Answered step by step

Verified Expert Solution

Question

1 Approved Answer

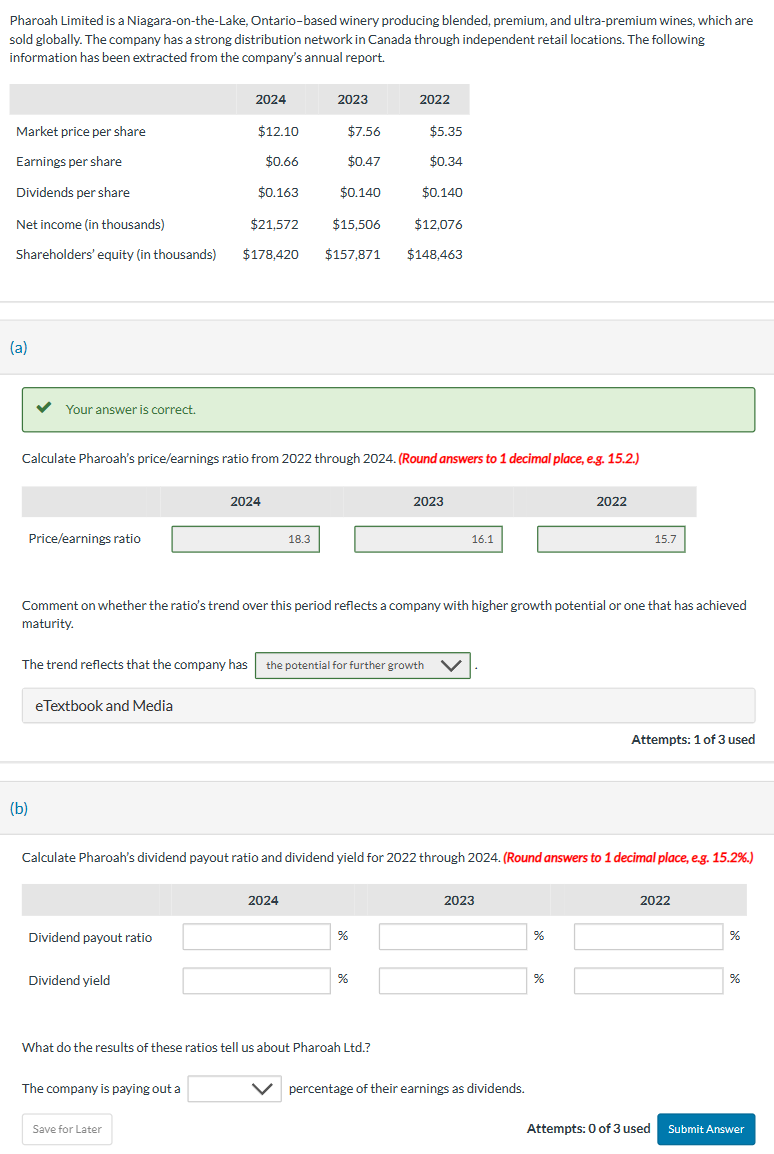

Pharoah Limited is a Niagara-on-the-Lake, Ontario-based winery producing blended, premium, and ultra-premium wines, which are sold globally. The company has a strong distribution network

Pharoah Limited is a Niagara-on-the-Lake, Ontario-based winery producing blended, premium, and ultra-premium wines, which are sold globally. The company has a strong distribution network in Canada through independent retail locations. The following information has been extracted from the company's annual report. Market price per share Earnings per share Dividends per share Net income (in thousands) 2024 2023 2022 $12.10 $7.56 $5.35 $0.66 $0.47 $0.34 $0.163 $0.140 $0.140 $21,572 $15,506 $12,076 Shareholders' equity (in thousands) $178,420 $157,871 $148,463 (a) Your answer is correct. Calculate Pharoah's price/earnings ratio from 2022 through 2024. (Round answers to 1 decimal place, e.g. 15.2.) Price/earnings ratio 2024 18.3 2023 16.1 2022 15.7 Comment on whether the ratio's trend over this period reflects a company with higher growth potential or one that has achieved maturity. The trend reflects that the company has the potential for further growth eTextbook and Media (b) Attempts: 1 of 3 used Calculate Pharoah's dividend payout ratio and dividend yield for 2022 through 2024. (Round answers to 1 decimal place, e.g. 15.2%.) Dividend payout ratio Dividend yield 2024 % % What do the results of these ratios tell us about Pharoah Ltd.? The company is paying out a Save for Later 2023 % % 2022 % % percentage of their earnings as dividends. Attempts: 0 of 3 used Submit Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started