Answered step by step

Verified Expert Solution

Question

1 Approved Answer

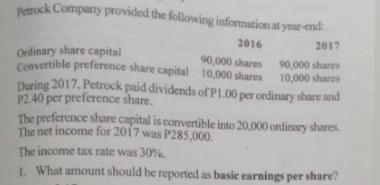

Petrock Company provided the following information at year-end 2016 Ordinary share capital 90,000 shares Convertible preference share capital 10,000 shares 2017 90,000 shares 10,000

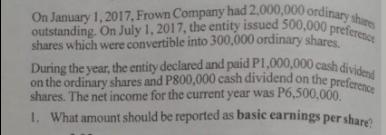

Petrock Company provided the following information at year-end 2016 Ordinary share capital 90,000 shares Convertible preference share capital 10,000 shares 2017 90,000 shares 10,000 shares During 2017, Petrock paid dividends of P1.00 per ordinary share and P2.40 per preference share. The preference share capital is convertible into 20,000 ordinary shares. The net income for 2017 was P285,000. The income tax rate was 30%. 1. What amount should be reported as basic earnings per share? 2. What amount should be reported as diluted earnings per share? On January 1, 2017, Frown Company had 2,000,000 ordinary shares outstanding. On July 1, 2017, the entity issued 500,000 preference shares which were convertible into 300,000 ordinary shares. on the ordinary shares and P800,000 cash dividend on the preference During the year, the entity declared and paid P1,000,000 cash dividend shares. The net income for the current year was P6,500,000. 1. What amount should be reported as basic earnings per share? 2. What amount should be reported as diluted earnings per share?

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the basic earnings per share EPS we need to divide the net income applicable to ordinary shareholders by the weighted average number of ordinary shares outstanding during the per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started