Answered step by step

Verified Expert Solution

Question

1 Approved Answer

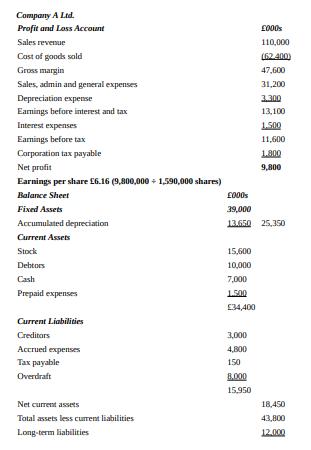

Company A Ltd. Profit and Loss Account Sales revenue Cost of goods sold Gross margin Sales, admin and general expenses Depreciation expense Earnings before

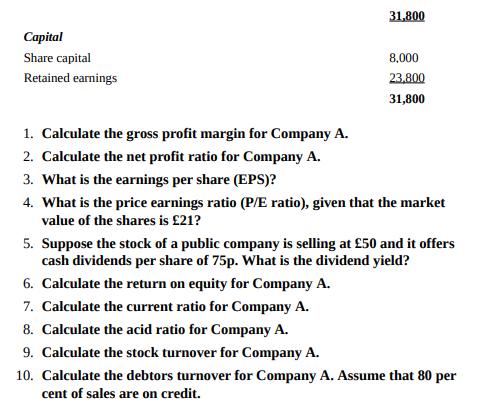

Company A Ltd. Profit and Loss Account Sales revenue Cost of goods sold Gross margin Sales, admin and general expenses Depreciation expense Earnings before interest and tax Interest expenses Earnings before tax Corporation tax payable Net profit Earnings per share 6.16 (9,800,000+ 1,590,000 shares) Balance Sheet Fixed Assets Accumulated depreciation Current Assets Stock Debtors Cash Prepaid expenses Current Liabilities Creditors Accrued expenses Tax payable Overdraft Net current assets Total assets less current liabilities Long-term liabilities 15,600 10,000 000s 39,000 13.650 25,350 7,000 1.500 34,400 000s 110,000 (62.400) 47,600 31,200 3.300 13,100 3,000 4,800 150 8.000 15,950 1.500 11,600 1.800 9,800 18,450 43,800 12.000 Capital Share capital Retained earnings 31,800 8,000 23,800 31,800 1. Calculate the gross profit margin for Company A. 2. Calculate the net profit ratio for Company A. 3. What is the earnings per share (EPS)? 4. What is the price earnings ratio (P/E ratio), given that the market value of the shares is 21? 5. Suppose the stock of a public company is selling at 50 and it offers cash dividends per share of 75p. What is the dividend yield? 6. Calculate the return on equity for Company A. 7. Calculate the current ratio for Company A. 8. Calculate the acid ratio for Company A. 9. Calculate the stock turnover for Company A. 10. Calculate the debtors turnover for Company A. Assume that 80 per cent of sales are on credit.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Gross profit margin 47600 62400 100 762 2 Net profit ratio 9800 62400 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started