Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pharoah Limited, a public company following IFRS, decided to upgrade the coffee machines in all of its office locations. Pharoah leased 54 machines from

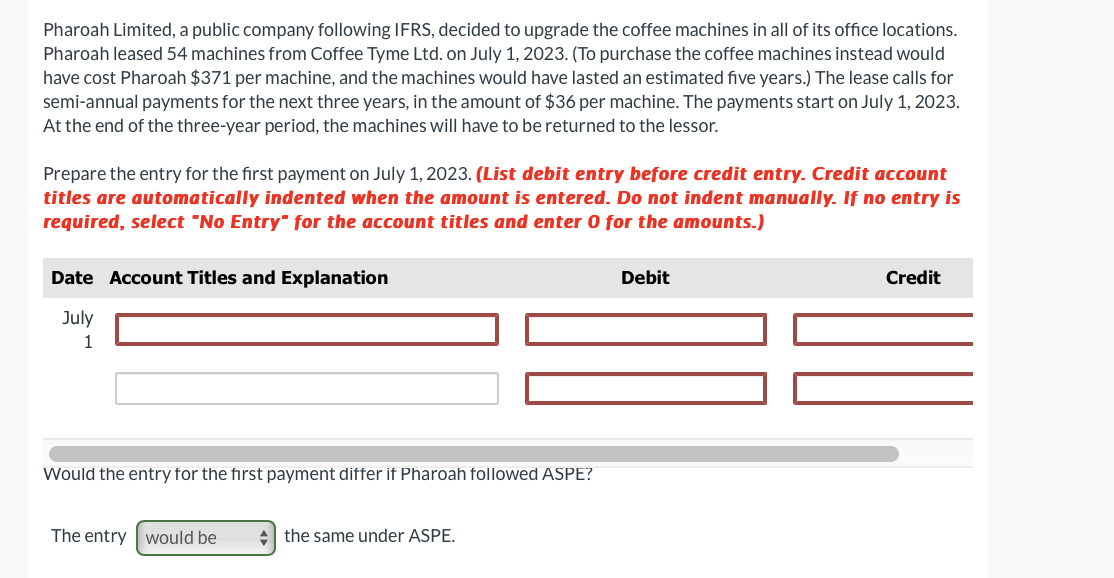

Pharoah Limited, a public company following IFRS, decided to upgrade the coffee machines in all of its office locations. Pharoah leased 54 machines from Coffee Tyme Ltd. on July 1, 2023. (To purchase the coffee machines instead would have cost Pharoah $371 per machine, and the machines would have lasted an estimated five years.) The lease calls for semi-annual payments for the next three years, in the amount of $36 per machine. The payments start on July 1, 2023. At the end of the three-year period, the machines will have to be returned to the lessor. Prepare the entry for the first payment on July 1, 2023. (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation July 1 Would the entry for the first payment differ if Pharoah followed ASPE? The entry would be the same under ASPE. Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Under IFRS Date Account Titles and Explanation Debit Credit July 1 Lease Expense 1944 Leas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started