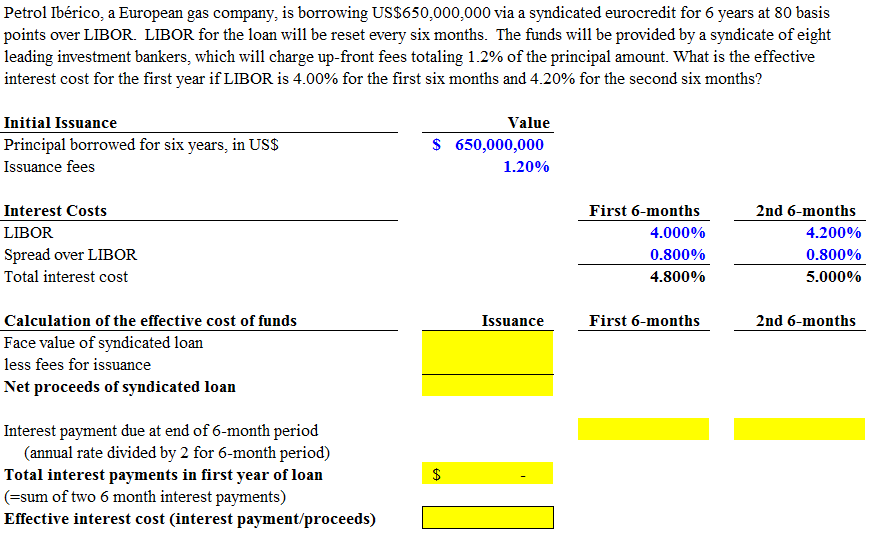

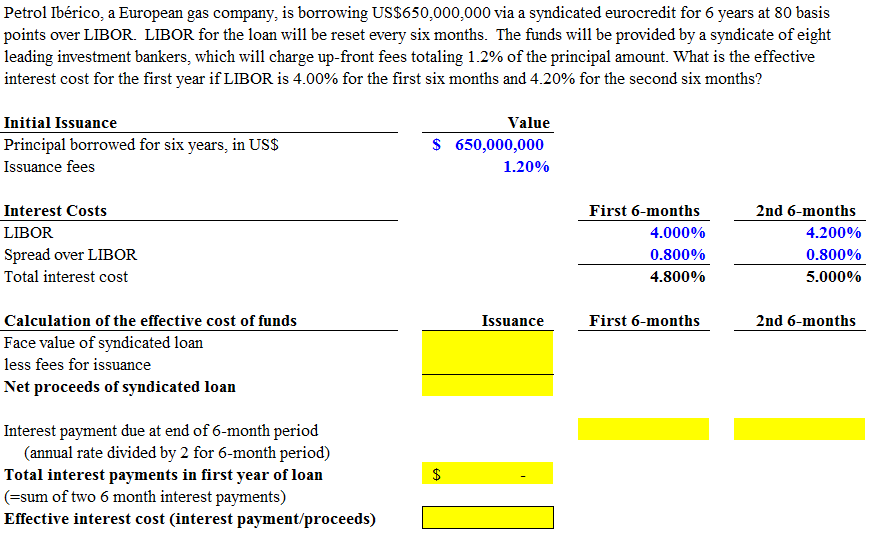

Petrol Ibrico, a European gas company, is borrowing US$650,000,000 via a syndicated eurocredit for 6 years at 80 basis points over LIBOR. LIBOR for the loan will be reset every six months. The funds will be provided by a syndicate of eight leading investment bankers, which will charge up-front fees totaling 1.2% of the principal amount. What is the effective interest cost for the first year if LIBOR is 4.00% for the first six months and 4.20% for the second six months? Initial Issuance Value Principal borrowed for six years, in US$ 650,000,000 Issuance fees 1.20% Interest Costs First 6-months 2nd 6-months LIBOR 4.000% 4.200% Spread over LIBOR 0.800% 0.800% Total interest cost 4.800% 5.000% Calculation of the effective cost of funds Issuance First 6-months 2nd 6-months Face value of syndicated loan less fees for issuance Net proceeds of syndicated loan Interest payment due at end of 6-month period (annual rate divided by 2 for 6-month period) Total interest payments in first year of loan (sum of two 6 month interest payments) Effective interest cost (interest payment/proceeds) Petrol Ibrico, a European gas company, is borrowing US$650,000,000 via a syndicated eurocredit for 6 years at 80 basis points over LIBOR. LIBOR for the loan will be reset every six months. The funds will be provided by a syndicate of eight leading investment bankers, which will charge up-front fees totaling 1.2% of the principal amount. What is the effective interest cost for the first year if LIBOR is 4.00% for the first six months and 4.20% for the second six months? Initial Issuance Value Principal borrowed for six years, in US$ 650,000,000 Issuance fees 1.20% Interest Costs First 6-months 2nd 6-months LIBOR 4.000% 4.200% Spread over LIBOR 0.800% 0.800% Total interest cost 4.800% 5.000% Calculation of the effective cost of funds Issuance First 6-months 2nd 6-months Face value of syndicated loan less fees for issuance Net proceeds of syndicated loan Interest payment due at end of 6-month period (annual rate divided by 2 for 6-month period) Total interest payments in first year of loan (sum of two 6 month interest payments) Effective interest cost (interest payment/proceeds)