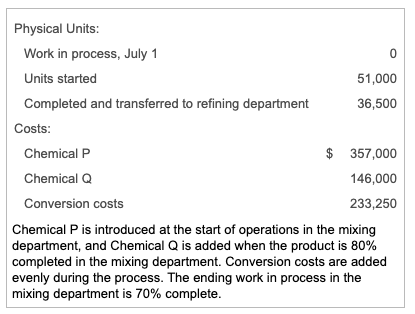

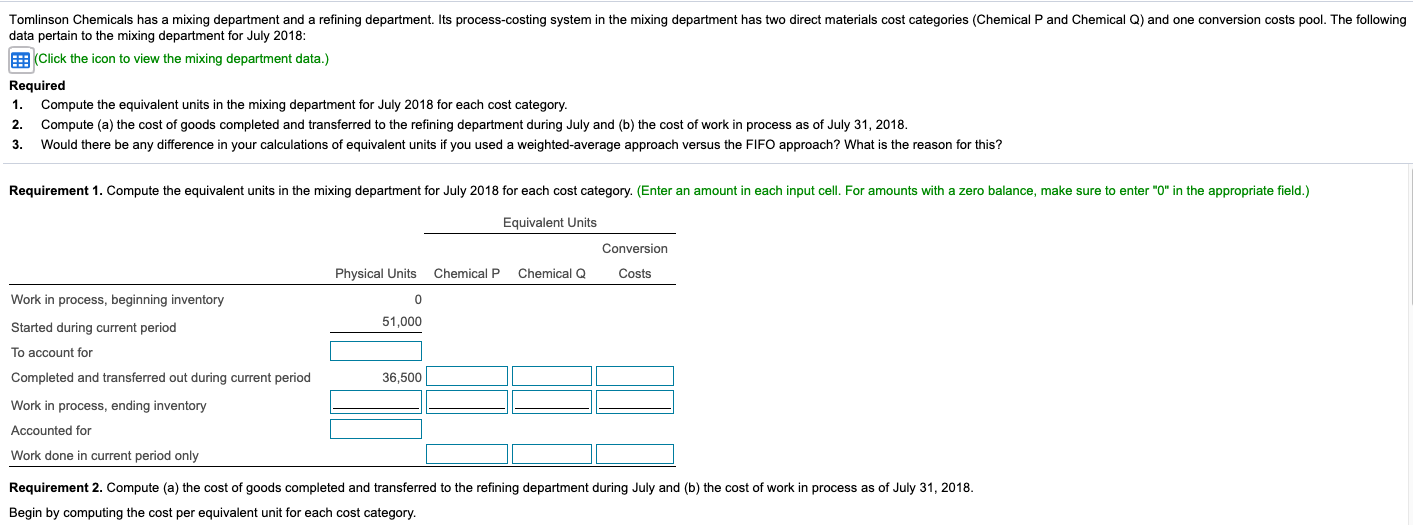

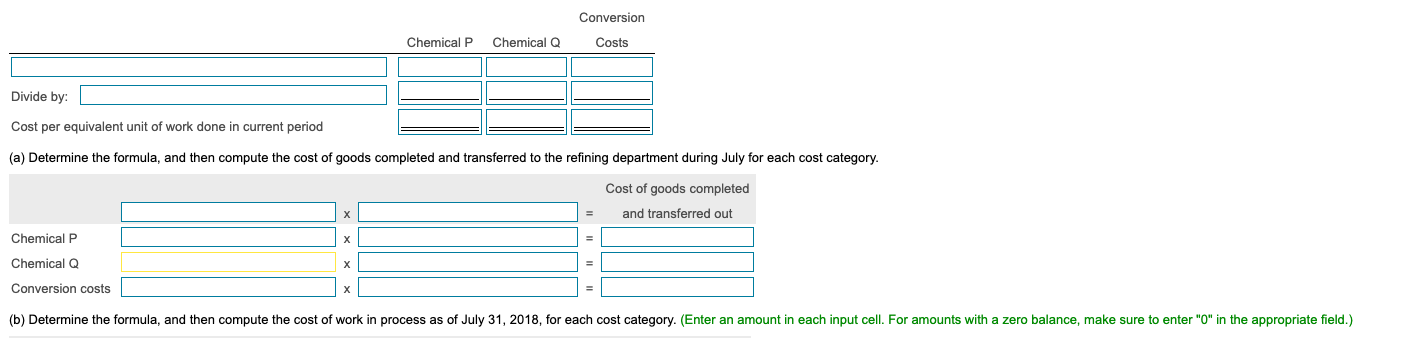

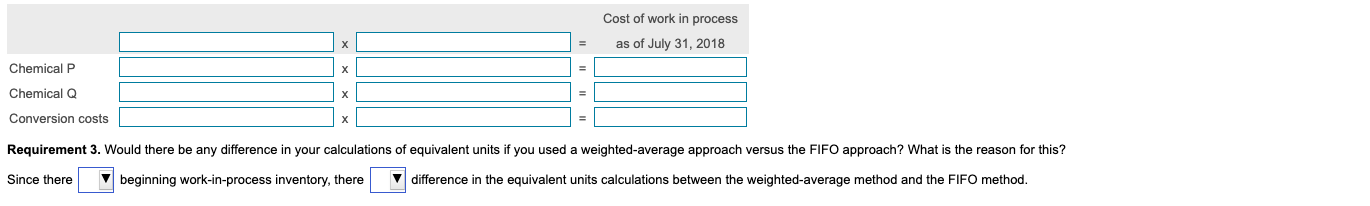

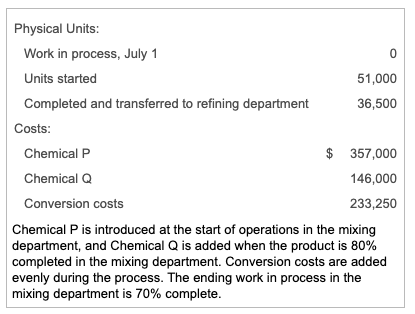

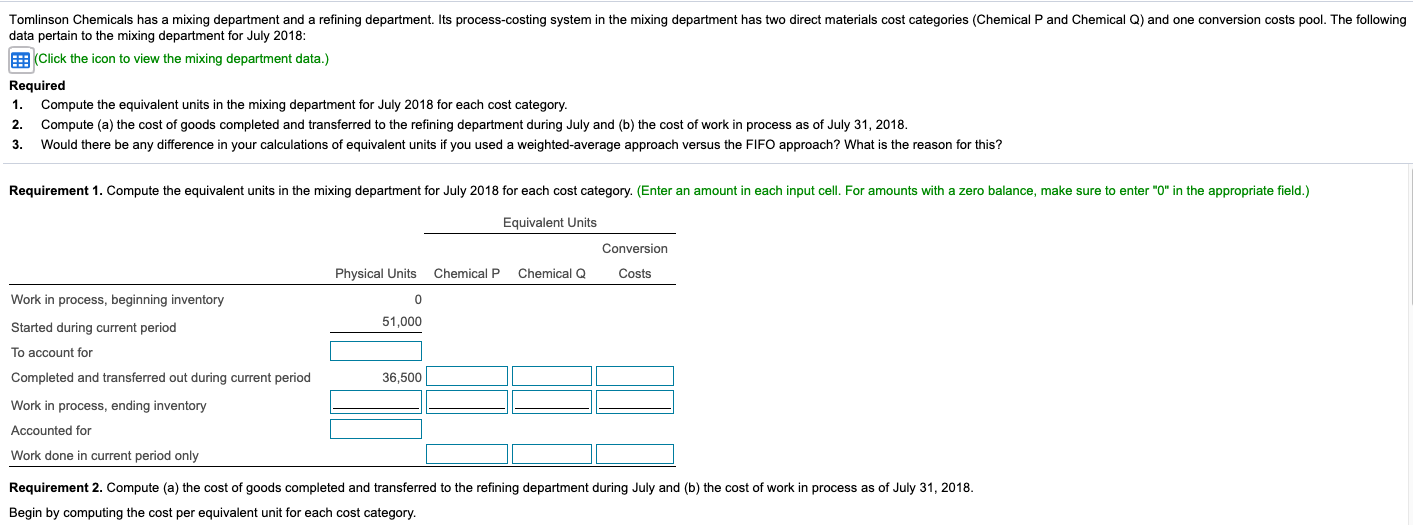

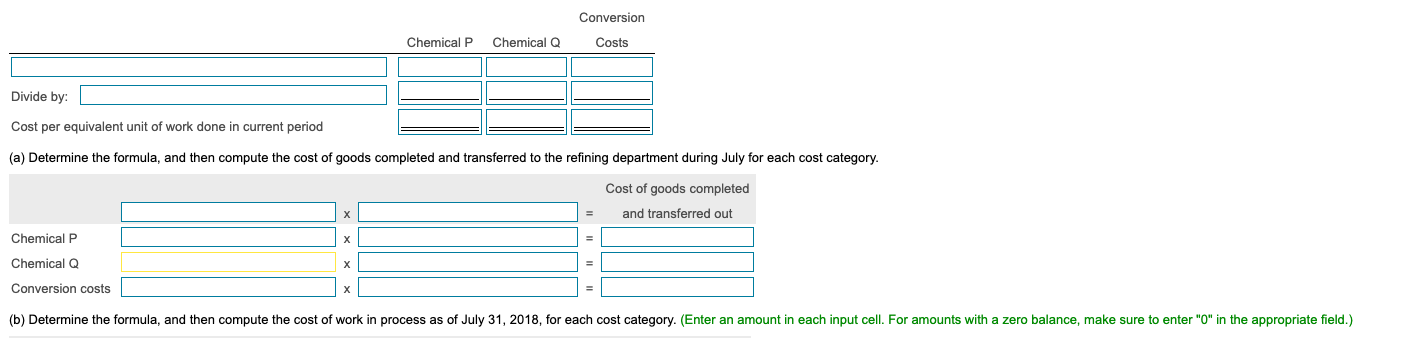

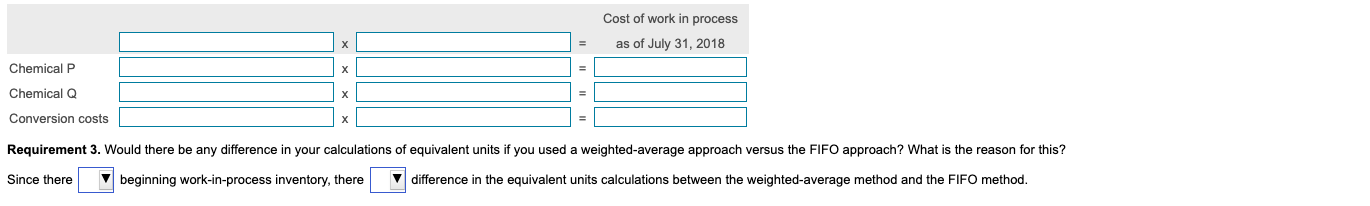

Physical Units: Work in process, July 1 0 Units started 51,000 Completed and transferred to refining department 36,500 Costs: Chemical P $ 357,000 Chemical Q 146,000 Conversion costs 233,250 Chemical P is introduced at the start of operations in the mixing department, and Chemical Q is added when the product is 80% completed in the mixing department. Conversion costs are added evenly during the process. The ending work in process in the mixing department is 70% complete. Tomlinson Chemicals has a mixing department and a refining department. Its process-costing system in the mixing department has two direct materials cost categories (Chemical P and Chemical Q) and one conversion costs pool. The following data pertain to the mixing department for July 2018: Click the icon to view the mixing department data.) Required 1. Compute the equivalent units in the mixing department for July 2018 for each cost category. 2. Compute (a) the cost of goods completed and transferred to the refining department during July and (b) the cost of work in process as of July 31, 2018. 3. Would there be any difference in your calculations of equivalent units if you used a weighted average approach versus the FIFO approach? What is the reason for this? Requirement 1. Compute the equivalent units in the mixing department for July 2018 for each cost category. (Enter an amount in each input cell. For amounts with a zero balance, make sure to enter "0" in the appropriate field.) Equivalent Units Conversion Physical Units Chemical P Chemical Q Costs Work in process, beginning inventory 0 51,000 Started during current period To account for Completed and transferred out during current period Work in process, ending inventory Accounted for 36,500 Work done in current period only Requirement 2. Compute (a) the cost of goods completed and transferred to the refining department during July and (b) the cost of work in process as of July 31, 2018. Begin by computing the cost per equivalent unit for each cost category. Conversion Chemical P Chemical Q Costs Divide by: Cost per equivalent unit of work done in current period (a) Determine the formula, and then compute the cost of goods completed and transferred to the refining department during July for each cost category. Cost of goods completed and transferred out Chemical P Chemical Q Conversion costs (b) Determine the formula, and then compute the cost of work in process as of July 31, 2018, for each cost category. (Enter an amount in each input cell. For amounts with a zero balance, make sure to enter "0" in the appropriate field.) Cost of work in process as of July 31, 2018 Chemical P Chemical Q Conversion costs Requirement 3. Would there be any difference in your calculations of equivalent units if you used a weighted average approach versus the FIFO approach? What is the reason for this? Since there beginning work-in-process inventory, there difference in the equivalent units calculations between the weighted average method and the FIFO method