Answered step by step

Verified Expert Solution

Question

1 Approved Answer

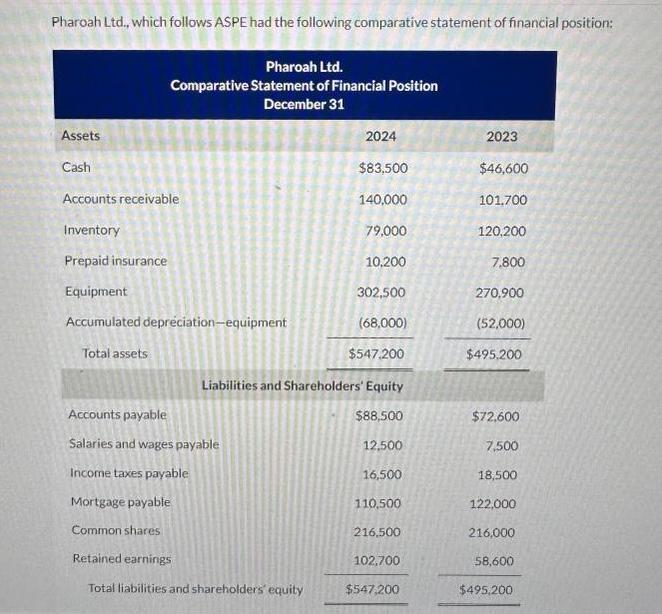

Pharoah Ltd., which follows ASPE had the following comparative statement of financial position: Assets Cash Pharoah Ltd. Comparative Statement of Financial Position December 31

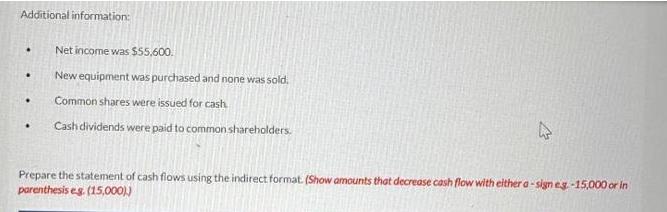

Pharoah Ltd., which follows ASPE had the following comparative statement of financial position: Assets Cash Pharoah Ltd. Comparative Statement of Financial Position December 31 2024 $83,500 140,000 79,000 10.200 302,500 (68,000) $547.200 Liabilities and Shareholders' Equity $88,500 12,500 16,500 110,500 216,500 102,700 $547,200 Accounts receivable Inventory Prepaid insurance Equipment Accumulated depreciation-equipment Total assets Accounts payable Salaries and wages payable Income taxes payable Mortgage payable Common shares Retained earnings Total liabilities and shareholders' equity 2023 $46,600 101.700 120,200 7.800 270,900 (52,000) $495.200 $72,600 7,500 18,500 122,000 216,000 58,600 $495,200 Additional information: . . Net income was $55,600. New equipment was purchased and none was sold. Common shares were issued for cash Cash dividends were paid to common shareholders. Prepare the statement of cash flows using the indirect format. (Show amounts that decrease cash flow with either a-sign eg.-15,000 or in parenthesis eg. (15,000))

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Cash FlowS Indirect Format For the Year Ended December 31 2023 Cash flows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started