Answered step by step

Verified Expert Solution

Question

1 Approved Answer

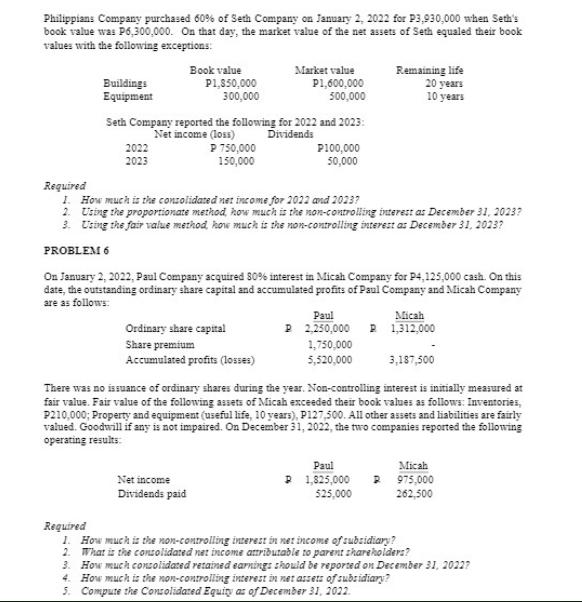

Philippians Company purchased 60% of Seth Company on January 2, 2022 for P3,930,000 when Seth's book value was P6,300,000. On that day, the market

Philippians Company purchased 60% of Seth Company on January 2, 2022 for P3,930,000 when Seth's book value was P6,300,000. On that day, the market value of the net assets of Seth equaled their book values with the following exceptions: Buildings Equipment 2022 2023 Book value P1,850,000 300,000 Seth Company reported the following for 2022 and 2023: Net income (loss) Dividends P 750,000 150,000 Market value P1,600,000 500,000 Ordinary share capital Share premium Accumulated profits (losses) Net income Dividends paid P100,000 50,000 Required 1. How much is the consolidated net income for 2022 and 2023? 2. Using the proportionate method, how much is the non-controlling interest as December 31, 2023? 3. Using the fair value method, how much is the non-controlling interest as December 31, 20237 PROBLEM 6 On January 2, 2022, Paul Company acquired 80% interest in Micah Company for P4,125,000 cash. On this date, the outstanding ordinary share capital and accumulated profits of Paul Company and Micah Company are as follows: Remaining life 20 years 10 years Paul Micah P 2,250,000 R 1,312,000 1,750,000 5,520,000 There was no issuance of ordinary shares during the year. Non-controlling interest is initially measured at fair value. Fair value of the following assets of Micah exceeded their book values as follows: Inventories, P210,000; Property and equipment (useful life, 10 years), P127,500. All other assets and liabilities are fairly valued. Goodwill if any is not impaired. On December 31, 2022, the two companies reported the following operating results: Paul P 1,825,000 525,000 3,187,500 Micah R 975,000 262,500 Required 1. How much is the non-controlling interest in net income of subsidiary? 2. What is the consolidated net income attributable to parent shareholders? 3. How much consolidated retained earnings should be reported on December 31, 20227 4. How much is the non-controlling interest in net assets of subsidiary? 5. Compute the Consolidated Equity as of December 31, 2022.

Step by Step Solution

★★★★★

3.27 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

PROBLEM 5 Calculate the consolidated net income for 2022 and 2023 Consolidated Net Income 2022 Net Income of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started