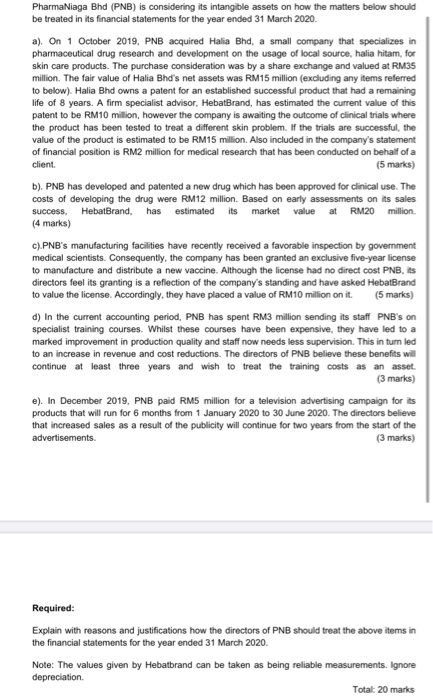

PharmaNiaga Bhd (PNB) is considering its intangible assets on how the matters below should be treated in its financial statements for the year ended 31 March 2020 a). On 1 October 2019, PNB acquired Halia Bhd, a small company that specializes in pharmaceutical drug research and development on the usage of local source, halia hitam, for skin care products. The purchase consideration was by a share exchange and valued at RM35 million. The fair value of Halia Bhd's net assets was RM15 million (excluding any items referred to below). Halia Bhd owns a patent for an established successful product that had a remaining life of 8 years. A firm specialist advisor, HebatBrand, has estimated the current value of this patent to be RM10 million, however the company is awaiting the outcome of clinical trials where the product has been tested to treat a different skin problem. If the trials are successful, the value of the product is estimated to be RM15 million. Also included in the company's statement of financial position is RM2 million for medical research that has been conducted on behalf of a client. (5 marks) b). PNB has developed and patented a new drug which has been approved for clinical use. The costs of developing the drug were RM12 million. Based on early assessments on its sales success. HebatBrand, has estimated its market value at RM20 million (4 marks) C).PNB's manufacturing facilities have recently received a favorable inspection by government medical scientists. Consequently, the company has been granted an exclusive five-year license to manufacture and distribute a new vaccine. Although the license had no direct cost PNB, its directors feel its granting is a reflection of the company's standing and have asked HebatBrand to value the license. Accordingly, they have placed a value of RM10 million on it. (5 marks) d) In the current accounting period, PNB has spent RM3 million sending its staff PNB's on specialist training courses. Whilst these courses have been expensive, they have led to a marked improvement in production quality and staff now needs less supervision. This in turn led to an increase in revenue and cost reductions. The directors of PNB believe these benefits will continue at least three years and wish to treat the training costs as an asset. (3 marks) e). In December 2019, PNB paid RM5 million for a television advertising campaign for its products that will run for 6 months from 1 January 2020 to 30 June 2020. The directors believe that increased sales as a result of the publicity will continue for two years from the start of the advertisements. (3 marks) Required: Explain with reasons and justifications how the directors of PNB should treat the above items in the financial statements for the year ended 31 March 2020. Note: The values given by Hebatbrand can be taken as being reliable measurements. Ignore depreciation Total: 20 marks