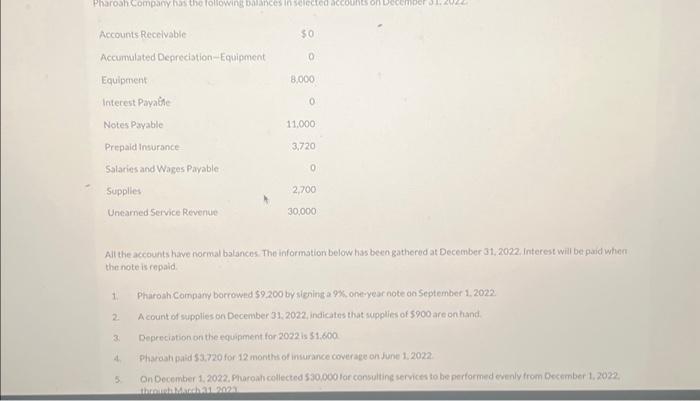

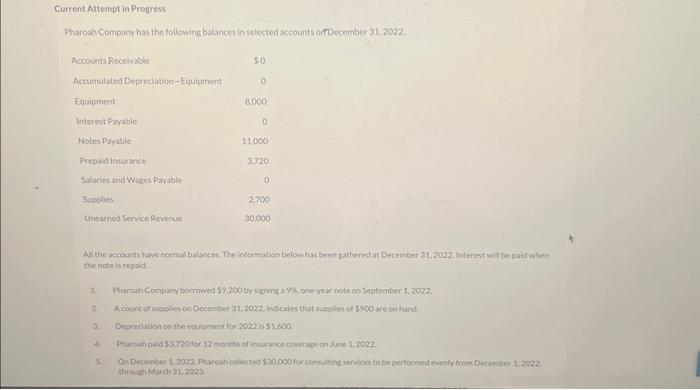

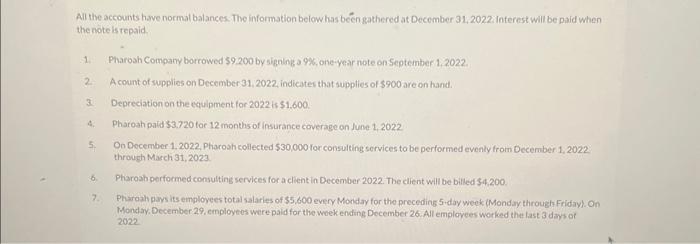

Pharoah Company has the following balances in selected accounts on December 31, Accounts Receivable Accumulated Depreciation-Equipment Equipment Interest Payable Notes Payable Prepaid Insurance Salaries and Wages Payable Supplies Unearned Service Revenue 1. 2. 3. 4. $0 5. 0 8,000 0 11,000 All the accounts have normal balances. The information below has been gathered at December 31, 2022. Interest will be paid when the note is repaid. 3,720 0 2,700 30,000 Pharoah Company borrowed $9,200 by signing a 9%, one-year note on September 1, 2022. A count of supplies on December 31, 2022, indicates that supplies of $900 are on hand. Depreciation on the equipment for 2022 is $1,600. Pharoah paid $3,720 for 12 months of insurance coverage on June 1, 2022. On December 1, 2022, Pharoah collected $30,000 for consulting services to be performed evenly from December 1, 2022, through March 31, 2023

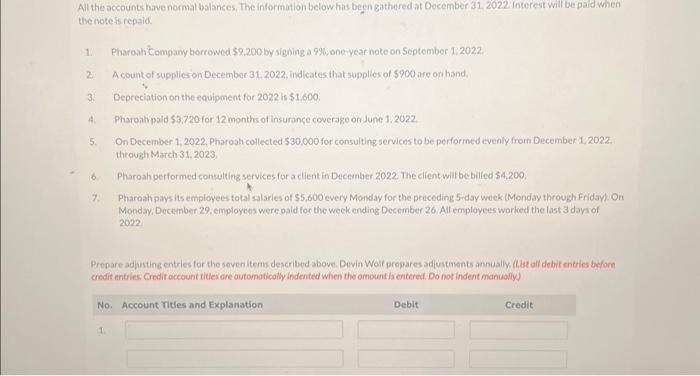

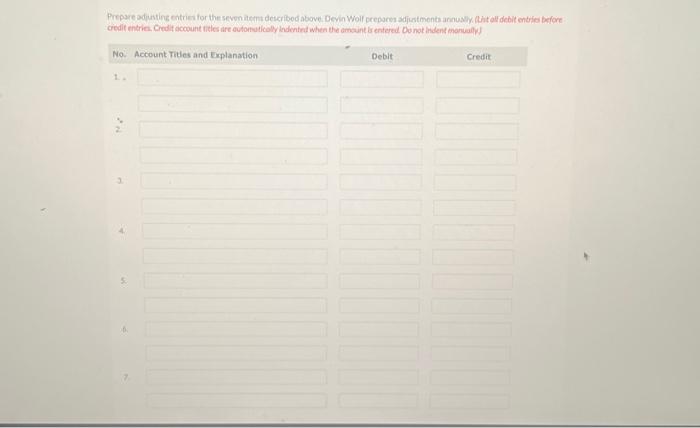

All the accounts have normal balances, The information below has begen gathered at December 31, 2022. Interest will be paid when the note is repaid. 1. Pharoah Company borrowed 59.200 by signing a 9%, one-year note on 5 eptember 1.2022. 2. A count of supplies on December 31,2022, indicates that supplies of $900 are on hand. 3. Depreciation on the equipment for 2022 is $1,600. 4. Pharoahpaid $3,720 for 12 months of insurance coverage on June 1.2022. 5. On December 1, 2022. Pharoah collected $30,000 for consulting services to be performed evenly from December 1,2022. through March 31,2023. 6. Pharoah performed consulting services for a client in December 2022. The client will be billed \$4,200. 7. Pharoah pays its employees total salaries of $5,600 every Monday for the preceding 5-day week (Monday through Friday). On Monday, December 29, employees were paid for the week ending December 26 . All employees worked the last 3 days of 2022. Propare adpusting entries for the seven items described above. Devin Wolt prepares adjustments annually ilist all debit entries befom credit entries: Credir occount titles are automatically indented when the amount his entered. Do not indent manuollys Prepare adjusting entries for the soven item dincribed above. Devin Wolf prepares adjustments annualiy (Liat all debit entries before credit entries. Cred t account titles are automatically indented when the amount is enternd, Do not indent manualiy) All the accounts have normal balances. The informstion below has been gathered at December 31,2022, interest will be paid when the note is repaid. 1. Pharosh Company borrowed 59,200 by sienins a 9%, one-year note on September 1.2022. 2. A count of supplies on December 31,2022, indicates that supplies of 5900 are on thand. 3. Depeciation on the equipment for 2022 is 31.800 4. Pharoah paid 53,720 for 12 months of insurance coverage on June 1,2022. 5. On December 1, 2022, Pharoah collected 530,000 tor consulting services to be performed evenly from Oecember 1.2022. credit entries. Credit account titles are autonsuticolly indented when the amount is entered Do not indent manualy. All the accounts have normal balances. The information below has ben gathered at December 31, 2022. Inferest will be paid when the note is repaid. 1. Pharosh Company borrowed $9,200 by signing a 9%, one-year note on September 1,2022. 2. A count of supplies on December 31, 2022, indicates that suppties of $900 are on hand. 3. Depreciation on the equipment for 2022 is $1,600. 4. Pharoah pald $3,720 tor 12 months of insurance coverage on June 1,2022 5. On December 1.2022. Pharosh collected $30,000 for consulting services to be performed evenly from December 1, 2022 through March 31,2023. 6. Pharoah performed consulting services for a client in December 2022. The client will be billed \$4.200. 7. Pharash pays its employees total salaries of $5,600 every Monday for the precedins 5 -day week (Monday through Friday). On 2022 Current Attempt in Progress Pharoah Company has the following balances in selected accounts orfoecember 31, 2022 All the accounts have poemal talancec. The information below has beengathered at December 31, 2022 interest wil be paid when: the note is repaid 1. Pharoah Company borrowed 59,200 by sienins a \%k, oneverar note on September 1,20022. 2 Acount of supplies on December 31.2022 . indicates that sueplies 065%00 are on hand. 3. Depredistion on the equipinent tor 2022 ias $1600 throuph March 31.2022