Answered step by step

Verified Expert Solution

Question

1 Approved Answer

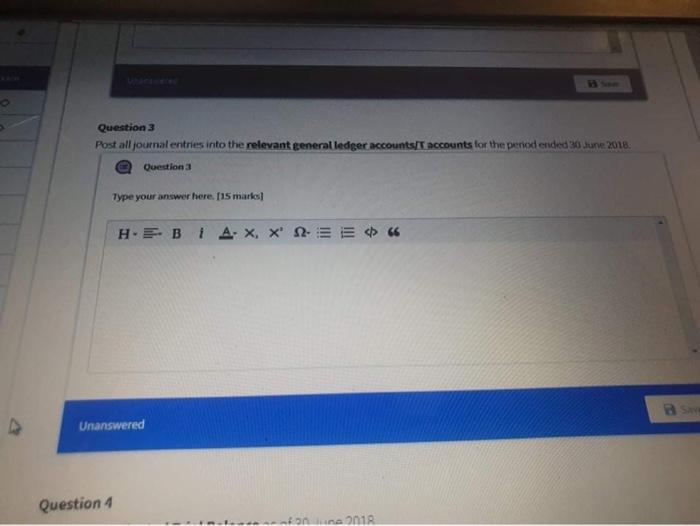

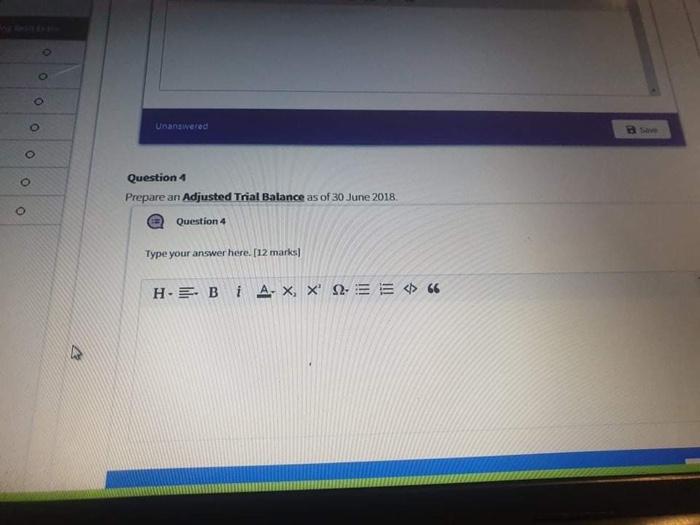

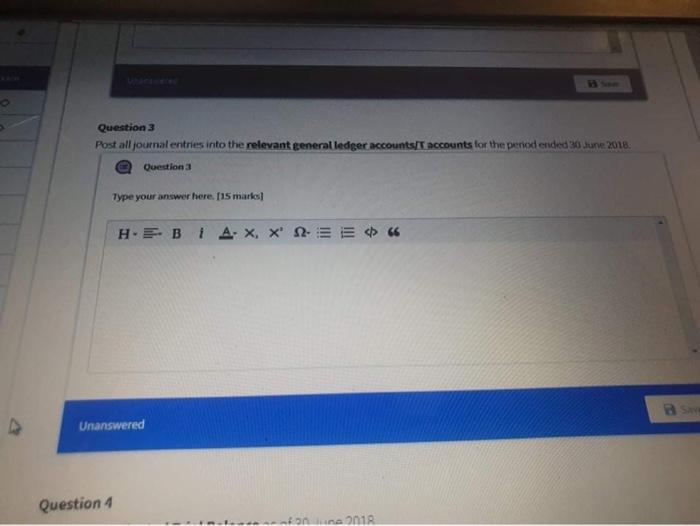

photos of journal entries Question 3 Post all journal entries into the relevant general ledger accounts/T accounts for the period ended 30 June 2018 Questiona

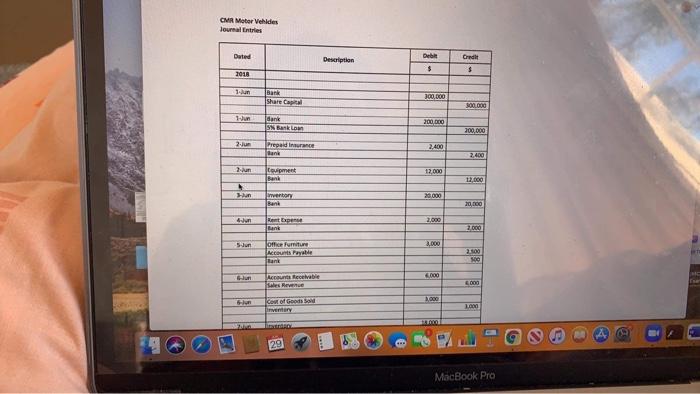

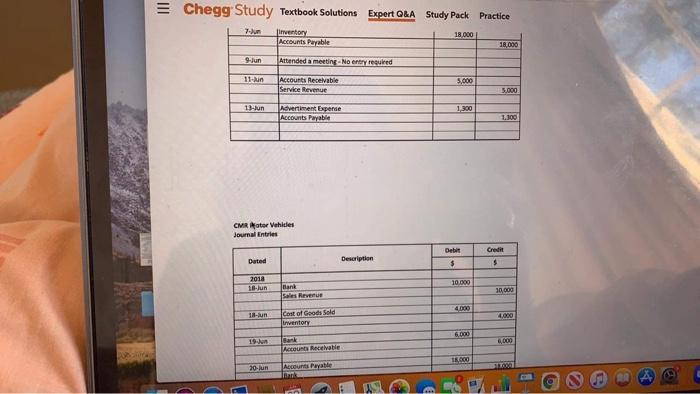

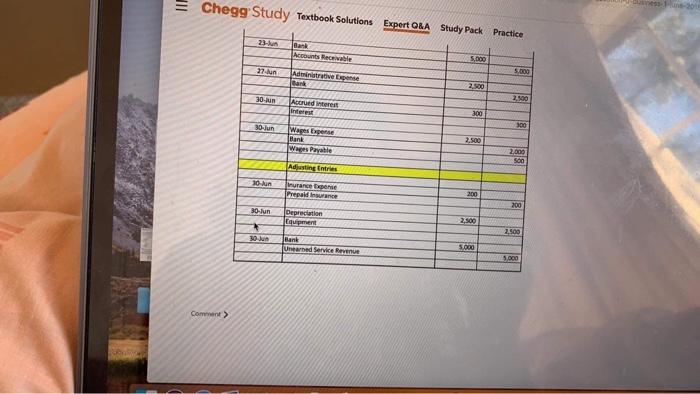

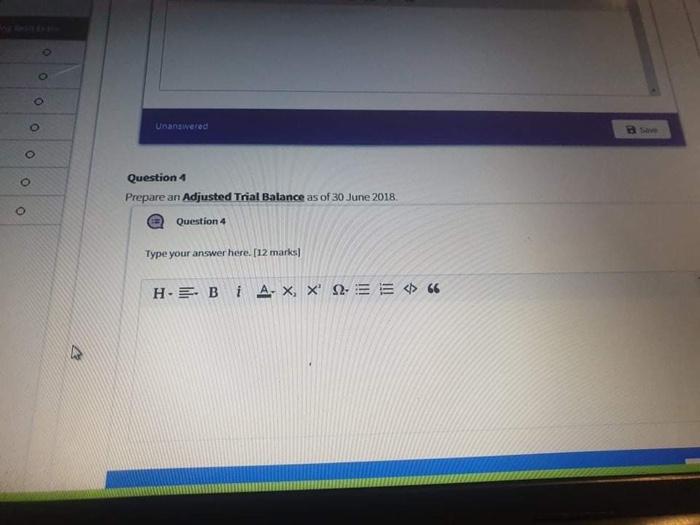

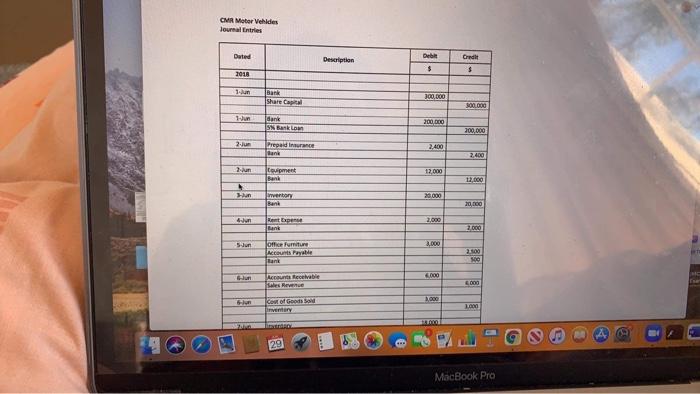

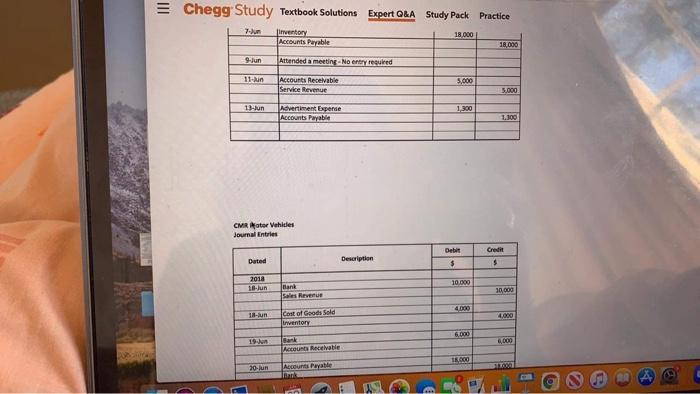

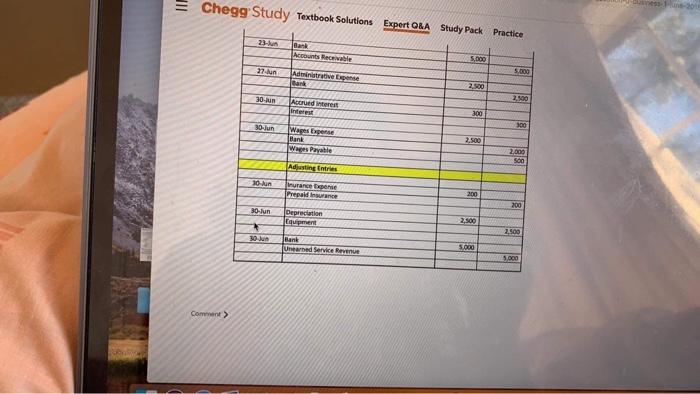

photos of journal entries Question 3 Post all journal entries into the relevant general ledger accounts/T accounts for the period ended 30 June 2018 Questiona Type your answer here. [15 marks] HE B 1 AX, X NE 66 BS Unanswered Question 4 na OIR O Unanswered O O Question 4 Prepare an Adjusted Trial Balance as of 30 June 2018 Question 4 O Type your answer here. [12 marks] HEB i A-X, X 12.5 = 66 CMR Motor Vehicles Journal Entries Duted Deble Candlet Description $ $ 2018 100.000 Share Capital Hun dan SN Banko 200.000 200,000 2- Prepaid in anh 2,400 2.400 2.un topment Bank 12.000 12.000 Hun 20.000 inventory Bank 20.000 2,000 Renten an 5.Jun 2.000 JOffice Furniture Account Payale Bank 200 so 000 Account Receivable Rue 6.000 1,000 com of God Vetery 100 29 MacBook Pro = Chegg Study Textbook Solutions Expert OLA Study Pack Practice 7.un 18.000 Inventory Accounts Payable 18.000 9 Jun Attended a meeting. No entry required 11-un 5,000 Accounts Receivable Servke Revenue 5.000 13 Jun Nevertiment Expense Accounts Payable 1.300 1.300 CMR ator Vehicles Journal Entries Credo Debit $ Dated Description $ 2018 -lan 10.000 Bank Sales Revenue 30,000 400 18-un Cost of Goods Sold invertory 4.000 6.000 000 Bank Accounts Receivable TR000 20 Jun Account Payable an SE Chegg Study Textbook Solutions Expert G&A Study Pack Practice 23 Bank Account Recen 5,000 27- 5.000 Adminle Expense Bank 10- 2,590 Acorder interest 1913 300 - 100 Wages bente Bank Wees Payable 2.500 2.000 500 Adjusting Entries 10.A urance pense Prepaid in 200 200 30-un Depreciation Copment 2.500 2.500 30- Bank Uneared Service Ravenue 5.000 5.000 Cont>

photos of journal entries Question 3 Post all journal entries into the relevant general ledger accounts/T accounts for the period ended 30 June 2018 Questiona Type your answer here. [15 marks] HE B 1 AX, X NE 66 BS Unanswered Question 4 na OIR O Unanswered O O Question 4 Prepare an Adjusted Trial Balance as of 30 June 2018 Question 4 O Type your answer here. [12 marks] HEB i A-X, X 12.5 = 66 CMR Motor Vehicles Journal Entries Duted Deble Candlet Description $ $ 2018 100.000 Share Capital Hun dan SN Banko 200.000 200,000 2- Prepaid in anh 2,400 2.400 2.un topment Bank 12.000 12.000 Hun 20.000 inventory Bank 20.000 2,000 Renten an 5.Jun 2.000 JOffice Furniture Account Payale Bank 200 so 000 Account Receivable Rue 6.000 1,000 com of God Vetery 100 29 MacBook Pro = Chegg Study Textbook Solutions Expert OLA Study Pack Practice 7.un 18.000 Inventory Accounts Payable 18.000 9 Jun Attended a meeting. No entry required 11-un 5,000 Accounts Receivable Servke Revenue 5.000 13 Jun Nevertiment Expense Accounts Payable 1.300 1.300 CMR ator Vehicles Journal Entries Credo Debit $ Dated Description $ 2018 -lan 10.000 Bank Sales Revenue 30,000 400 18-un Cost of Goods Sold invertory 4.000 6.000 000 Bank Accounts Receivable TR000 20 Jun Account Payable an SE Chegg Study Textbook Solutions Expert G&A Study Pack Practice 23 Bank Account Recen 5,000 27- 5.000 Adminle Expense Bank 10- 2,590 Acorder interest 1913 300 - 100 Wages bente Bank Wees Payable 2.500 2.000 500 Adjusting Entries 10.A urance pense Prepaid in 200 200 30-un Depreciation Copment 2.500 2.500 30- Bank Uneared Service Ravenue 5.000 5.000 Cont>

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started