Answered step by step

Verified Expert Solution

Question

1 Approved Answer

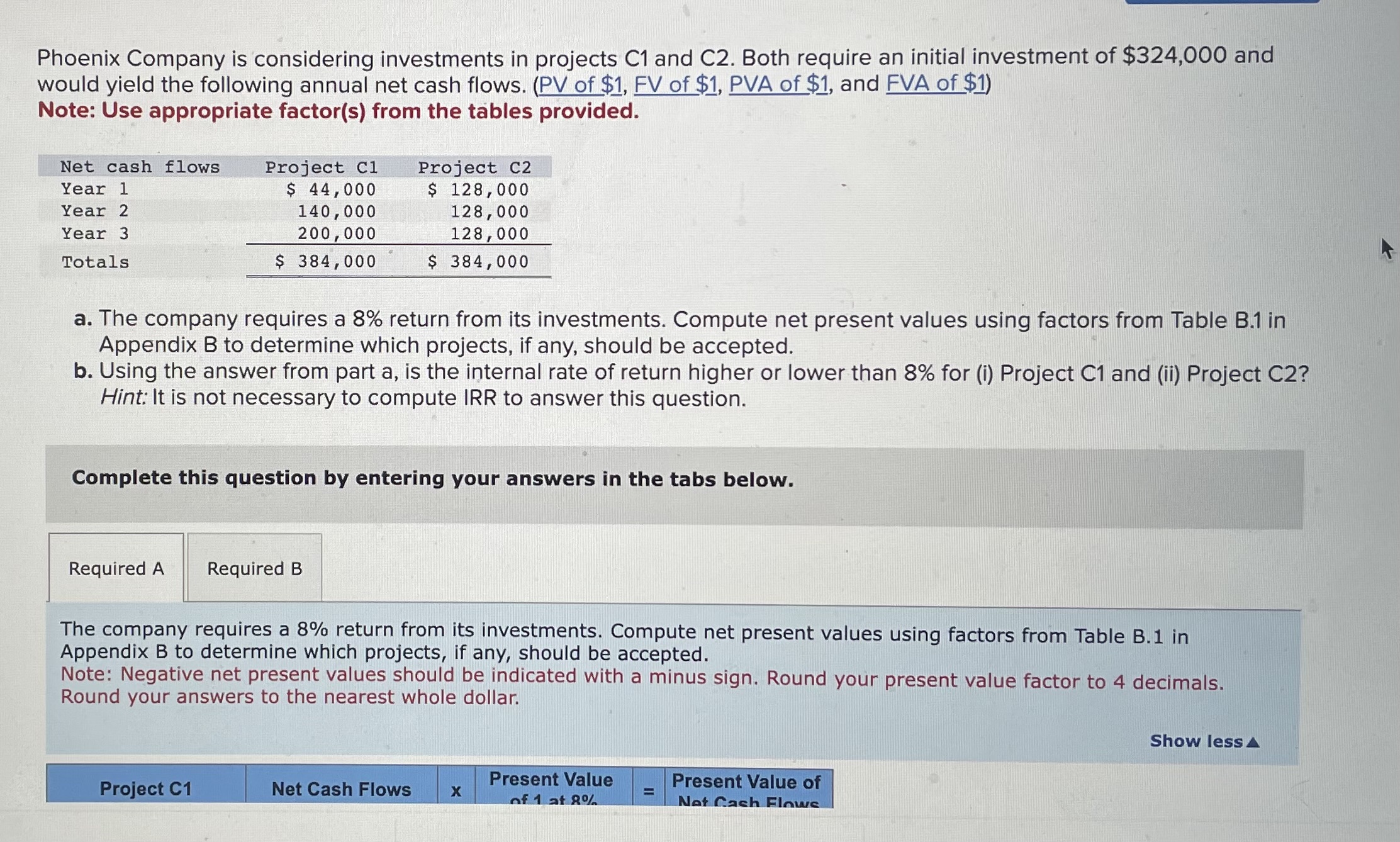

Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $324,000 and would yield the following annual net

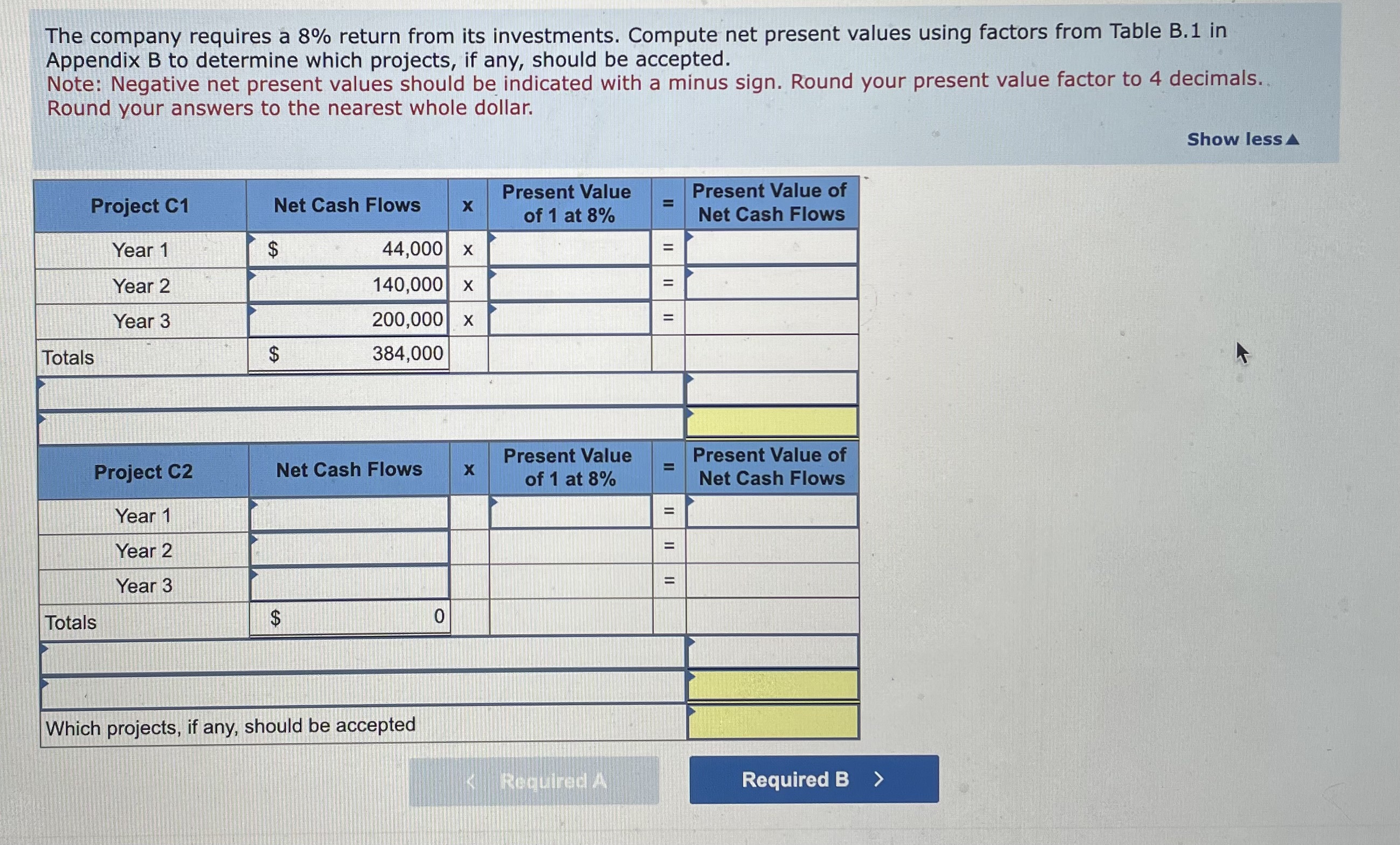

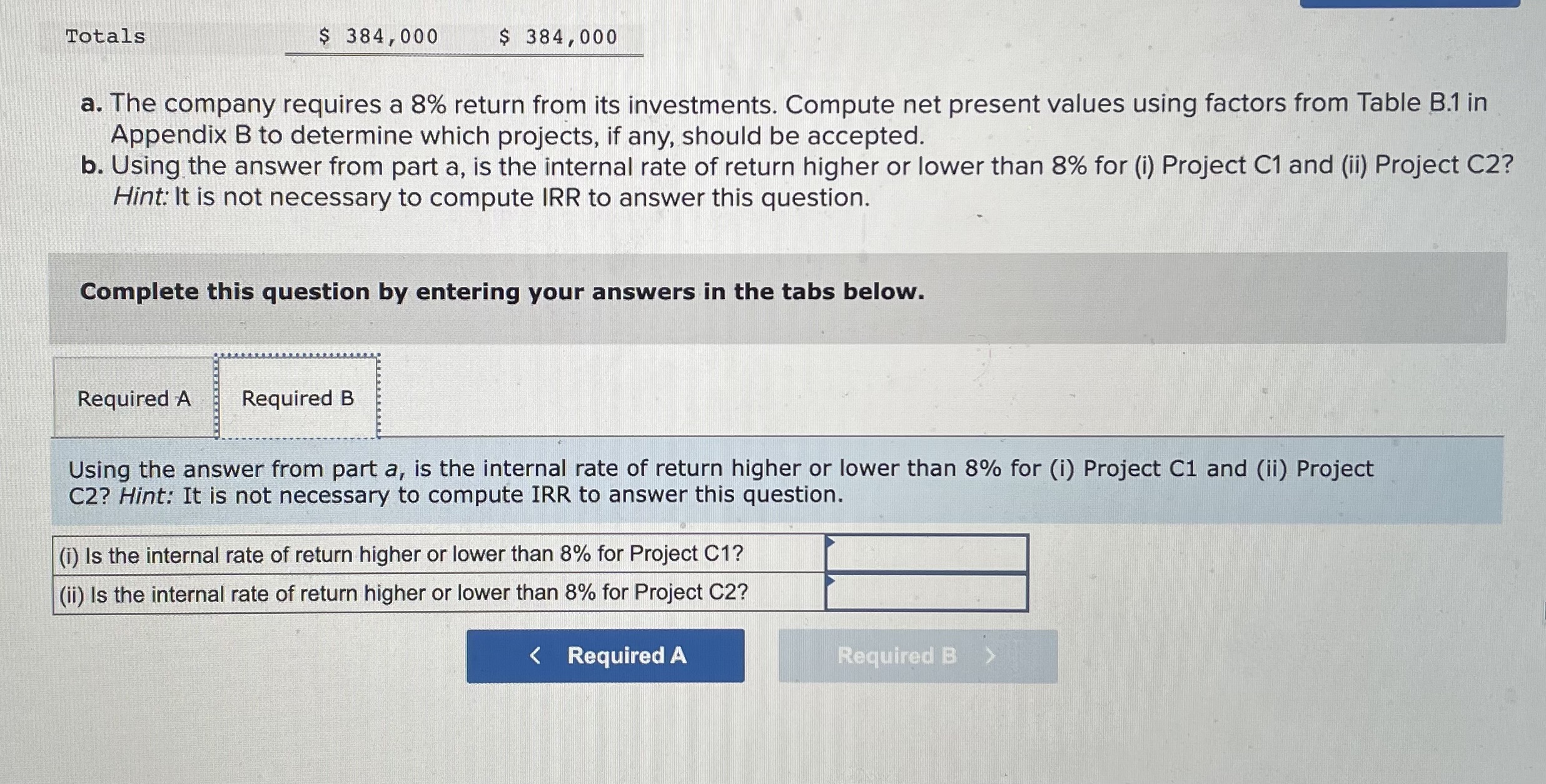

Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $324,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Net cash flows Year 1 Year 2 Year 3 Totals Project C1 44,000 140,000 200,000 $ 384,000 a. The company requires a 8% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. b. Using the answer from part a, is the internal rate of return higher or lower than 8% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question. Required A Complete this question by entering your answers in the tabs below. Project C2 $ 128,000 128,000 128,000 $ 384,000 Project C1 Required B The company requires a 8% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. Note: Negative net present values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar. Net Cash Flows X Present Value of 1 at 8% = Present Value of Net Cash Flows Show less A The company requires a 8% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. Note: Negative net present values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar. Project C1 Year 1 Year 2 Year 3 Totals Project C2 Year 1 Year 2 Year 3 Totals Net Cash Flows $ $ Net Cash Flows $ 44,000 X 140,000 X 200,000 X 384,000 Which projects, if any, should be accepted X 0 X Present Value of 1 at 8% Present Value of 1 at 8% Required A = = || = II = E II = II Present Value of Net Cash Flows Present Value of Net Cash Flows Required B > Show less A Totals $ 384,000 $ 384,000 a. The company requires a 8% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. b. Using the answer from part a, is the internal rate of return higher or lower than 8% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question. Complete this question by entering your answers in the tabs below. Required A Required B Using the answer from part a, is the internal rate of return higher or lower than 8% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question. (i) Is the internal rate of return higher or lower than 8% for Project C1? (ii) Is the internal rate of return higher or lower than 8% for Project C2? < Required A Required B

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Project C1 Initial Investment 32400000 Chart values are based on i 8 Year Cash Inflow ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started