Question

Phil Smith and Kate Jones formed the P&K General Partnership on March 1, 2017, to provide computer consulting services. Partnership profits and losses are allocated

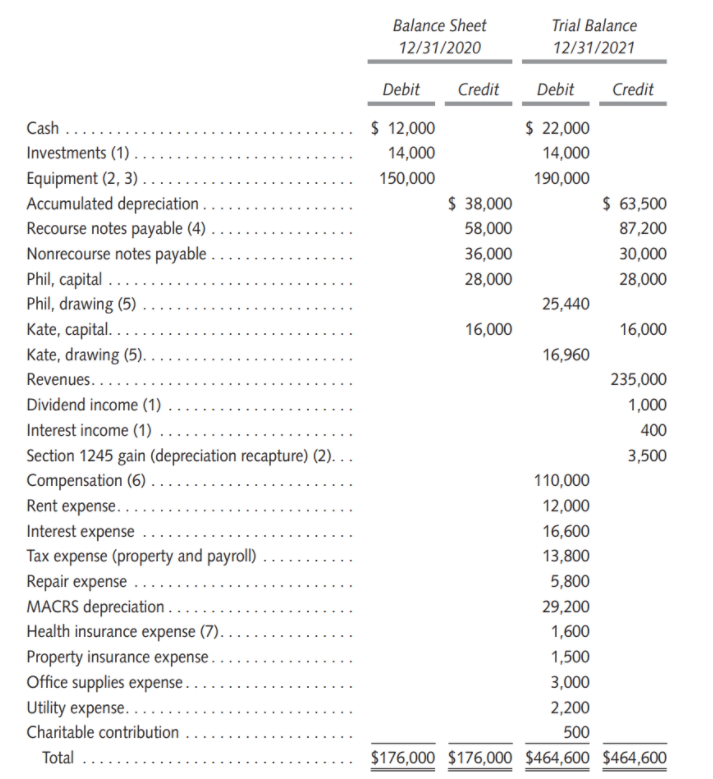

Phil Smith and Kate Jones formed the P&K General Partnership on March 1, 2017, to provide computer consulting services. Partnership profits and losses are allocated 60% to Phil and 40% to Kate. The business code and employer identification numbers are 7370 and 24-3897625, respectively. The business office is located at 3010 East Apple Street, Atlanta, Georgia 30304. Phil and Kate live nearby at 1521 South Elm Street and 3315 East Apple Street, respectively. Their Social Security numbers are 403-16-5110 for Phil and 518-72-9147 for Kate. The calendar year, cash basis partnerships December 31, 2020, balance sheet and December 31, 2021, trial balance (both prepared for tax purposes) contains the following information:

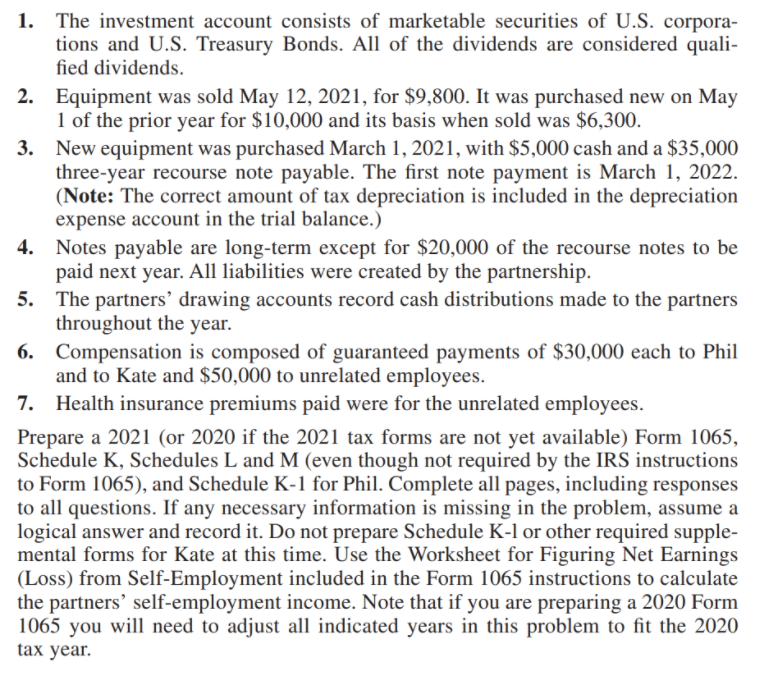

Balance Sheet 12/31/2020 Trial Balance 12/31/2021 Debit Credit Debit Credit Cash Investments (1).. Equipment (2, 3). Accumulated depreciation .... Recourse notes payable (4)... Nonrecourse notes payable Phil, capital ..... Phil, drawing (5) Kate, capital.... Kate, drawing (5) Revenues.... Dividend income (1) Interest income (1) .... Section 1245 gain (depreciation recapture) (2)... Compensation (6)... ( Rent expense... Interest expense Tax expense (property and payroll) Repair expense ... MACRS depreciation .... Health insurance expense (7). Property insurance expense. Office supplies expense.. Utility expense. Charitable contribution Total $ 12,000 $ 22,000 14,000 14,000 150,000 190,000 $ 38,000 $ 63,500 58,000 87,200 36,000 30,000 28,000 28,000 25,440 16,000 16,000 16,960 235,000 1,000 400 3,500 110,000 12,000 16,600 13,800 5,800 29,200 1,600 1,500 3,000 2,200 500 $176,000 $176,000 $464,600 $464,600 1. The investment account consists of marketable securities of U.S. corpora- tions and U.S. Treasury Bonds. All of the dividends are considered quali- fied dividends. 2. Equipment was sold May 12, 2021, for $9,800. It was purchased new on May 1 of the prior year for $10,000 and its basis when sold was $6,300. 3. New equipment was purchased March 1, 2021, with $5,000 cash and a $35,000 three-year recourse note payable. The first note payment is March 1, 2022. (Note: The correct amount of tax depreciation is included in the depreciation expense account in the trial balance.) 4. Notes payable are long-term except for $20,000 of the recourse notes to be paid next year. All liabilities were created by the partnership. 5. The partners' drawing accounts record cash distributions made to the partners throughout the year. 6. Compensation is composed of guaranteed payments of $30,000 each to Phil and to Kate and $50,000 to unrelated employees. 7. Health insurance premiums paid were for the unrelated employees. Prepare a 2021 (or 2020 if the 2021 tax forms are not yet available) Form 1065, Schedule K, Schedules L and M (even though not required by the IRS instructions to Form 1065), and Schedule K-1 for Phil. Complete all pages, including responses to all questions. If any necessary information is missing in the problem, assume a logical answer and record it. Do not prepare Schedule K-1 or other required supple- mental forms for Kate at this time. Use the Worksheet for Figuring Net Earnings (Loss) from Self-Employment included in the Form 1065 instructions to calculate the partners' self-employment income. Note that if you are preparing a 2020 Form 1065 you will need to adjust all indicated years in this problem to fit the 2020 tax year. Balance Sheet 12/31/2020 Trial Balance 12/31/2021 Debit Credit Debit Credit Cash Investments (1).. Equipment (2, 3). Accumulated depreciation .... Recourse notes payable (4)... Nonrecourse notes payable Phil, capital ..... Phil, drawing (5) Kate, capital.... Kate, drawing (5) Revenues.... Dividend income (1) Interest income (1) .... Section 1245 gain (depreciation recapture) (2)... Compensation (6)... ( Rent expense... Interest expense Tax expense (property and payroll) Repair expense ... MACRS depreciation .... Health insurance expense (7). Property insurance expense. Office supplies expense.. Utility expense. Charitable contribution Total $ 12,000 $ 22,000 14,000 14,000 150,000 190,000 $ 38,000 $ 63,500 58,000 87,200 36,000 30,000 28,000 28,000 25,440 16,000 16,000 16,960 235,000 1,000 400 3,500 110,000 12,000 16,600 13,800 5,800 29,200 1,600 1,500 3,000 2,200 500 $176,000 $176,000 $464,600 $464,600 1. The investment account consists of marketable securities of U.S. corpora- tions and U.S. Treasury Bonds. All of the dividends are considered quali- fied dividends. 2. Equipment was sold May 12, 2021, for $9,800. It was purchased new on May 1 of the prior year for $10,000 and its basis when sold was $6,300. 3. New equipment was purchased March 1, 2021, with $5,000 cash and a $35,000 three-year recourse note payable. The first note payment is March 1, 2022. (Note: The correct amount of tax depreciation is included in the depreciation expense account in the trial balance.) 4. Notes payable are long-term except for $20,000 of the recourse notes to be paid next year. All liabilities were created by the partnership. 5. The partners' drawing accounts record cash distributions made to the partners throughout the year. 6. Compensation is composed of guaranteed payments of $30,000 each to Phil and to Kate and $50,000 to unrelated employees. 7. Health insurance premiums paid were for the unrelated employees. Prepare a 2021 (or 2020 if the 2021 tax forms are not yet available) Form 1065, Schedule K, Schedules L and M (even though not required by the IRS instructions to Form 1065), and Schedule K-1 for Phil. Complete all pages, including responses to all questions. If any necessary information is missing in the problem, assume a logical answer and record it. Do not prepare Schedule K-1 or other required supple- mental forms for Kate at this time. Use the Worksheet for Figuring Net Earnings (Loss) from Self-Employment included in the Form 1065 instructions to calculate the partners' self-employment income. Note that if you are preparing a 2020 Form 1065 you will need to adjust all indicated years in this problem to fit the 2020 tax year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started