Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BACKGROUND Wellington Trailers Ltd. (WT) manufactures and sells quality car trailers and is organised in a divisional structure with three divisions named Chassis ,

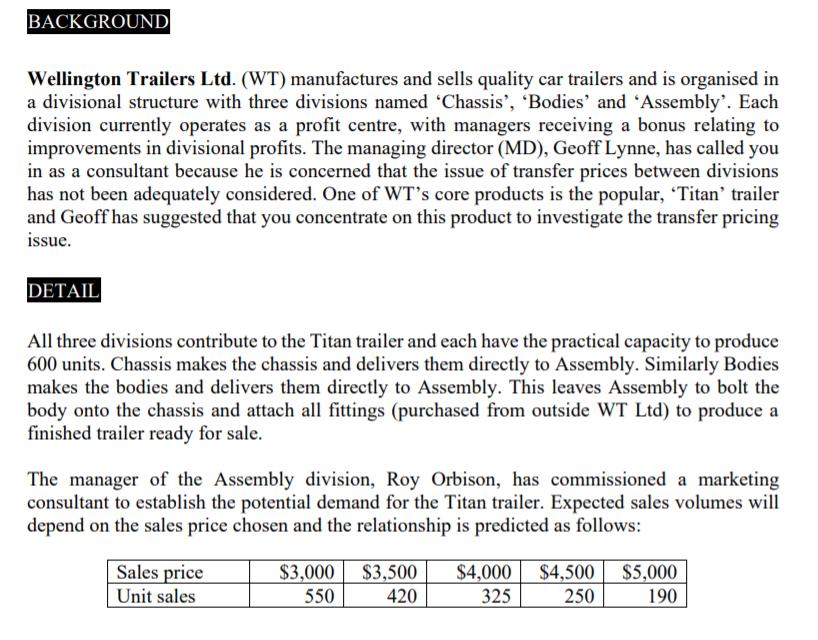

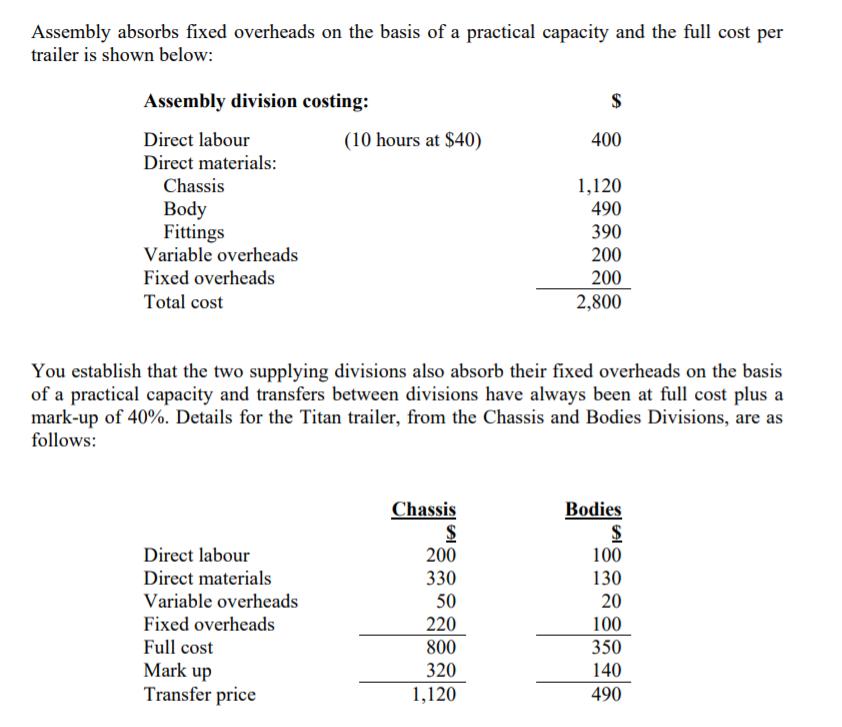

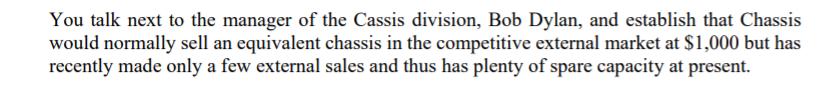

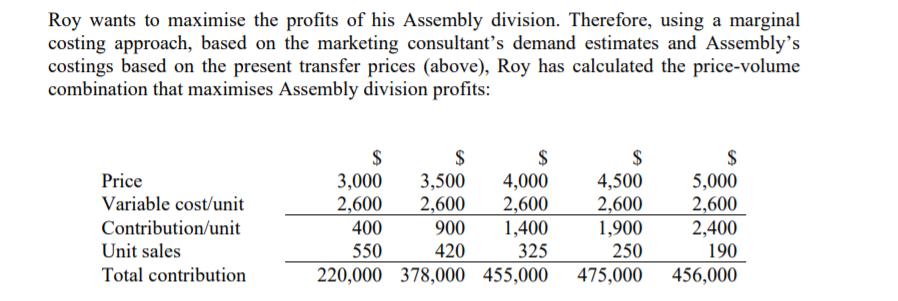

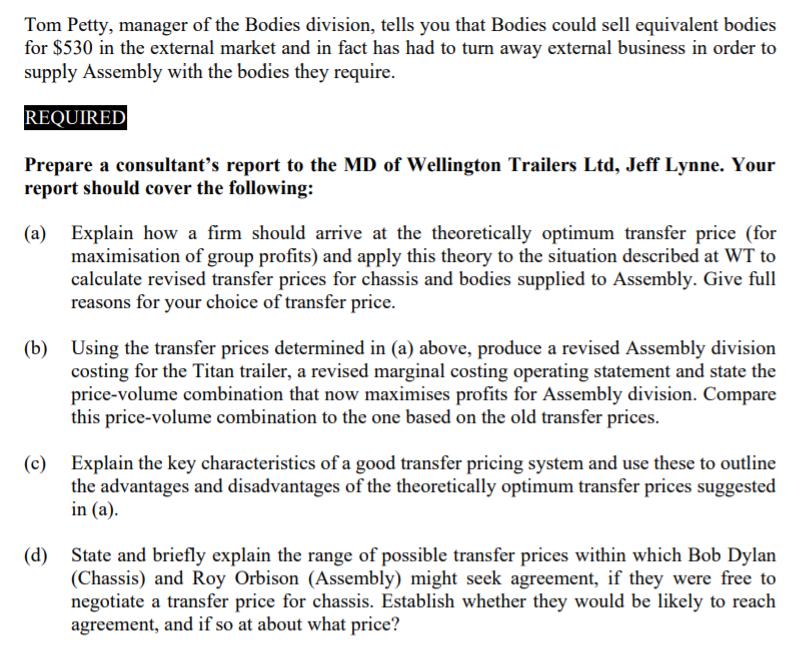

BACKGROUND Wellington Trailers Ltd. (WT) manufactures and sells quality car trailers and is organised in a divisional structure with three divisions named Chassis , Bodies and Assembly . Each division currently operates as a profit centre, with managers receiving a bonus relating to improvements in divisional profits. The managing director (MD), Geoff Lynne, has called you in as a consultant because he is concerned that the issue of transfer prices between divisions has not been adequately considered. One of WT s core products is the popular, Titan trailer and Geoff has suggested that you concentrate on this product to investigate the transfer pricing issue. DETAIL All three divisions contribute to the Titan trailer and each have the practical capacity to produce 600 units. Chassis makes the chassis and delivers them directly to Assembly. Similarly Bodies makes the bodies and delivers them directly to Assembly. This leaves Assembly to bolt the body onto the chassis and attach all fittings (purchased from outside WT Ltd) to produce a finished trailer ready for sale. The manager of the Assembly division, Roy Orbison, has commissioned a marketing consultant to establish the potential demand for the Titan trailer. Expected sales volumes will depend on the sales price chosen and the relationship is predicted as follows: Sales price Unit sales $3,000 550 $3,500 $4,000 $4,500 $5,000 420 325 250 190 Assembly absorbs fixed overheads on the basis of a practical capacity and the full cost per trailer is shown below: Assembly division costing: Direct labour Direct materials: Chassis Body Fittings Variable overheads Fixed overheads Total cost (10 hours at $40) Direct labour Direct materials Variable overheads Fixed overheads Full cost Mark up Transfer price $ 400 You establish that the two supplying divisions also absorb their fixed overheads on the basis of a practical capacity and transfers between divisions have always been at full cost plus a mark-up of 40%. Details for the Titan trailer, from the Chassis and Bodies Divisions, are as follows: Chassis $ 200 330 50 220 800 320 1,120 1,120 490 390 200 200 2,800 Bodies $ 100 130 20 100 350 140 490 You talk next to the manager of the Cassis division, Bob Dylan, and establish that Chassis would normally sell an equivalent chassis in the competitive external market at $1,000 but has recently made only a few external sales and thus has plenty of spare capacity at present. Roy wants to maximise the profits of his Assembly division. Therefore, using a marginal costing approach, based on the marketing consultant s demand estimates and Assembly s costings based on the present transfer prices (above), Roy has calculated the price-volume combination that maximises Assembly division profits: Price Variable cost/unit Contribution/unit Unit sales Total contribution $ 3,000 2,600 400 550 220,000 $ $ 3,500 4,000 2,600 2,600 900 1,400 420 325 378,000 455,000 $ 4,500 2,600 1,900 250 475,000 $ 5,000 2,600 2,400 190 456,000 Tom Petty, manager of the Bodies division, tells you that Bodies could sell equivalent bodies for $530 in the external market and in fact has had to turn away external business in order to supply Assembly with the bodies they require. REQUIRED Prepare a consultant s report to the MD of Wellington Trailers Ltd, Jeff Lynne. Your report should cover the following: (a) Explain how a firm should arrive at the theoretically optimum transfer price (for maximisation of group profits) and apply this theory to the situation described at WT to calculate revised transfer prices for chassis and bodies supplied to Assembly. Give full reasons for your choice of transfer price. (b) Using the transfer prices determined in (a) above, produce a revised Assembly division costing for the Titan trailer, a revised marginal costing operating statement and state the price-volume combination that now maximises profits for Assembly division. Compare this price-volume combination to the one based on the old transfer prices. (c) Explain the key characteristics of a good transfer pricing system and use these to outline the advantages and disadvantages of the theoretically optimum transfer prices suggested in (a). (d) State and briefly explain the range of possible transfer prices within which Bob Dylan (Chassis) and Roy Orbison (Assembly) might seek agreement, if they were free to negotiate a transfer price for chassis. Establish whether they would be likely to reach agreement, and if so at about what price?

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

A The total price is Market value Any price set above will not be equal to the purchase price This will result in the buyer buying from an external su...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started