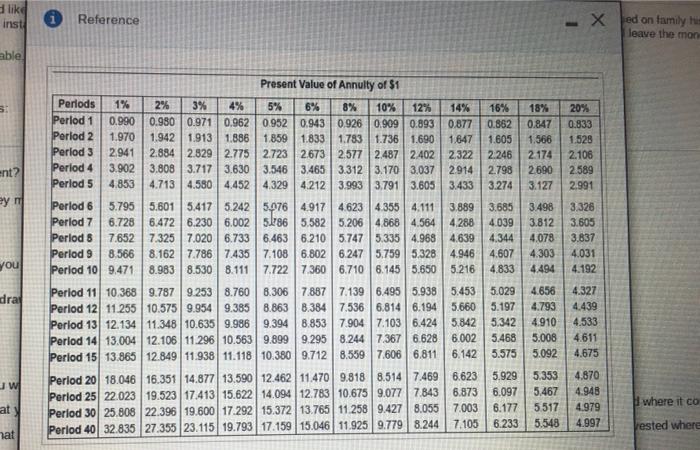

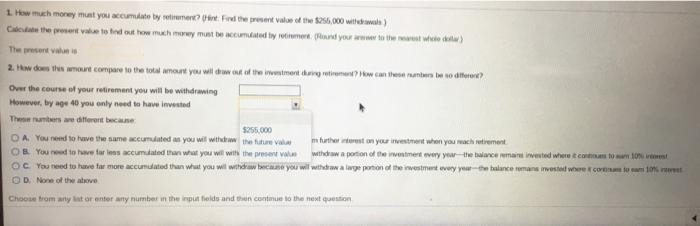

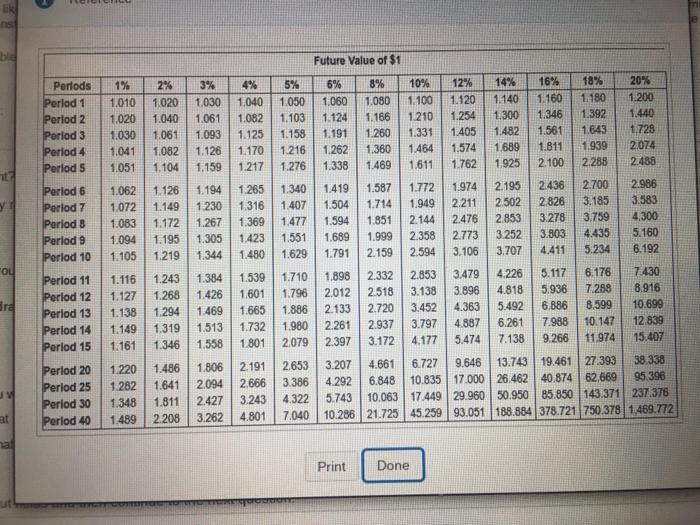

photo one: present value annuity table

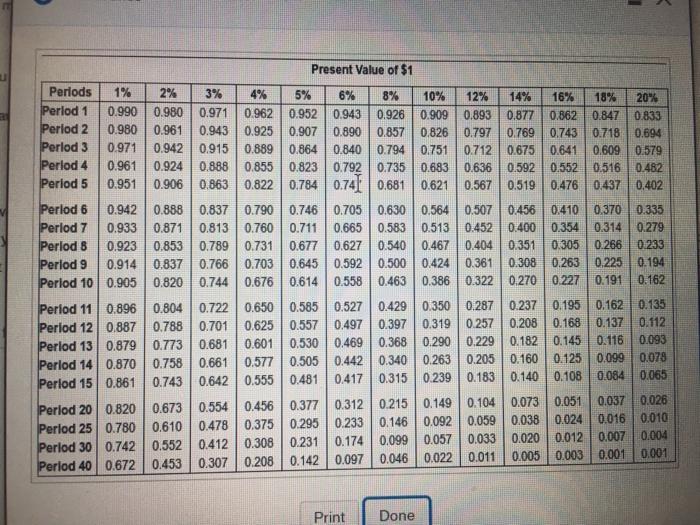

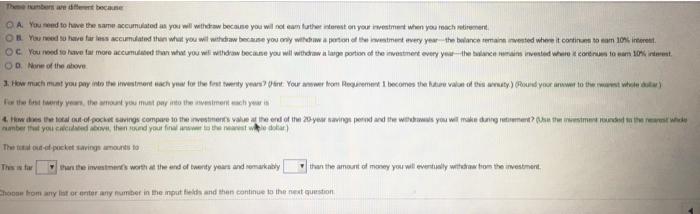

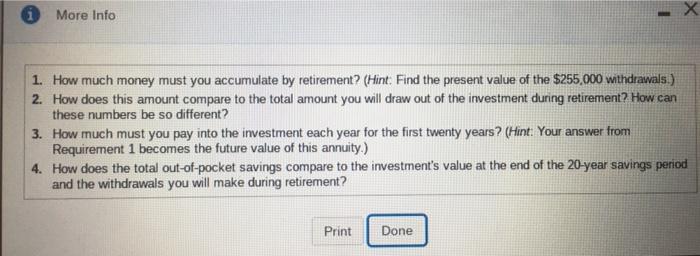

photo two: present value table

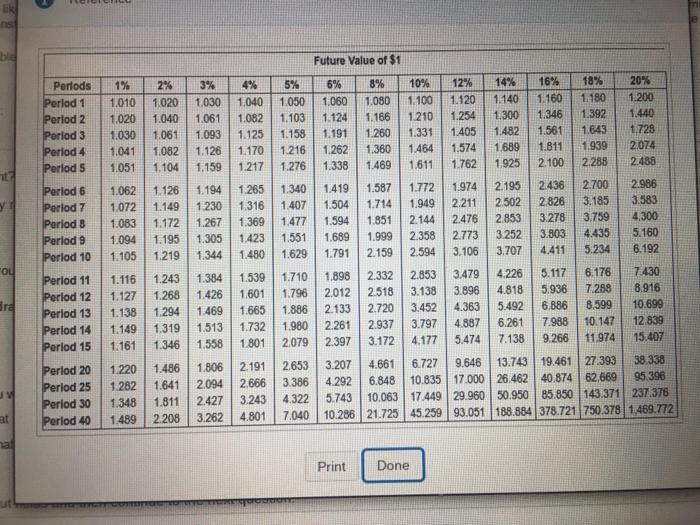

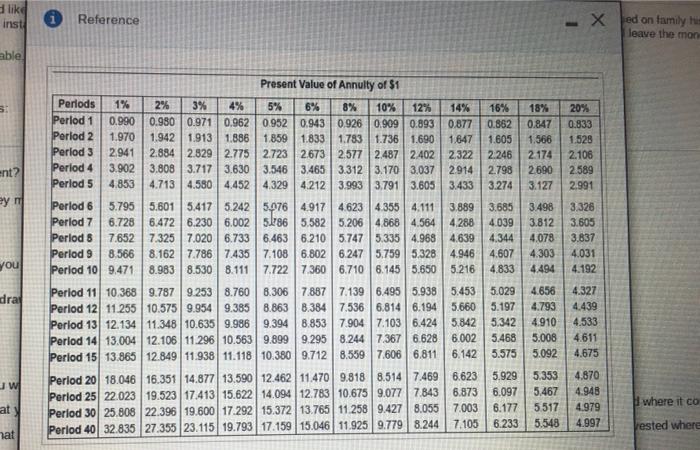

photo three: future value table

let me know if you need anything else!

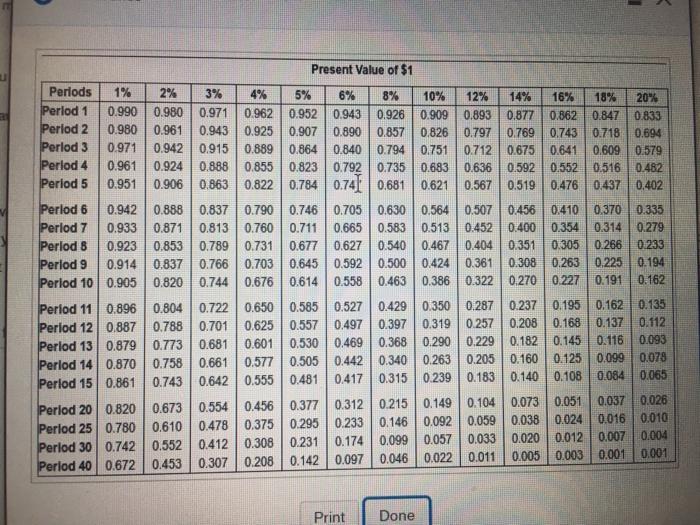

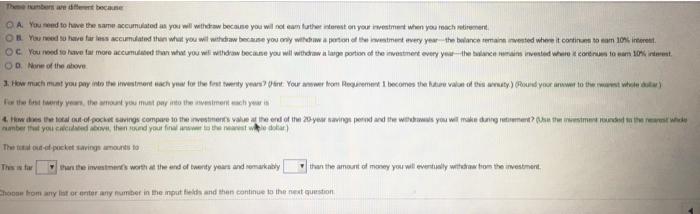

blank one less/more

blank two higher/lower

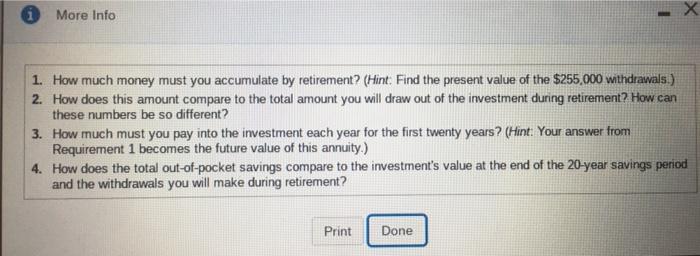

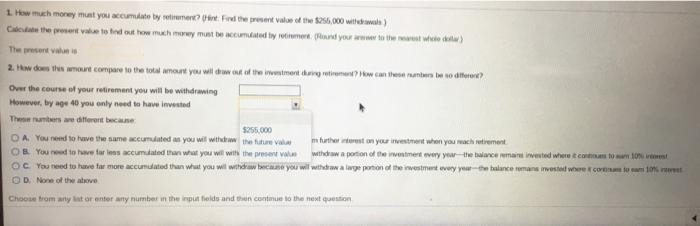

like inst Reference X ed on family he leave the mon able Periods Perlod 1 Period 2 Period 3 Period 4 Perlod 5 Present Value of Annulty of $1 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.9090.893 0.877 1.970 1.942 1.913 1.886 1.859 1.833 1.783 1.736 1.690 1647 2941 2.884 2.829 2.775 2.723 2.673 2577 2.487 2402 2.322 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3,037 2914 4.853 4.713 4.580 4.452 4.32942123.993 3.791 3.605 3.433 16% 0.862 1.605 2.246 2.798 3.274 18% 0.847 1.566 2.174 2690 3.127 20% 0.833 1.528 2.106 2.589 2.991 ent? ey m Perlod 6 5.795 5.601 5.417 5.2425076 4.917 4.623 4355 4.111 Period 7 6.728 6.472 6.230 6.002 51486 5.5825.20648684.564 Perlod 8 7.652 7.325 7,020 6.733 6.463 6.210 5.747 5.335 4.968 Perlod 9 8.566 8.1627.786 7.435 7.108 6.8026.247 5.759 5,328 Period 10 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.650 3.889 4.288 4.639 4.946 5.216 3.685 4.039 4.344 4.607 4.833 3.498 3.812 4.078 4.303 4.494 3.326 3.605 3.837 4.031 4.192 you dra Period 11 10.368 9.787 9.253 8.760 8.3067.887 7.139 6.495 5.938 Perlod 12) 11.255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 Period 13 12.134 11.348 10.635 9.9869.3948.853 7.904 7.103 6.424 Perlod 14 13.004 12.106 11.296 10.563 9.899 9.2958.244 7.3676.628 Period 15 13.865 12.849 11.938 11.118 10.380 9.7128.5597.606 6.811 5.453 5.029 5.660 5.197 5.842 5.342 6.002 5.468 6.142 5.575 4.656 4.793 4.910 5.008 5.092 4.327 4.439 4.533 4.611 4.675 JW 5.929 6.097 6.177 6.233 Period 20 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7.469 6.623 Period 25 22.023 19.523 17.413 15.622 14.094 12783 10.675 9.077 7.8436.873 Period 30 25.808 22.396 19.600 17.292 15.372 13.765 11.258 9.4278.055 7.003 Perlod 40/32 835 27.355 23.115 19.793 17.159 15.046 11.925 9.7798.244 7.105 5.353 5.467 5517 5.548 4.870 4.948 4.979 4.997 at where it co Vested where at 10% Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 8% 12% 14% 16% 18% 20" Perlod 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.857 0.826 0.797 0.769 0.743 0.718 0.694 Perlod 3 0.971 0.942 0.915 0.889 0.864 0.840 0.794 0.751 0.712 0.675 0.641 0.609 0.579 Perlod 4 0.961 0.924 0.888 0.855 0.823 0.792 0.735 0.683 0.636 0.592 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.74 0.681 0.621 0.567 0.519 0.476 0.437 0.402 Perlod 6 0.942 0.888 | 0.837 0.790 0.746 0.705 0.630 0.564 0.507 0.456 0.410 0.370 0.335 Perlod 7 0.933 0.871 0.813 0.760 0.711 0.665 0.583 0.513 0.452 0.400 0.354 0.314 0.279 Perlod 8 0.923 0.853 0.789 0.731 0.677 0.627 0.540 0.467 0.404 0.351 0.305 0.266 0.233 Perlod 9 0.914 0.837 0.766 0.703 0.6450.592 0.500 0.424 0.361 0.308 0.263 0.225 0.194 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.463 0.386 0.322 0.270 0.227 0.191 0.162 Period 11 0.896 0.8040.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.135 Period 12 0.887 0.788 0.701 0.625 0.5570.497 0.397 0.319 0.257 0.208 0.168 0.137 0.112 Perlod 130.879 0.773 0.681 0.601 0.530 0.4690.368 0.290 0.229 0.182 0.145 0.116 0.093 Perlod 14 0.870 0.758 0.661 0.577 0.505 0.442 0.340 0.263 0.205 0.160 0.125 0.099 0.078 Period 15 0.861 0.108 0.481 0.417 0.315 0.743 0.642 0.555 0.239 0.183 0.140 0.084 0.065 0.051 0.377 0.312 0.215 0.149 0.104 0.073 0.037 0.026 Period 20 0.820 0.673 0.554 0.456 0.295 0.233 0.146 Perlod 25 0.780 0.610 0.478 0.375 0.092 0.059 0.038 0.024 0.016 0.010 0.231 0.020 0.174 0.099 0.057 0.033 Perlod 30 0.742 0.552 0.412 0.308 0.012 0.007 0.004 0.022 0.011 0.005 0.142 0.097 0.046 0.001 0.003 0.001 Period 40 0.672 0.453 0.307 0.208 Print Done Future Value of $1 Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 1.010 1.020 1.030 1.041 1.051 2% 1.020 1.040 1,061 1.082 1.104 3% 1.030 1.061 1.093 1.126 1.159 4% 1,040 1.082 1.125 1.170 1.217 5% 1.050 1.103 1.158 1.216 1.276 6% 1.060 1.124 1.191 1.262 1.338 8% 1.080 1.166 1.260 1.360 1.469 1.587 1.714 1.851 1.999 2.159 10% 1.100 1210 1.331 1.464 1.611 12% 1.120 1.254 1.405 1.574 1.762 14% 1.140 1.300 1.482 1.689 1.925 16% 1.160 1.346 1.561 1.811 2.100 18% 1.180 1.392 1.643 1.939 2.288 20% 1.200 1.440 1.728 2074 2.488 Period 6 Period 7 Period 8 Period 9 Perlod 10 1.062 1.072 1.083 1.094 1.105 1.126 1.149 1.172 1.195 1.219 1.194 1230 1.267 1.305 1.344 1.265 1.316 1.369 1.423 1.480 1.340 1.407 1.477 1.551 1.629 1.419 1.504 1.594 1.689 1.791 1.772 1.949 2.144 2.358 2.594 1.974 2.211 2.476 2.773 3.106 2.195 2502 2.853 3.252 3,707 2.436 2.826 3.278 3.803 4.411 2.700 3.185 3,759 4.435 5.234 2.986 3.583 4,300 5.160 6.192 ou ara Period 11 Perlod 12 Period 13 Period 14 Period 15 1.116 1.127 1.138 1.149 1.161 1.243 1.268 1.294 1.319 1.346 1.384 1.426 1.469 1.513 1.558 1.539 1.601 1.665 1.732 1.801 1.710 1.796 1.886 1.980 2.079 1.898 2.012 2.133 2.261 2.397 2.332 2518 2.720 2.937 3.172 2.853 3.138 3.452 3.797 4,177 3.479 3.896 4.363 4.887 5.474 4.226 4.818 5.492 6.261 7.138 5.117 5.936 6.886 7.988 9.266 6.176 7.288 8.599 10.147 11 974 7.430 8.916 10.699 12 839 15.407 Period 20 Period 25 Period 30 Perlod 40 1.220 1.282 1.348 1.489 1.486 1.641 1.811 2.208 1.806 2.094 2.427 3.262 2. 191 2.666 3.243 4.801 2.653 3.386 4.322 7.040 3.207 4.661 6.727 9.646 13.743 19.461 27 393 38 338 4.292 6.848 10.83517.000 26.462 40.874 62.669 95 396 5.743 10.063 17.449 29.960 50.950 85.850 143.371 237.376 10.286 21.725 45.25993.051 188.884 378.721 750.378 1.469.772 at Print Done More Info - 1. How much money must you accumulate by retirement? (Hint. Find the present value of the $255,000 withdrawals.) 2. How does this amount compare to the total amount you will draw out of the investment during retirement? How can these numbers be so different? 3. How much must you pay into the investment each year for the first twenty years? (Hint: Your answer from Requirement 1 becomes the future value of this annuity.) 4. How does the total out-of-pocket savings compare to the investment's value at the end of the 20-year savings period and the withdrawals you will make during retirement? Print Done 1. How much morey must you accumulate by setrument. Find the present value of the $255,000 withdrawal Cated the present value to find out how much morwy must be accumulated by roditement and you wote twee The presenti 2. how does the outcome to the total amount you wil word of the investment retirement? How can the antes de todos Over the course of your retirement you will be withdrawing However, bye 40 you only need to have invested There are different because $255.000 O A. You need to fave the same accumulated as you wil with the future au murest on your investment when you rachutrement Os You need to have farines accumulated than what you wil will the present Value withdraw a portion of the investment every year the local invested where come to OC. You need to have for more accurated than what you wil www because you will withdrawalge portion of the investment every year-the balance romane invested were como 10% OD. None of the above Choose from any it or enter any number in the input fields and then come to the next question The numbers are bene OA You need to have the same accumulated as you will withdraw because you will not an other worst on your smart Wien you reach tirement On You need to have for less accumulated on what you wil withdraw because you only worwa pertand the entert very year the balance teman invented where it continue to mam 101 interent Of Youred so have a more accumulated than what you wel withdraw because you will withdraw a large portion of the restment every year the balance in invested where conto em 10% interest OD. None of the above 3. How much munt you pay into the investment och you for the first twenty years) Pnt. Your swer from Prousement, I becomes the Maire valent of this way) Pound your drawer to the water stay For the best way the worst you must be into the mentach 4. win the total out of pockets compare do the western as the end of the 29yesi tarvinet print and the watches you will make denne peretet? Ou se este mundet te the rest weke ambert you round your the ) The tour of pocket savings amounts to that the new worth at the end of twenty years and remarkably then the amount of money you will eventually with me thon the westment, Chocow from any list or enter any number in the inputs and then continue to the next question like inst Reference X ed on family he leave the mon able Periods Perlod 1 Period 2 Period 3 Period 4 Perlod 5 Present Value of Annulty of $1 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.9090.893 0.877 1.970 1.942 1.913 1.886 1.859 1.833 1.783 1.736 1.690 1647 2941 2.884 2.829 2.775 2.723 2.673 2577 2.487 2402 2.322 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3,037 2914 4.853 4.713 4.580 4.452 4.32942123.993 3.791 3.605 3.433 16% 0.862 1.605 2.246 2.798 3.274 18% 0.847 1.566 2.174 2690 3.127 20% 0.833 1.528 2.106 2.589 2.991 ent? ey m Perlod 6 5.795 5.601 5.417 5.2425076 4.917 4.623 4355 4.111 Period 7 6.728 6.472 6.230 6.002 51486 5.5825.20648684.564 Perlod 8 7.652 7.325 7,020 6.733 6.463 6.210 5.747 5.335 4.968 Perlod 9 8.566 8.1627.786 7.435 7.108 6.8026.247 5.759 5,328 Period 10 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.650 3.889 4.288 4.639 4.946 5.216 3.685 4.039 4.344 4.607 4.833 3.498 3.812 4.078 4.303 4.494 3.326 3.605 3.837 4.031 4.192 you dra Period 11 10.368 9.787 9.253 8.760 8.3067.887 7.139 6.495 5.938 Perlod 12) 11.255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 Period 13 12.134 11.348 10.635 9.9869.3948.853 7.904 7.103 6.424 Perlod 14 13.004 12.106 11.296 10.563 9.899 9.2958.244 7.3676.628 Period 15 13.865 12.849 11.938 11.118 10.380 9.7128.5597.606 6.811 5.453 5.029 5.660 5.197 5.842 5.342 6.002 5.468 6.142 5.575 4.656 4.793 4.910 5.008 5.092 4.327 4.439 4.533 4.611 4.675 JW 5.929 6.097 6.177 6.233 Period 20 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7.469 6.623 Period 25 22.023 19.523 17.413 15.622 14.094 12783 10.675 9.077 7.8436.873 Period 30 25.808 22.396 19.600 17.292 15.372 13.765 11.258 9.4278.055 7.003 Perlod 40/32 835 27.355 23.115 19.793 17.159 15.046 11.925 9.7798.244 7.105 5.353 5.467 5517 5.548 4.870 4.948 4.979 4.997 at where it co Vested where at 10% Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 8% 12% 14% 16% 18% 20" Perlod 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.857 0.826 0.797 0.769 0.743 0.718 0.694 Perlod 3 0.971 0.942 0.915 0.889 0.864 0.840 0.794 0.751 0.712 0.675 0.641 0.609 0.579 Perlod 4 0.961 0.924 0.888 0.855 0.823 0.792 0.735 0.683 0.636 0.592 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.74 0.681 0.621 0.567 0.519 0.476 0.437 0.402 Perlod 6 0.942 0.888 | 0.837 0.790 0.746 0.705 0.630 0.564 0.507 0.456 0.410 0.370 0.335 Perlod 7 0.933 0.871 0.813 0.760 0.711 0.665 0.583 0.513 0.452 0.400 0.354 0.314 0.279 Perlod 8 0.923 0.853 0.789 0.731 0.677 0.627 0.540 0.467 0.404 0.351 0.305 0.266 0.233 Perlod 9 0.914 0.837 0.766 0.703 0.6450.592 0.500 0.424 0.361 0.308 0.263 0.225 0.194 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.463 0.386 0.322 0.270 0.227 0.191 0.162 Period 11 0.896 0.8040.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.135 Period 12 0.887 0.788 0.701 0.625 0.5570.497 0.397 0.319 0.257 0.208 0.168 0.137 0.112 Perlod 130.879 0.773 0.681 0.601 0.530 0.4690.368 0.290 0.229 0.182 0.145 0.116 0.093 Perlod 14 0.870 0.758 0.661 0.577 0.505 0.442 0.340 0.263 0.205 0.160 0.125 0.099 0.078 Period 15 0.861 0.108 0.481 0.417 0.315 0.743 0.642 0.555 0.239 0.183 0.140 0.084 0.065 0.051 0.377 0.312 0.215 0.149 0.104 0.073 0.037 0.026 Period 20 0.820 0.673 0.554 0.456 0.295 0.233 0.146 Perlod 25 0.780 0.610 0.478 0.375 0.092 0.059 0.038 0.024 0.016 0.010 0.231 0.020 0.174 0.099 0.057 0.033 Perlod 30 0.742 0.552 0.412 0.308 0.012 0.007 0.004 0.022 0.011 0.005 0.142 0.097 0.046 0.001 0.003 0.001 Period 40 0.672 0.453 0.307 0.208 Print Done Future Value of $1 Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 1.010 1.020 1.030 1.041 1.051 2% 1.020 1.040 1,061 1.082 1.104 3% 1.030 1.061 1.093 1.126 1.159 4% 1,040 1.082 1.125 1.170 1.217 5% 1.050 1.103 1.158 1.216 1.276 6% 1.060 1.124 1.191 1.262 1.338 8% 1.080 1.166 1.260 1.360 1.469 1.587 1.714 1.851 1.999 2.159 10% 1.100 1210 1.331 1.464 1.611 12% 1.120 1.254 1.405 1.574 1.762 14% 1.140 1.300 1.482 1.689 1.925 16% 1.160 1.346 1.561 1.811 2.100 18% 1.180 1.392 1.643 1.939 2.288 20% 1.200 1.440 1.728 2074 2.488 Period 6 Period 7 Period 8 Period 9 Perlod 10 1.062 1.072 1.083 1.094 1.105 1.126 1.149 1.172 1.195 1.219 1.194 1230 1.267 1.305 1.344 1.265 1.316 1.369 1.423 1.480 1.340 1.407 1.477 1.551 1.629 1.419 1.504 1.594 1.689 1.791 1.772 1.949 2.144 2.358 2.594 1.974 2.211 2.476 2.773 3.106 2.195 2502 2.853 3.252 3,707 2.436 2.826 3.278 3.803 4.411 2.700 3.185 3,759 4.435 5.234 2.986 3.583 4,300 5.160 6.192 ou ara Period 11 Perlod 12 Period 13 Period 14 Period 15 1.116 1.127 1.138 1.149 1.161 1.243 1.268 1.294 1.319 1.346 1.384 1.426 1.469 1.513 1.558 1.539 1.601 1.665 1.732 1.801 1.710 1.796 1.886 1.980 2.079 1.898 2.012 2.133 2.261 2.397 2.332 2518 2.720 2.937 3.172 2.853 3.138 3.452 3.797 4,177 3.479 3.896 4.363 4.887 5.474 4.226 4.818 5.492 6.261 7.138 5.117 5.936 6.886 7.988 9.266 6.176 7.288 8.599 10.147 11 974 7.430 8.916 10.699 12 839 15.407 Period 20 Period 25 Period 30 Perlod 40 1.220 1.282 1.348 1.489 1.486 1.641 1.811 2.208 1.806 2.094 2.427 3.262 2. 191 2.666 3.243 4.801 2.653 3.386 4.322 7.040 3.207 4.661 6.727 9.646 13.743 19.461 27 393 38 338 4.292 6.848 10.83517.000 26.462 40.874 62.669 95 396 5.743 10.063 17.449 29.960 50.950 85.850 143.371 237.376 10.286 21.725 45.25993.051 188.884 378.721 750.378 1.469.772 at Print Done More Info - 1. How much money must you accumulate by retirement? (Hint. Find the present value of the $255,000 withdrawals.) 2. How does this amount compare to the total amount you will draw out of the investment during retirement? How can these numbers be so different? 3. How much must you pay into the investment each year for the first twenty years? (Hint: Your answer from Requirement 1 becomes the future value of this annuity.) 4. How does the total out-of-pocket savings compare to the investment's value at the end of the 20-year savings period and the withdrawals you will make during retirement? Print Done 1. How much morey must you accumulate by setrument. Find the present value of the $255,000 withdrawal Cated the present value to find out how much morwy must be accumulated by roditement and you wote twee The presenti 2. how does the outcome to the total amount you wil word of the investment retirement? How can the antes de todos Over the course of your retirement you will be withdrawing However, bye 40 you only need to have invested There are different because $255.000 O A. You need to fave the same accumulated as you wil with the future au murest on your investment when you rachutrement Os You need to have farines accumulated than what you wil will the present Value withdraw a portion of the investment every year the local invested where come to OC. You need to have for more accurated than what you wil www because you will withdrawalge portion of the investment every year-the balance romane invested were como 10% OD. None of the above Choose from any it or enter any number in the input fields and then come to the next question The numbers are bene OA You need to have the same accumulated as you will withdraw because you will not an other worst on your smart Wien you reach tirement On You need to have for less accumulated on what you wil withdraw because you only worwa pertand the entert very year the balance teman invented where it continue to mam 101 interent Of Youred so have a more accumulated than what you wel withdraw because you will withdraw a large portion of the restment every year the balance in invested where conto em 10% interest OD. None of the above 3. How much munt you pay into the investment och you for the first twenty years) Pnt. Your swer from Prousement, I becomes the Maire valent of this way) Pound your drawer to the water stay For the best way the worst you must be into the mentach 4. win the total out of pockets compare do the western as the end of the 29yesi tarvinet print and the watches you will make denne peretet? Ou se este mundet te the rest weke ambert you round your the ) The tour of pocket savings amounts to that the new worth at the end of twenty years and remarkably then the amount of money you will eventually with me thon the westment, Chocow from any list or enter any number in the inputs and then continue to the next