Question

Pharoah Acres sponsors a defined-benefit pension plan. The corporation's actuary provides the following information about the plan: January 1, 2025 December 31, 2025 Vested

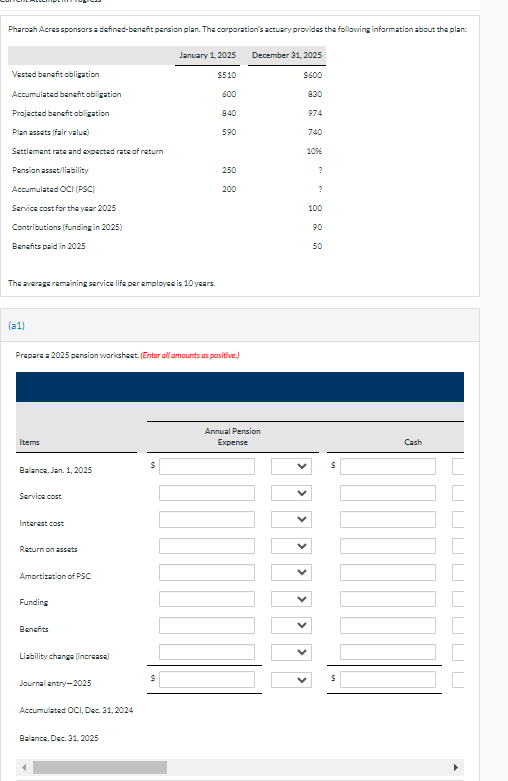

Pharoah Acres sponsors a defined-benefit pension plan. The corporation's actuary provides the following information about the plan: January 1, 2025 December 31, 2025 Vested benefit obligation $510 $600 Accumulated benefit obligation 600 830 Projected benefit obligation 840 974 Plan assets (fair value) 590 740 Settlement rate and expected rate of return 10% Pension asset/liability 250 ? Accumulated OCI (PSC) 200 ? Service cost for the year 2025 100 Contributions (funding in 2025) 90 Benefits paid in 2025 50 The average remaining service life per employee is 10 years. (a1) Prepare a 2025 pension worksheet. (Enter all amounts as positive.) Items Balance, Jan. 1, 2025 Service cost Interest cost Return on assets Amortization of PSC Funding Benefits Liability change (increase) Journal entry-2025 Accumulated OCI, Dec. 31, 2024 Balance, Dec. 31, 2025 $ Annual Pension Expense > > > > > > Cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started