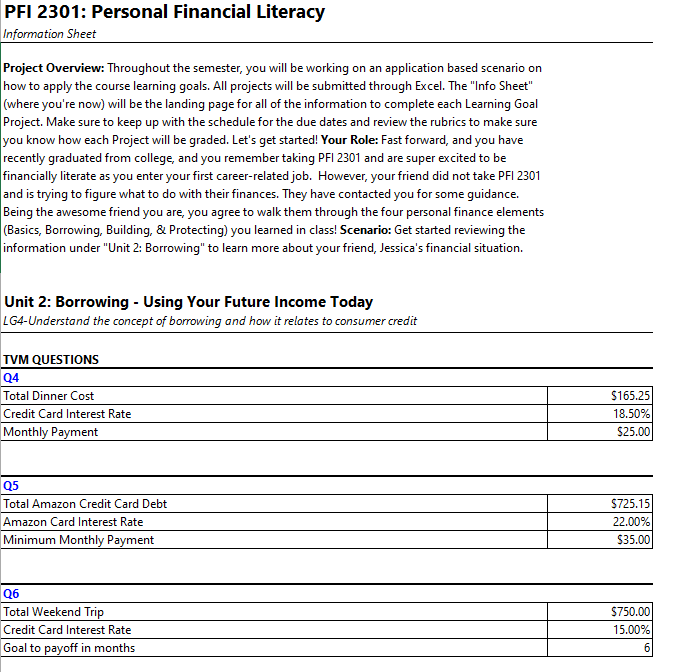

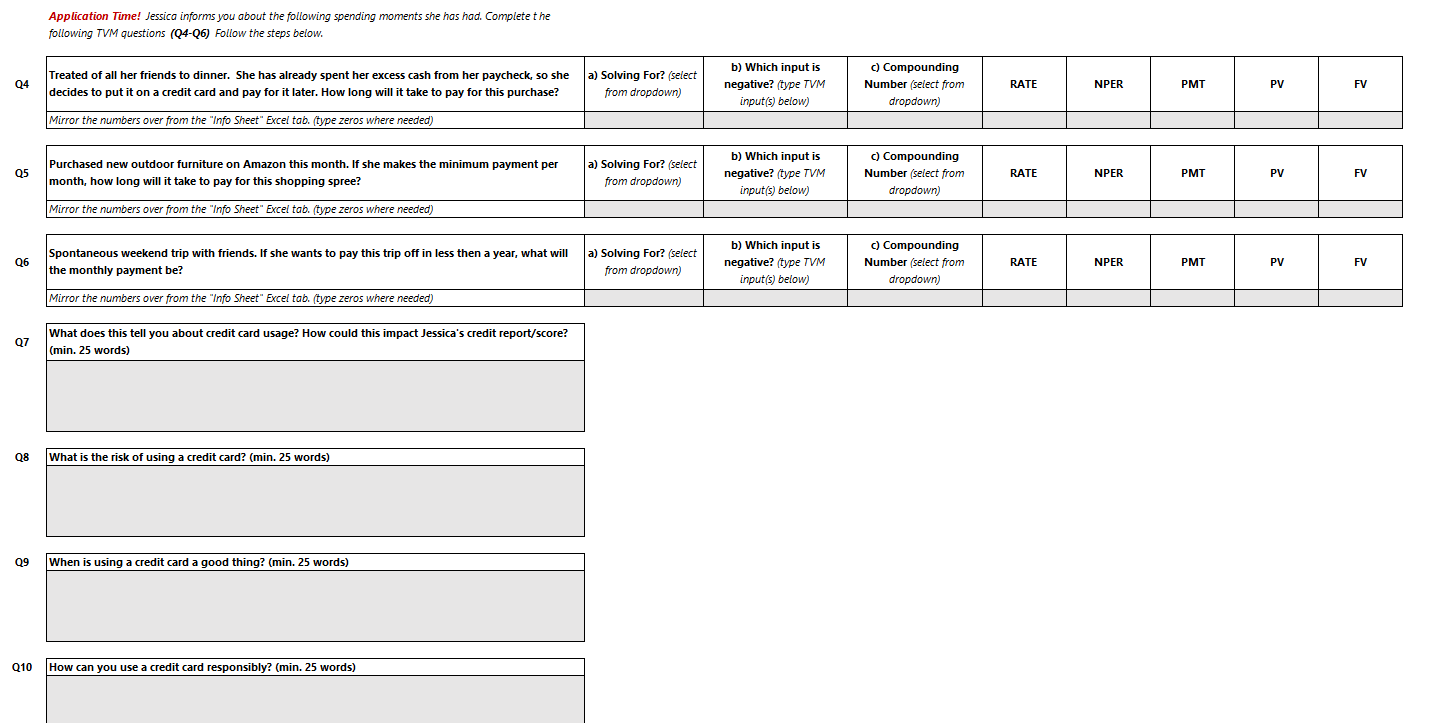

PFI 2301: Personal Financial Literacy Information Sheet Project Overview: Throughout the semester, you will be working on an application based scenario on how to apply the course learning goals. All projects will be submitted through Excel. The "Info Sheet" (where you're now) will be the landing page for all of the information to complete each Learning Goal Project. Make sure to keep up with the schedule for the due dates and review the rubrics to make sure you know how each Project will be graded. Let's get started! Your Role: Fast forward, and you have recently graduated from college, and you remember taking PFI 2301 and are super excited to be financially literate as you enter your first career-related job. However, your friend did not take PFI 2301 and is trying to figure what to do with their finances. They have contacted you for some guidance. Being the awesome friend you are, you agree to walk them through the four personal finance elements (Basics, Borrowing, Building, & Protecting) you learned in class! Scenario: Get started reviewing the information under "Unit 2: Borrowing" to learn more about your friend, Jessica's financial situation. Unit 2: Borrowing - Using Your Future Income Today LG4-Understand the concept of borrowing and how it relates to consumer credit TVM QUESTIONS Q4 Total Dinner Cost Credit Card Interest Rate Monthly Payment $165.25 18.50% $25.00 Q5 Total Amazon Credit Card Debt Amazon Card Interest Rate Minimum Monthly Payment $725.151 22.00% $35.00 Q6 Total Weekend Trip Credit Card Interest Rate Goal to payoff in months $750.00 15.00% 6 Application Time! Jessica informs you about the following spending moments she has had. Complete the following TVM questions (04-06) Follow the steps below. Q4 Treated of all her friends to dinner. She has already spent her excess cash from her paycheck, so she decides to put it on a credit card and pay for it later. How long will it take to pay for this purchase? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) c) Compounding Number select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab. (type zeros where needed) Q5 Purchased new outdoor furniture on Amazon this month. If she makes the minimum payment per month, how long will it take to pay for this shopping spree? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) Compounding Number (select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab. (type zeros where needed) Q6 Spontaneous weekend trip with friends. If she wants to pay this trip off in less then a year, what will the monthly payment be? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) c) Compounding Number (select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab. (type zeros where needed) 07 What does this tell you about credit card usage? How could this impact Jessica's credit report/score? (min. 25 words) . ) Q8 What is the risk of using a credit card? (min. 25 words) 09 When is using a credit card a good thing? (min. 25 words) Q10 How can you use a credit card responsibly? (min. 25 words) PFI 2301: Personal Financial Literacy Information Sheet Project Overview: Throughout the semester, you will be working on an application based scenario on how to apply the course learning goals. All projects will be submitted through Excel. The "Info Sheet" (where you're now) will be the landing page for all of the information to complete each Learning Goal Project. Make sure to keep up with the schedule for the due dates and review the rubrics to make sure you know how each Project will be graded. Let's get started! Your Role: Fast forward, and you have recently graduated from college, and you remember taking PFI 2301 and are super excited to be financially literate as you enter your first career-related job. However, your friend did not take PFI 2301 and is trying to figure what to do with their finances. They have contacted you for some guidance. Being the awesome friend you are, you agree to walk them through the four personal finance elements (Basics, Borrowing, Building, & Protecting) you learned in class! Scenario: Get started reviewing the information under "Unit 2: Borrowing" to learn more about your friend, Jessica's financial situation. Unit 2: Borrowing - Using Your Future Income Today LG4-Understand the concept of borrowing and how it relates to consumer credit TVM QUESTIONS Q4 Total Dinner Cost Credit Card Interest Rate Monthly Payment $165.25 18.50% $25.00 Q5 Total Amazon Credit Card Debt Amazon Card Interest Rate Minimum Monthly Payment $725.151 22.00% $35.00 Q6 Total Weekend Trip Credit Card Interest Rate Goal to payoff in months $750.00 15.00% 6 Application Time! Jessica informs you about the following spending moments she has had. Complete the following TVM questions (04-06) Follow the steps below. Q4 Treated of all her friends to dinner. She has already spent her excess cash from her paycheck, so she decides to put it on a credit card and pay for it later. How long will it take to pay for this purchase? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) c) Compounding Number select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab. (type zeros where needed) Q5 Purchased new outdoor furniture on Amazon this month. If she makes the minimum payment per month, how long will it take to pay for this shopping spree? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) Compounding Number (select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab. (type zeros where needed) Q6 Spontaneous weekend trip with friends. If she wants to pay this trip off in less then a year, what will the monthly payment be? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) c) Compounding Number (select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab. (type zeros where needed) 07 What does this tell you about credit card usage? How could this impact Jessica's credit report/score? (min. 25 words) . ) Q8 What is the risk of using a credit card? (min. 25 words) 09 When is using a credit card a good thing? (min. 25 words) Q10 How can you use a credit card responsibly? (min. 25 words)