Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Phoebe, Inc., a domestic retailer, bought merchandise for resale from a French supplier on August 20th with the purchase being denominated in Euros (E).

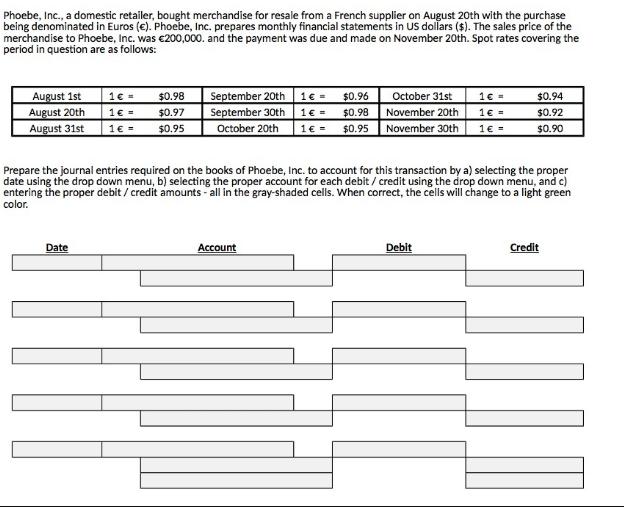

Phoebe, Inc., a domestic retailer, bought merchandise for resale from a French supplier on August 20th with the purchase being denominated in Euros (E). Phoebe, Inc. prepares monthly financial statements in US dollars ($). The sales price of the merchandise to Phoebe, Inc. was 200,000. and the payment was due and made on November 20th. Spot rates covering the period in question are as follows: August 1st August 20th August 31st 1 = 16= 1 = Date $0.98 $0.97 $0.95 September 20th September 30th October 20th 1 = 1 = 1 = Account $0.96 $0.98 $0.95 October 31st November 20th November 30th Prepare the journal entries required on the books of Phoebe, Inc. to account for this transaction by a) selecting the proper date using the drop down menu, b) selecting the proper account for each debit/credit using the drop down menu, and c) entering the proper debit/credit amounts - all in the gray-shaded cells. When correct, the cells will change to a light green color. 1 = 1 = 1 = Debit $0.94 $0.92 $0.90 Credit

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The journal entries for the transactions involving Phoebe Inc and its Frenc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started