Answered step by step

Verified Expert Solution

Question

1 Approved Answer

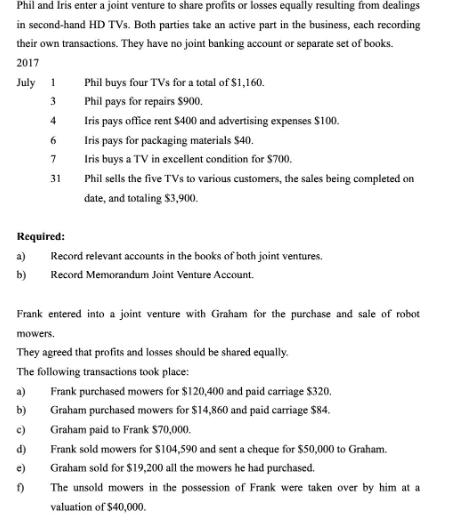

Phil and Iris enter a joint venture to share profits or losses equally resulting from dealings in second-hand HD TVs. Both parties take an

Phil and Iris enter a joint venture to share profits or losses equally resulting from dealings in second-hand HD TVs. Both parties take an active part in the business, each recording their own transactions. They have no joint banking account or separate set of books. 2017 July 1 3 4 6 Required: a) b) 7 31 a) b) c) d) e) f) Phil buys four TVs for a total of $1,160. Phil pays for repairs $900. Iris pays office rent $400 and advertising expenses $100. Iris pays for packaging materials $40. Iris buys a TV in excellent condition for $700. Phil sells the five TVs to various customers, the sales being completed on date, and totaling $3,900. Frank entered into a joint venture with Graham for the purchase and sale of robot mowers. They agreed that profits and losses should be shared equally. The following transactions took place: Record relevant accounts in the books of both joint ventures. Record Memorandum Joint Venture Account. Frank purchased mowers for $120,400 and paid carriage $320. Graham purchased mowers for $14,860 and paid carriage $84. Graham paid to Frank $70,000. Frank sold mowers for $104,590 and sent a cheque for $50,000 to Graham. Graham sold for $19,200 all the mowers he had purchased. The unsold mowers in the possession of Frank were taken over by him at a valuation of $40,000.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Books of Phil July 1 TV Inventory AC 1160 Cash AC 1160 July 3 Repair Expenses AC 900 Cash AC 900 J...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started