Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Phillips Electronics Inc. located in Sheraton Mall Christ Church currently has annual credit sales of $12 million and an average collection period of 30 days.

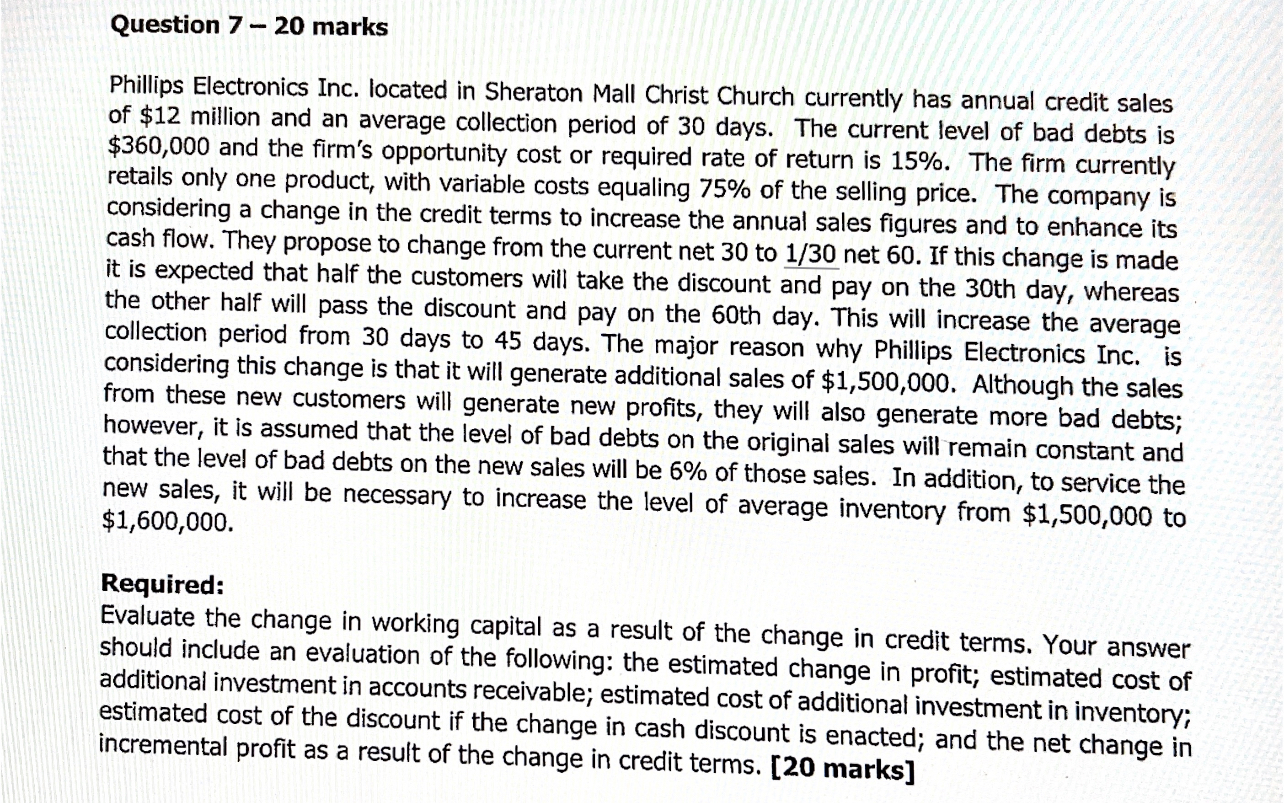

Phillips Electronics Inc. located in Sheraton Mall Christ Church currently has annual credit sales of $12 million and an average collection period of 30 days. The current level of bad debts is $360,000 and the firm's opportunity cost or required rate of return is 15%. The firm currently retails only one product, with variable costs equaling 75% of the selling price. The company is considering a change in the credit terms to increase the annual sales figures and to enhance its cash flow. They propose to change from the current net 30 to 1/30 net 60 . If this change is made it is expected that half the customers will take the discount and pay on the 30th day, whereas the other half will pass the discount and pay on the 60th day. This will increase the average collection period from 30 days to 45 days. The major reason why Phillips Electronics Inc. is considering this change is that it will generate additional sales of $1,500,000. Although the sales from these new customers will generate new profits, they will also generate more bad debts; however, it is assumed that the level of bad debts on the original sales will remain constant and that the level of bad debts on the new sales will be 6% of those sales. In addition, to service the new sales, it will be necessary to increase the level of average inventory from $1,500,000 to $1,600,000. Required: Evaluate the change in working capital as a result of the change in credit terms. Your answer should include an evaluation of the following: the estimated change in profit; estimated cost of additional investment in accounts receivable; estimated cost of additional investment in inventory; estimated cost of the discount if the change in cash discount is enacted; and the net change in incremental profit as a result of the change in credit terms. [20 marks]

Phillips Electronics Inc. located in Sheraton Mall Christ Church currently has annual credit sales of $12 million and an average collection period of 30 days. The current level of bad debts is $360,000 and the firm's opportunity cost or required rate of return is 15%. The firm currently retails only one product, with variable costs equaling 75% of the selling price. The company is considering a change in the credit terms to increase the annual sales figures and to enhance its cash flow. They propose to change from the current net 30 to 1/30 net 60 . If this change is made it is expected that half the customers will take the discount and pay on the 30th day, whereas the other half will pass the discount and pay on the 60th day. This will increase the average collection period from 30 days to 45 days. The major reason why Phillips Electronics Inc. is considering this change is that it will generate additional sales of $1,500,000. Although the sales from these new customers will generate new profits, they will also generate more bad debts; however, it is assumed that the level of bad debts on the original sales will remain constant and that the level of bad debts on the new sales will be 6% of those sales. In addition, to service the new sales, it will be necessary to increase the level of average inventory from $1,500,000 to $1,600,000. Required: Evaluate the change in working capital as a result of the change in credit terms. Your answer should include an evaluation of the following: the estimated change in profit; estimated cost of additional investment in accounts receivable; estimated cost of additional investment in inventory; estimated cost of the discount if the change in cash discount is enacted; and the net change in incremental profit as a result of the change in credit terms. [20 marks] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started