Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Phoenix Medical Associates operates a walk-in medical clinic in Tempe, Arizona. (Click the icon to additional information.) Chen has recently become aware of activity-based

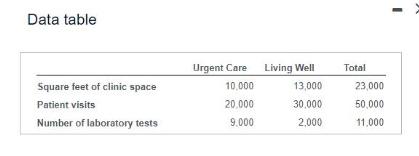

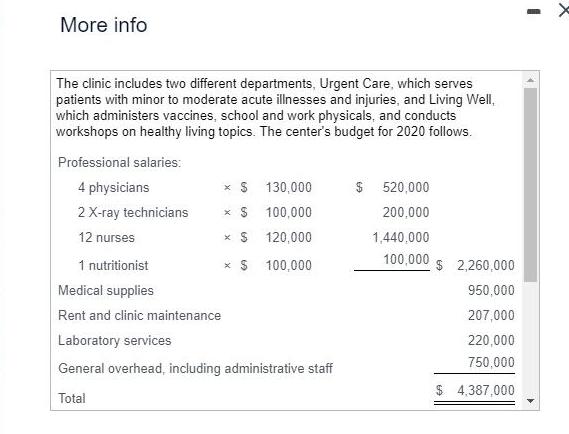

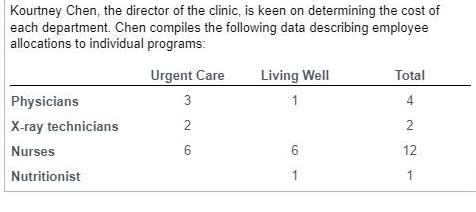

Phoenix Medical Associates operates a walk-in medical clinic in Tempe, Arizona. (Click the icon to additional information.) Chen has recently become aware of activity-based costing as a method to refine costing systems C She asks her accountant, Larry Reed, how she should apply this technique. Reed obtains the following budgeted information for 2020 (Click the icon to view the budget data.) Read the requirements Data table Square feet of clinic space Patient visits Number of laboratory tests Urgent Care 10,000 20,000 9,000 Living Well 13,000 30,000 2,000 Total 23,000 50,000 11.000 More info The clinic includes two different departments, Urgent Care, which serves patients with minor to moderate acute illnesses and injuries, and Living Well, which administers vaccines, school and work physicals, and conducts workshops on healthy living topics. The center's budget for 2020 follows. Professional salaries: 4 physicians 2 X-ray technicians 12 nurses * $ x S * $ * $ 130,000 100,000 120,000 100,000 1 nutritionist Medical supplies Rent and clinic maintenance Laboratory services General overhead, including administrative staff Total $ 520,000 200,000 1,440,000 100,000 $ 2,260,000 950,000 207,000 220,000 750,000 $ 4,387,000 I Kourtney Chen, the director of the clinic, is keen on determining the cost of each department. Chen compiles the following data describing employee allocations to individual programs: Physicians X-ray technicians Nurses Nutritionist Urgent Care 3 2 6 Living Well 6 1 Total 4 2 12 1 Requirements 1. a. Selecting cost-allocation bases that you believe are the most appropriate for allocating indirect costs to departments, calculate the budgeted indirect cost rates for medical supplies, rent and clinic maintenance, laboratory services, and general overhead. b. Using an activity-based costing approach to cost analysis, calculate the budgeted cost of each department and the budgeted cost per patient visit of each department. c. What benefits can Phoenix Medical Associates obtain by implementing the ABC system? 2. What factors, other than cost, do you think Phoenix Medical Associates should consider in allocating resources to its departments? Phoenix Medical Associates operates a walk-in medical clinic in Tempe, Arizona. (Click the icon to additional information.) Chen has recently become aware of activity-based costing as a method to refine costing systems C She asks her accountant, Larry Reed, how she should apply this technique. Reed obtains the following budgeted information for 2020 (Click the icon to view the budget data.) Read the requirements Data table Square feet of clinic space Patient visits Number of laboratory tests Urgent Care 10,000 20,000 9,000 Living Well 13,000 30,000 2,000 Total 23,000 50,000 11.000 More info The clinic includes two different departments, Urgent Care, which serves patients with minor to moderate acute illnesses and injuries, and Living Well, which administers vaccines, school and work physicals, and conducts workshops on healthy living topics. The center's budget for 2020 follows. Professional salaries: 4 physicians 2 X-ray technicians 12 nurses * $ x S * $ * $ 130,000 100,000 120,000 100,000 1 nutritionist Medical supplies Rent and clinic maintenance Laboratory services General overhead, including administrative staff Total $ 520,000 200,000 1,440,000 100,000 $ 2,260,000 950,000 207,000 220,000 750,000 $ 4,387,000 I Kourtney Chen, the director of the clinic, is keen on determining the cost of each department. Chen compiles the following data describing employee allocations to individual programs: Physicians X-ray technicians Nurses Nutritionist Urgent Care 3 2 6 Living Well 6 1 Total 4 2 12 1 Requirements 1. a. Selecting cost-allocation bases that you believe are the most appropriate for allocating indirect costs to departments, calculate the budgeted indirect cost rates for medical supplies, rent and clinic maintenance, laboratory services, and general overhead. b. Using an activity-based costing approach to cost analysis, calculate the budgeted cost of each department and the budgeted cost per patient visit of each department. c. What benefits can Phoenix Medical Associates obtain by implementing the ABC system? 2. What factors, other than cost, do you think Phoenix Medical Associates should consider in allocating resources to its departments? Phoenix Medical Associates operates a walk-in medical clinic in Tempe, Arizona. (Click the icon to additional information.) Chen has recently become aware of activity-based costing as a method to refine costing systems C She asks her accountant, Larry Reed, how she should apply this technique. Reed obtains the following budgeted information for 2020 (Click the icon to view the budget data.) Read the requirements Data table Square feet of clinic space Patient visits Number of laboratory tests Urgent Care 10,000 20,000 9,000 Living Well 13,000 30,000 2,000 Total 23,000 50,000 11.000 More info The clinic includes two different departments, Urgent Care, which serves patients with minor to moderate acute illnesses and injuries, and Living Well, which administers vaccines, school and work physicals, and conducts workshops on healthy living topics. The center's budget for 2020 follows. Professional salaries: 4 physicians 2 X-ray technicians 12 nurses * $ x S * $ * $ 130,000 100,000 120,000 100,000 1 nutritionist Medical supplies Rent and clinic maintenance Laboratory services General overhead, including administrative staff Total $ 520,000 200,000 1,440,000 100,000 $ 2,260,000 950,000 207,000 220,000 750,000 $ 4,387,000 I Kourtney Chen, the director of the clinic, is keen on determining the cost of each department. Chen compiles the following data describing employee allocations to individual programs: Physicians X-ray technicians Nurses Nutritionist Urgent Care 3 2 6 Living Well 6 1 Total 4 2 12 1 Requirements 1. a. Selecting cost-allocation bases that you believe are the most appropriate for allocating indirect costs to departments, calculate the budgeted indirect cost rates for medical supplies, rent and clinic maintenance, laboratory services, and general overhead. b. Using an activity-based costing approach to cost analysis, calculate the budgeted cost of each department and the budgeted cost per patient visit of each department. c. What benefits can Phoenix Medical Associates obtain by implementing the ABC system? 2. What factors, other than cost, do you think Phoenix Medical Associates should consider in allocating resources to its departments? Phoenix Medical Associates operates a walk-in medical clinic in Tempe, Arizona. (Click the icon to additional information.) Chen has recently become aware of activity-based costing as a method to refine costing systems C She asks her accountant, Larry Reed, how she should apply this technique. Reed obtains the following budgeted information for 2020 (Click the icon to view the budget data.) Read the requirements Data table Square feet of clinic space Patient visits Number of laboratory tests Urgent Care 10,000 20,000 9,000 Living Well 13,000 30,000 2,000 Total 23,000 50,000 11.000 More info The clinic includes two different departments, Urgent Care, which serves patients with minor to moderate acute illnesses and injuries, and Living Well, which administers vaccines, school and work physicals, and conducts workshops on healthy living topics. The center's budget for 2020 follows. Professional salaries: 4 physicians 2 X-ray technicians 12 nurses * $ x S * $ * $ 130,000 100,000 120,000 100,000 1 nutritionist Medical supplies Rent and clinic maintenance Laboratory services General overhead, including administrative staff Total $ 520,000 200,000 1,440,000 100,000 $ 2,260,000 950,000 207,000 220,000 750,000 $ 4,387,000 I Kourtney Chen, the director of the clinic, is keen on determining the cost of each department. Chen compiles the following data describing employee allocations to individual programs: Physicians X-ray technicians Nurses Nutritionist Urgent Care 3 2 6 Living Well 6 1 Total 4 2 12 1 Requirements 1. a. Selecting cost-allocation bases that you believe are the most appropriate for allocating indirect costs to departments, calculate the budgeted indirect cost rates for medical supplies, rent and clinic maintenance, laboratory services, and general overhead. b. Using an activity-based costing approach to cost analysis, calculate the budgeted cost of each department and the budgeted cost per patient visit of each department. c. What benefits can Phoenix Medical Associates obtain by implementing the ABC system? 2. What factors, other than cost, do you think Phoenix Medical Associates should consider in allocating resources to its departments? Phoenix Medical Associates operates a walk-in medical clinic in Tempe, Arizona. (Click the icon to additional information.) Chen has recently become aware of activity-based costing as a method to refine costing systems C She asks her accountant, Larry Reed, how she should apply this technique. Reed obtains the following budgeted information for 2020 (Click the icon to view the budget data.) Read the requirements Data table Square feet of clinic space Patient visits Number of laboratory tests Urgent Care 10,000 20,000 9,000 Living Well 13,000 30,000 2,000 Total 23,000 50,000 11.000 More info The clinic includes two different departments, Urgent Care, which serves patients with minor to moderate acute illnesses and injuries, and Living Well, which administers vaccines, school and work physicals, and conducts workshops on healthy living topics. The center's budget for 2020 follows. Professional salaries: 4 physicians 2 X-ray technicians 12 nurses * $ x S * $ * $ 130,000 100,000 120,000 100,000 1 nutritionist Medical supplies Rent and clinic maintenance Laboratory services General overhead, including administrative staff Total $ 520,000 200,000 1,440,000 100,000 $ 2,260,000 950,000 207,000 220,000 750,000 $ 4,387,000 I Kourtney Chen, the director of the clinic, is keen on determining the cost of each department. Chen compiles the following data describing employee allocations to individual programs: Physicians X-ray technicians Nurses Nutritionist Urgent Care 3 2 6 Living Well 6 1 Total 4 2 12 1 Requirements 1. a. Selecting cost-allocation bases that you believe are the most appropriate for allocating indirect costs to departments, calculate the budgeted indirect cost rates for medical supplies, rent and clinic maintenance, laboratory services, and general overhead. b. Using an activity-based costing approach to cost analysis, calculate the budgeted cost of each department and the budgeted cost per patient visit of each department. c. What benefits can Phoenix Medical Associates obtain by implementing the ABC system? 2. What factors, other than cost, do you think Phoenix Medical Associates should consider in allocating resources to its departments? Phoenix Medical Associates operates a walk-in medical clinic in Tempe, Arizona. (Click the icon to additional information.) Chen has recently become aware of activity-based costing as a method to refine costing systems C She asks her accountant, Larry Reed, how she should apply this technique. Reed obtains the following budgeted information for 2020 (Click the icon to view the budget data.) Read the requirements Data table Square feet of clinic space Patient visits Number of laboratory tests Urgent Care 10,000 20,000 9,000 Living Well 13,000 30,000 2,000 Total 23,000 50,000 11.000 More info The clinic includes two different departments, Urgent Care, which serves patients with minor to moderate acute illnesses and injuries, and Living Well, which administers vaccines, school and work physicals, and conducts workshops on healthy living topics. The center's budget for 2020 follows. Professional salaries: 4 physicians 2 X-ray technicians 12 nurses * $ x S * $ * $ 130,000 100,000 120,000 100,000 1 nutritionist Medical supplies Rent and clinic maintenance Laboratory services General overhead, including administrative staff Total $ 520,000 200,000 1,440,000 100,000 $ 2,260,000 950,000 207,000 220,000 750,000 $ 4,387,000 I Kourtney Chen, the director of the clinic, is keen on determining the cost of each department. Chen compiles the following data describing employee allocations to individual programs: Physicians X-ray technicians Nurses Nutritionist Urgent Care 3 2 6 Living Well 6 1 Total 4 2 12 1 Requirements 1. a. Selecting cost-allocation bases that you believe are the most appropriate for allocating indirect costs to departments, calculate the budgeted indirect cost rates for medical supplies, rent and clinic maintenance, laboratory services, and general overhead. b. Using an activity-based costing approach to cost analysis, calculate the budgeted cost of each department and the budgeted cost per patient visit of each department. c. What benefits can Phoenix Medical Associates obtain by implementing the ABC system? 2. What factors, other than cost, do you think Phoenix Medical Associates should consider in allocating resources to its departments?

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To implement an activitybased costing ABC approach we need to select appropriate costallocation bases for allocating indirect costs to the Urgent Care and Living Well departments Then well calculate t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started