Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pictures attached. Please explain to me the logic behind these answers and help me decide on the correct answer for questions 41 and 47 39-

Pictures attached.

Please explain to me the logic behind these answers and help me decide on the correct answer for questions 41 and 47

39- Form843

40-no

41-the answer is (Not b- 1040 nr)other options are

a- 1040

c 1040 nr ez

d- he does not need to file a return

42-1040nr

43-no

44-false

45-no

46-1040 nr

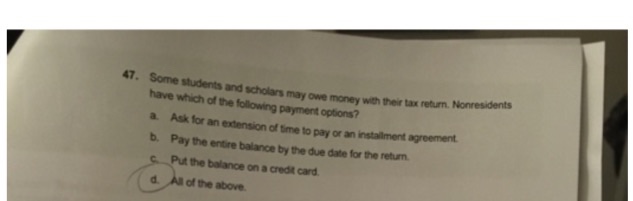

47. The answers is Not - to extend deadline

below for other options (picture)

48 true

49false

50 true

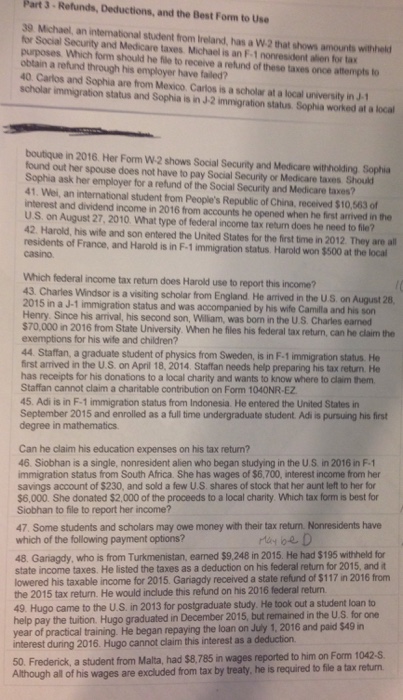

Part 3.Retunds, Deductions, and the Best Form to use 30 Michael, an student Ireland, has a W 2 that shows amounts withheld for Social Security and from form Medicare taxes Michael is an F1 obtain a retund fue to a of these taxes once atempts to through his employer have faled? 40, Carlos and Sophia are from Mexico, Car is a scholar at alocal scholar immigration status and Sophia is in J2 sophia worked at a local boutique in 2016, Her Form W.2 shows Social Security and Medicare withholding Sophia found out her spouse does not have to pay Security or Medicare taxes thoad ask her employer for of the Social Security and Medicare taxes? 1. Wei, an international student from People's Republic of China, received $10,563 of interest and dividend income in 2016 from accounts he opened when he frst amived in the US on August 27, 2010 What type of federal income tax retum does he need to file? 42. Harold, his wife and son entered the United States for the first time in 2012. They residents of France, and Harold is in F-1 immigration status. Harold won $500 at the local Which federal income tax return does Harold use to report this income? 43. Charles Windsor is a visiting scholar from England He arrived in the US, on August 28 2015 in a J-1 immigration status and was accompanied Since his son, by his wife Camilla and his $70,000 in 2016 from State University. When he files his federal tax return, can he claim the exemptions for his wife and children? 44. Staffan, a graduate student of physics from Sweden, is in status He first arrived in the US on April 18, 2014. Staffan needs help preparing his tax has receipts for his donations to a local charity and wants to know where to daim them. Staffan cannot claim a charitable contribution on Form 1040NR-EZ. 45, Adi is in F-1 immigration status from Indonesia. He entered the United States in September 2015 and enrolled as a full time undergraduate student Adi is pursuing his fi degree in mathematics. Can he claim his education expenses on his tax return? is a single, nonresident alien who began studying in the US in 2016 in F.1 immigration status from South Africa. She has wages of $6,700, interest income from her savings account of $230, and sold a few U.S, shares of stock that her aunt left to her for $6,000. She donated $2,000 of the proceeds to a local charity. Which tax form is best for Siobhan to file to report her income? 47. Some students and scholars may owe money with their tax return Nonresidents have which of the following payment options? Ganagdy, who is from Turkmenistan, earned $9.248 in 2015. He had $195 withheld for state income taxes. He listed the taxes as a deduction on his federal for and lowered his taxable income for 2015. Gariagdy received a state refund of in 2016 from 2015 tax return. He would include this refund on his 2016 to came to the US in 2013 for He took out a student loan help pay tuition. Hugo graduated in December 2015, but remained in the US for one the year of training. He began repaying the loan on July 1, 2016 and paid $49 in practical interest during 2016. Hugo cannot claim this interest as a deduction. 50. Frederick, a student from Malta, had s8,785 in wages reported to him on Form 1042.s Although all of his wages are excluded from tax by treaty, he is required to file a tax retumStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started