Question

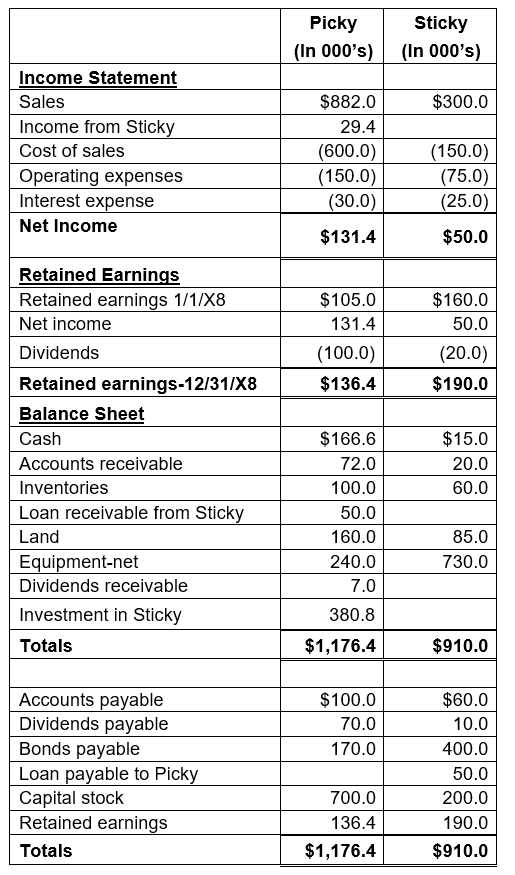

Picky Corporation paid $350,000 for an 70% interest in Sticky Corporation on January 1, 20X6 when the stockholders' equity of Sticky consisted of $200,000 capital

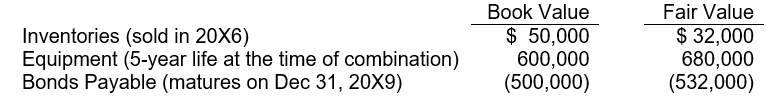

Picky Corporation paid $350,000 for an 70% interest in Sticky Corporation on January 1, 20X6 when the stockholders' equity of Sticky consisted of $200,000 capital stock and $140,000 retained earnings. The following assets of Sticky had fair values different from their book values when Picky acquired its interest:

Stickys accounts payable at December 31, 20X8 included $15,000 owed to Picky. Picky and Stickys financial statements for the year ended 12/31/20X8 are provided below:

Complete the partially completed Consolidated Workpapers for year ended 12/31/X8.

| Picky Corporation and Subsidiary Consolidation Working Papers | |||||||

| For the year ended December 31, 20X8 | |||||||

| Picky | Sticky | Adjustments & Eliminations (In 000's) | Consolidated | ||||

| (In 000s) | (In 000s) | (In 000's) | |||||

| Income Statement | DR. | CR. | |||||

| Sales | $882.0 | $300.0 | |||||

| Income from Sticky | 29.4 | ||||||

| Cost of sales | (600.0) | (150.0) | |||||

| Operating expenses | (150.0) | (75.0) | |||||

| Interest expense | (30.0) | (25.0) | |||||

| Consolidated net income (CNI) | |||||||

| Controlling share of CNI | $131.4 | $50.0 | |||||

| Retained Earnings | |||||||

| Retained earnings-Picky 1/1/X8 | $105.0 | ||||||

| Retained earnings-Sticky 1/1/X8 | $160.0 | ||||||

| Net income | 131.4 | 50.0 | |||||

| Dividends | (100.0) | (20.0) | |||||

| Retained earnings-12/31/X8 | $136.4 | $190.0 | |||||

| Balance Sheet | |||||||

| Cash | $166.6 | $15.0 | |||||

| Accounts receivable | 72.0 | 20.0 | |||||

| Inventories | 100.0 | 60.0 | |||||

| Loan receivable from Sticky | 50.0 | ||||||

| Land | 160.0 | 85.0 | |||||

| Equipment-net | 240.0 | 730.0 | |||||

| Dividends receivable | 7.0 | ||||||

| Investment in Sticky | 380.8 | ||||||

| Totals | $1,176.4 | $910.0 | |||||

| Accounts payable | $100.0 | $60.0 | |||||

| Dividends payable | 70.0 | 10.0 | |||||

| Bonds payable | 170.0 | 400.0 | |||||

| Loan payable to Picky | 50.0 | ||||||

| Capital stock | 700.0 | 200.0 | |||||

| Retained earnings | 136.4 | 190.0 | |||||

| Totals | $1,176.4 | $910.0 | |||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started