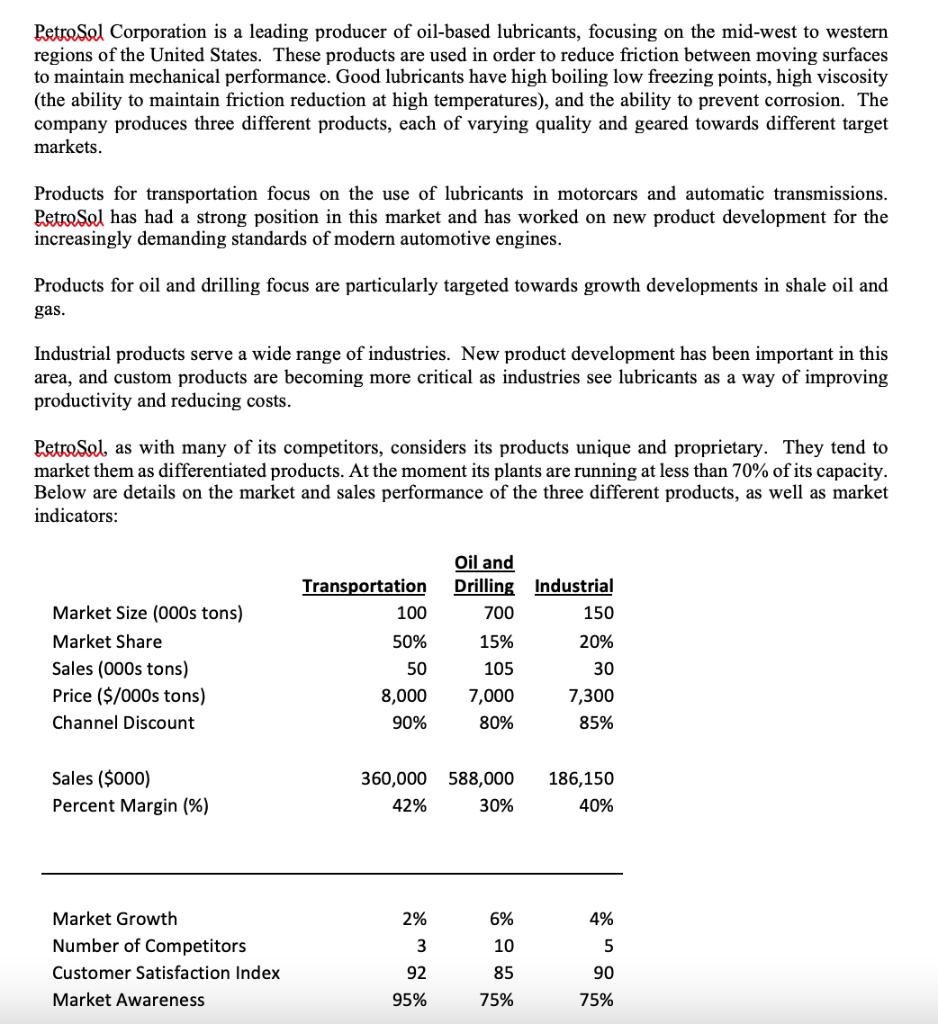

PetroSol Corporation is a leading producer of oil-based lubricants, focusing on the mid-west to western regions of the United States. These products are used in order to reduce friction between moving surfaces to maintain mechanical performance. Good lubricants have high boiling low freezing points, high viscosity (the ability to maintain friction reduction at high temperatures), and the ability to prevent corrosion. The company produces three different products, each of varying quality and geared towards different target markets. Products for transportation focus on the use of lubricants in motorcars and automatic transmissions. PetroSol has had a strong position in this market and has worked on new product development for the increasingly demanding standards of modern automotive engines. Products for oil and drilling focus are particularly targeted towards growth developments in shale oil and gas. Industrial products serve a wide range of industries. New product development has been important in this area, and custom products are becoming more critical as industries see lubricants as a way of improving productivity and reducing costs. PetroSol, as with many of its competitors, considers its products unique and proprietary. They tend to market them as differentiated products. At the moment its plants are running at less than 70% of its capacity. Below are details on the market and sales performance of the three different products, as well as market indicators: Market Size (000s tons) Market Share Sales (000s tons) Price ($/000s tons) Channel Discount Sales ($000) Percent Margin (%) Market Growth Number of Competitors Customer Satisfaction Index Market Awareness Transportation 100 50% 50 8,000 90% 360,000 588,000 42% 30% 2% 3 Oil and Drilling 700 15% 105 7,000 80% 92 95% 6% 10 85 75% Industrial 150 20% 30 7,300 85% 186,150 40% 4% 5 90 75% The three product lines are all sold through distributors, who then re-sell the product to various customers. PetroSol Corp. sells the products to distributors at a discount to the price final customers pay (channel discount). This enables distributors to cover costs and make profit. The discount is determined not only by this need, but also reflects bargaining power between suppliers and distributors. A higher discount reflects better bargaining power of the product producers. Marketing costs represent 10% of revenues. Each product is sold through different types of distributors that specialise in specific products. Distribution of transportation lubricants tends to be intensive (numerous distributors), while for oil and drilling it is quite selective (limited distribution). Industrial products are less intensive than that for transportation products. The corporation also incurs non-marketing general and administrative expenses of $100 million. It also has an equity value of $2 billion and pays a 20% effective tax rate. The company's target return on equity is a minimum 12%. At present, shareholders are placing pressure on management to improve financial performance. After exhaustive efforts to reduce costs, the CEO has now asked marketing to review its product lines in an attempt to improve margins. Questions: 1) Calculate the gross margin, marketing contribution, marketing return on sales and marketing return on investment for each product line. 2) Rank the financial performance of each product. Discuss why the performance of each product differs. 3) What would you recommend in order to obtain the corporations required return on equity? Consider how you would reallocate marketing expenses in order to grow and/or reduce sales of a product. Would you consider eliminating any products?

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Oil and Drilling lubes are the one with highest growth in the last financial term but still their ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started