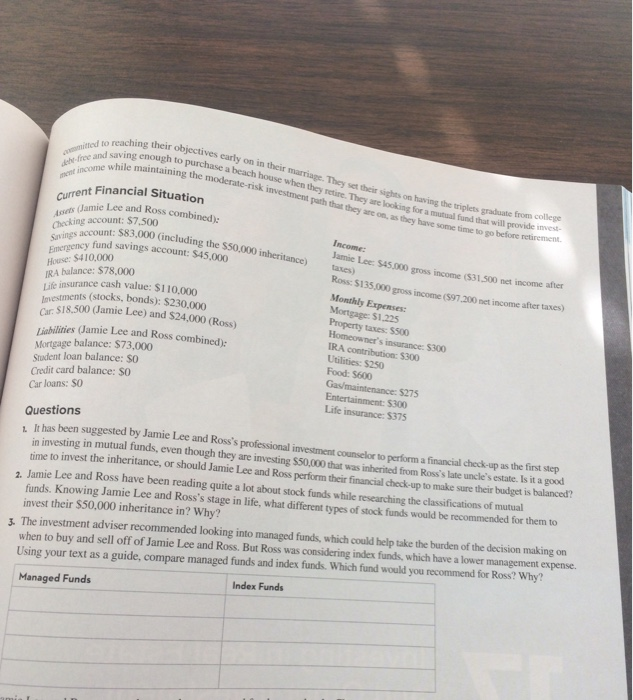

PFP Sheet 62 finance yahooc Reseanch the racent performance, costs, and fees for a mutual fund that ould helo you obtain your investment goals. Resources Your Long-Torm Financial Planning Activities ldentily types of mutual funds that you might use for your long-term finan- money.cnn.com Text pages 544-550 Develop plan for selecting and monitoring your mutusl fund portfolia CONTINUING CASE Investing in Mutual Funds Jamic Lee and Ross did several weeks' worth of research trying to choose just the right stock to invest in. After atu inheritance was a lot of money and they wanted to make the most informed investment choices they could.the S0 doing their homework, the various companies' stocks that they were looking to invest in did not seem like they were e have the promising future that Jamie Lee and Ross were hoping for. They are aware that they are taking a chance wi ment instrument, but they are both nervous about "putting all of their eggs in one basket" and want to be more con ing their investment choices. But how can they be more assured? amy inve confident in They decided to speak to their professional investment adviser, who suggested that investing in mutual funds to lessen the risk by joining a pool of other investors in a variety, or bundle, of securities chosen by the mutual fund way, Jamie Lee and Ross can eliminate the pressure of choosing the right company, and they minimize the cha their investment money by diversifying their portfolio. e fund managet. Th of losing be tailored to their inve. A mutual fund sounded like the sensible investment choice for them, but which mutual fund ment strategy? Jamie Lee and Ross are in their mid-40s and well on their way to reaching their long-term investment 562 td ht-free and ment income ching their objectives early on in their saving enough to purchase a beach house marriage. They set their sights on having the triplets graduate from when they retire. They are looking for a mutual fund that will provide invest ile maintaining the moderate-risk investmient path that they are on, as they have some time to go betore nt Financial Situation Jamie Lee and Ross combined): unt: $83,000 (including the S0,000 ineritance) taxes) fund savings account: $45,000 Checking account: $7.500 inheritnce)Jamie Lee gross income ($31 500 net income after gross income ($97.200 net income after taxes) House: $410,000 IRA bulance: $78,000 Life insurance cash value: $110,000 Imestments (stocks, bonds): $230,000 Car $18,500 Gamie Lee) and $24,000 (Ross) Ross: $135,000 Monthly Expenses: Mortgage: S1.225 Property taxes: $500 s insurance: $300 Liabilities Jamie Lee and Ross combined):- Mortgage balance: $73,000 Stuadent loan balance: $o Credit card balance: so Car loans: $0 IRA contribution: $300 Utilities: $250 Food: $600 Gas/maintenance: $275 Life insurance:$375 Questions 1. It has been suggested by Jamie Lee and Ross's professional investment counselor to perform a financial check-up as the first step in investing in mutual funds, even though they are investing $50,000 that was inherited from Ross's late uncle's estate. Is it a good time to invest the inheritance, or should Jamie Lee and Ross perform their financial check-up to make sure their budget is balanced? 2. Jamie Lee and Ross have been reading quite a lot about stock funds while researching the classifications of mutual funds. Knowing Jamie Lee and Ross's stage in life, what different types of stock funds would be recommended for them to invest their S50,000 inheritance in? Why? The investment adviser recommended looking into when to buy and sell off of Jamie Lee and Ross. But Ross was considering index funds, which have a lower management expense. Using your text as a guide, compare managed funds and index funds. Which fund would you recommend for Ross? Why? Index Funds Managed Funds