Answered step by step

Verified Expert Solution

Question

1 Approved Answer

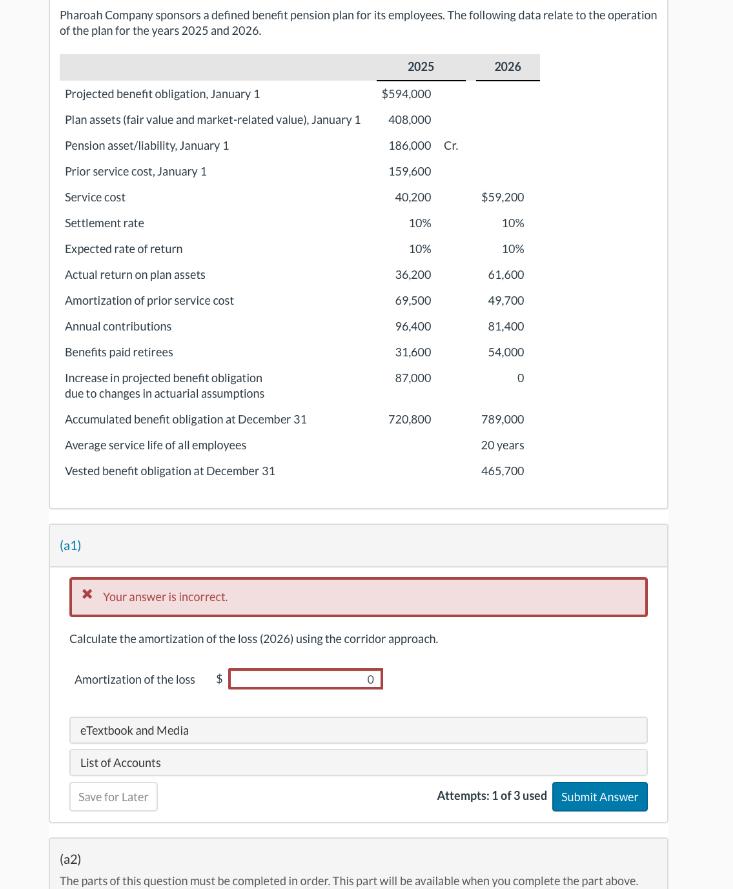

Pharoah Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years

Pharoah Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2025 and 2026. 2025 2026 Projected benefit obligation, January 1 $594,000 Plan assets (fair value and market-related value), January 1 408,000 Pension asset/liability, January 1 186,000 Cr. Prior service cost, January 1 159,600 Service cost Settlement rate 40,200 $59,200 10% 10% Expected rate of return 10% 10% Actual return on plan assets 36,200 61,600 Amortization of prior service cost 69,500 49.700 Annual contributions 96,400 81,400 Benefits paid retirees 31,600 54,000 Increase in projected benefit obligation 87,000 0 due to changes in actuarial assumptions Accumulated benefit obligation at December 31 720,800 789,000 Average service life of all employees 20 years Vested benefit obligation at December 31 465,700 (a1) * Your answer is incorrect. Calculate the amortization of the loss (2026) using the corridor approach. Amortization of the loss $ 0 eTextbook and Media List of Accounts Save for Later Attempts: 1 of 3 used Submit Answer (a2) The parts of this question must be completed in order. This part will be available when you complete the part above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the amortization of the loss using the corridor approach we first need to find the corr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started