Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pierce Control Systems In 20XX, Sam Fenton was extremely pleased to view the online The Globe and Mail and see that the prime rate had

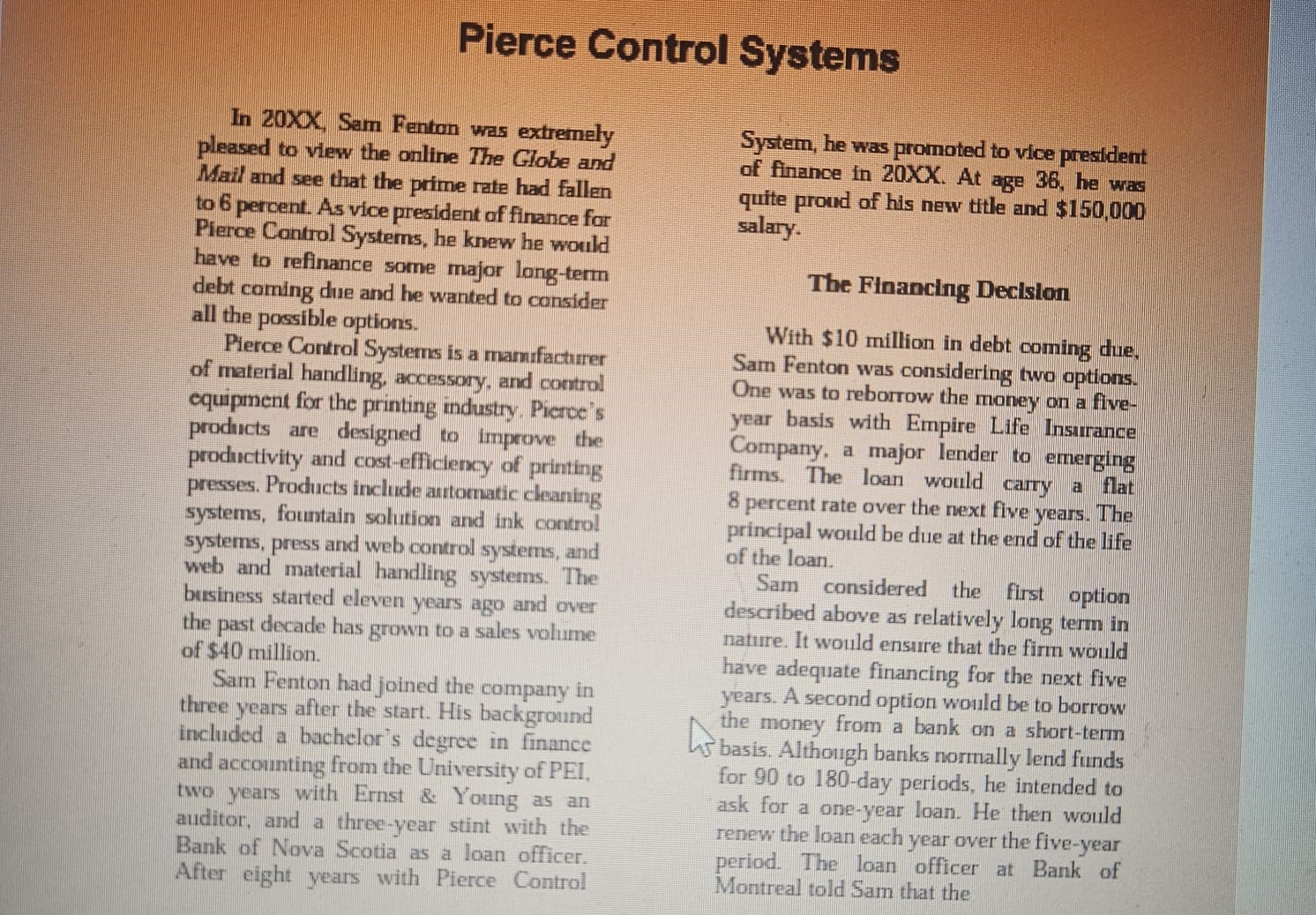

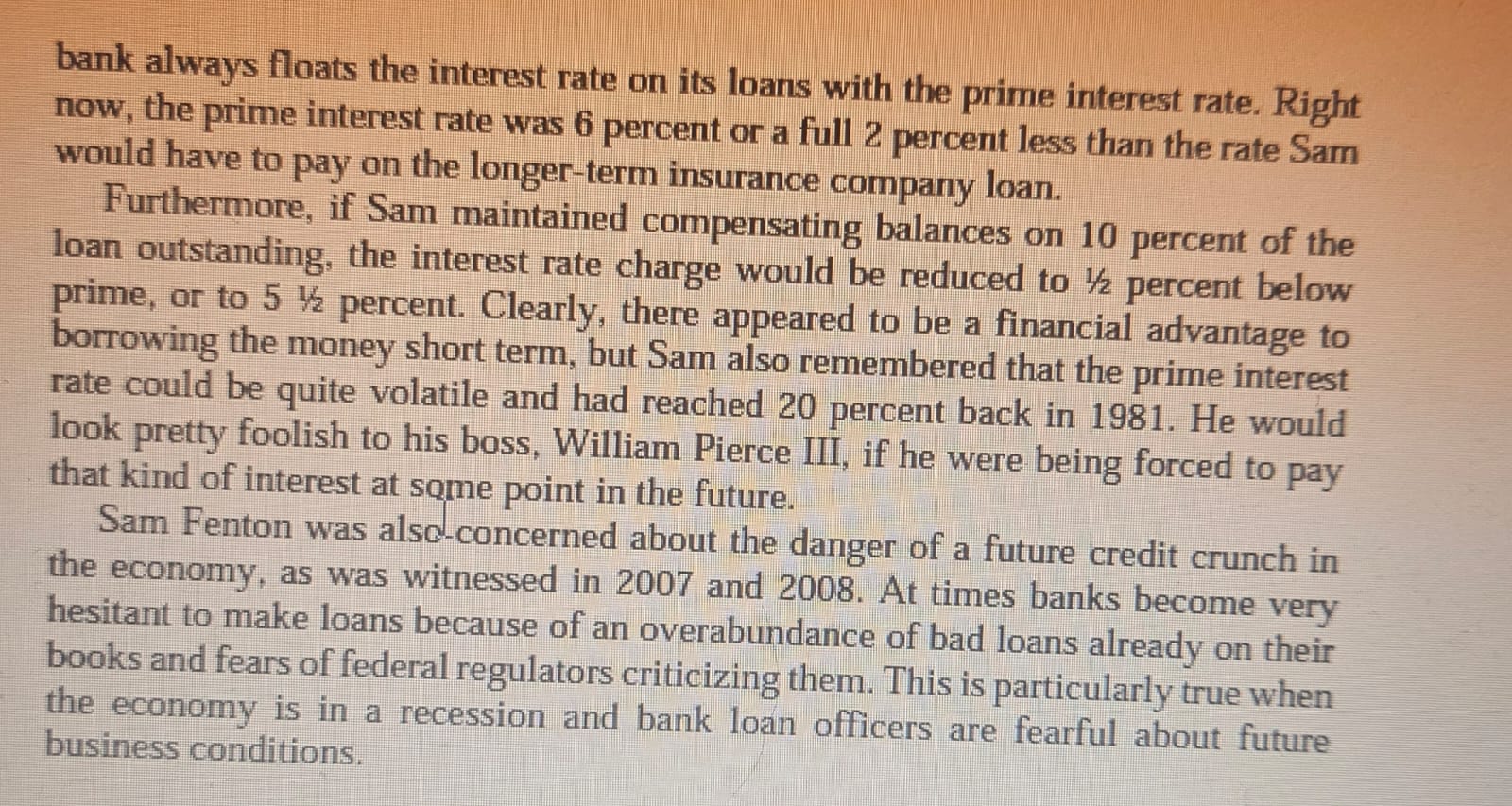

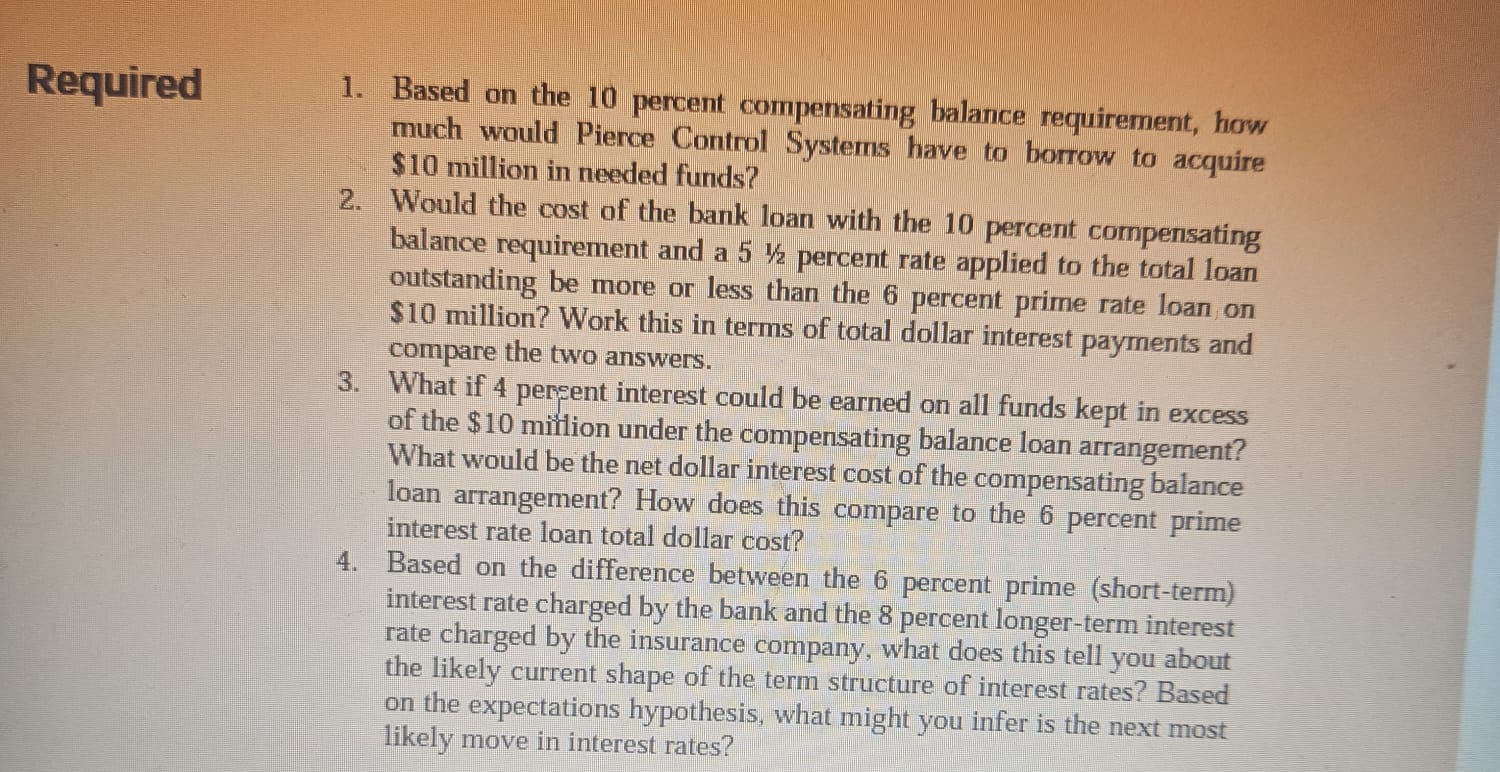

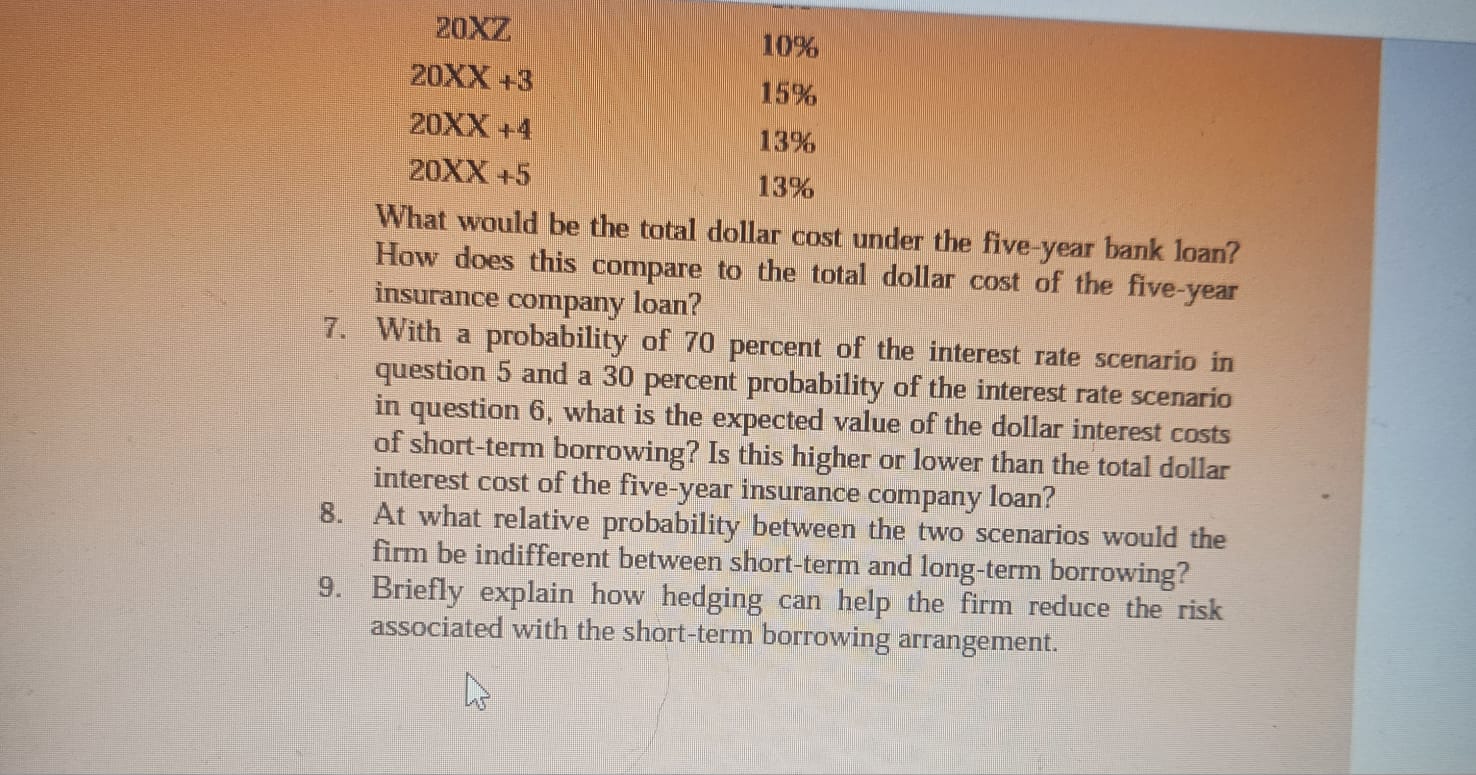

Pierce Control Systems In 20XX, Sam Fenton was extremely pleased to view the online The Globe and Mail and see that the prime rate had fallen to 6 percent. As vice president of finance for Pierce Control Systems, he knew he would have to refinance some major long-term debt coming due and he wanted to consider all the possible options. Pierce Control Systems is a manufacturer of material handling, accessory, and control equipment for the printing industry. Pieroe's products are designed to improve the productivity and cost-efficiency of printing presses. Products include automatic cleaning systems, fountain solution and ink control systems, press and web control systems, and web and material handling systems. The business started eleven years ago and over the past decade has grown to a sales volume of $40 million. Sam Fenton had joined the company in three years after the start. His background included a bachelor's degree in finance and accounting from the University of PEI, two years with Ernst \& Young as an auditor, and a three-year stint with the Bank of Nova Scotia as a loan officer. After eight years with Pierce Control System, he was promoted to vice president of finance in 20XX. At age 36, he was quite prond of his new title and $150,000 salary. The Financing Decision With $10 million in debt coming due, Sam Fenton was considering two options. One was to reborrow the money on a fiveyear basis with Empire Life Insurance Company, a major lender to emerging firms. The loan would carry a flat 8 percent rate over the next five years. The principal would be due at the end of the life of the loan. Sam considered the first option described above as relatively long term in nature. It would ensure that the firm would have adequate financing for the next five years. A second option would be to borrow the money from a bank on a short-term basis. Although banks normally lend funds for 90 to 180-day periods, he intended to ask for a one-year loan. He then would renew the loan each year over the five-year period. The loan officer at Bank of Montreal told Sam that the bank always floats the interest rate on its loans with the prime interest rate. Right now, the prime interest rate was 6 percent or a full 2 percent less than the rate Sam would have to pay on the longer-term insurance company loan. Furthermore, if Sam maintained compensating balances on 10 percent of the loan outstanding, the interest rate charge would be reduced to 1/2 percent below prime, or to 51/2 percent. Clearly, there appeared to be a financial advantage to borrowing the money short term, but Sam also remembered that the prime interest rate could be quite volatile and had reached 20 percent back in 1981 . He would look pretty foolish to his boss, William Pierce III, if he were being forced to pay that kind of interest at sqme point in the future. Sam Fenton was also-concerned about the danger of a future credit crunch in the economy, as was witnessed in 2007 and 2008. At times banks become very hesitant to make loans because of an overabundance of bad loans already on their books and fears of federal regulators criticizing them. This is particularly true when the economy is in a recession and bank loan officers are fearful about future business conditions. 1. Based on the 10 percent compensating balance requirement, how much would Pierce Control Systems have to borrow to acquire $10 million in needed funds? 2. Would the cost of the bank loan with the 10 percent compensating balance requirement and a 51/2 percent rate applied to the total loan outstanding be more or less than the 6 percent prime rate loan on $10 million? Work this in terms of total dollar interest payments and compare the two answers. 3. What if 4 pensent interest could be earned on all funds kept in excess of the $10 million under the compensating balance loan arrangement? What would be the net dollar interest cost of the compensating balance loan arrangement? How does this compare to the 6 percent prime interest rate loan total dollar cost? 4. Based on the difference between the 6 percent prime (short-term) interest rate charged by the bank and the 8 percent longer-term interest rate charged by the insurance company, what does this tell you about the likely current shape of the term structure of interest rates? Based on the expectations hypothesis, what might you infer is the next most likely move in interest rates? 5. Assume the following projected interest rates for the prime rate over the next five years; what would be the total interest cost on the $10 million loan over that period? (Disregard the compensating balance alternative for purposes of this question.) How does this compare to the total dollar cost 8 percent insurance company loan? of the five-year, 6. As a second scenario, assume the prime rate would move more dramatic Nly, as shown below: What would be the total dollar cost under the five-year bank loan? How does this compare to the total dollar cost of the five-year insurance company loan? What would be the total dollar cost under the five-year bank loan? How does this compare to the total dollar cost of the five-year insurance company loan? 7. With a probability of 70 percent of the interest rate scenario in question 5 and a 30 percent probability of the interest rate scenario in question 6 , what is the expected value of the dollar interest costs of short-term borrowing? Is this higher or lower than the total dollar interest cost of the five-year insurance company loan? 8. At what relative probability between the two scenarios would the firm be indifferent between short-term and long-term borrowing? 9. Briefly explain how hedging can help the firm reduce the risk associated with the short-term borrowing arrangement. Pierce Control Systems In 20XX, Sam Fenton was extremely pleased to view the online The Globe and Mail and see that the prime rate had fallen to 6 percent. As vice president of finance for Pierce Control Systems, he knew he would have to refinance some major long-term debt coming due and he wanted to consider all the possible options. Pierce Control Systems is a manufacturer of material handling, accessory, and control equipment for the printing industry. Pieroe's products are designed to improve the productivity and cost-efficiency of printing presses. Products include automatic cleaning systems, fountain solution and ink control systems, press and web control systems, and web and material handling systems. The business started eleven years ago and over the past decade has grown to a sales volume of $40 million. Sam Fenton had joined the company in three years after the start. His background included a bachelor's degree in finance and accounting from the University of PEI, two years with Ernst \& Young as an auditor, and a three-year stint with the Bank of Nova Scotia as a loan officer. After eight years with Pierce Control System, he was promoted to vice president of finance in 20XX. At age 36, he was quite prond of his new title and $150,000 salary. The Financing Decision With $10 million in debt coming due, Sam Fenton was considering two options. One was to reborrow the money on a fiveyear basis with Empire Life Insurance Company, a major lender to emerging firms. The loan would carry a flat 8 percent rate over the next five years. The principal would be due at the end of the life of the loan. Sam considered the first option described above as relatively long term in nature. It would ensure that the firm would have adequate financing for the next five years. A second option would be to borrow the money from a bank on a short-term basis. Although banks normally lend funds for 90 to 180-day periods, he intended to ask for a one-year loan. He then would renew the loan each year over the five-year period. The loan officer at Bank of Montreal told Sam that the bank always floats the interest rate on its loans with the prime interest rate. Right now, the prime interest rate was 6 percent or a full 2 percent less than the rate Sam would have to pay on the longer-term insurance company loan. Furthermore, if Sam maintained compensating balances on 10 percent of the loan outstanding, the interest rate charge would be reduced to 1/2 percent below prime, or to 51/2 percent. Clearly, there appeared to be a financial advantage to borrowing the money short term, but Sam also remembered that the prime interest rate could be quite volatile and had reached 20 percent back in 1981 . He would look pretty foolish to his boss, William Pierce III, if he were being forced to pay that kind of interest at sqme point in the future. Sam Fenton was also-concerned about the danger of a future credit crunch in the economy, as was witnessed in 2007 and 2008. At times banks become very hesitant to make loans because of an overabundance of bad loans already on their books and fears of federal regulators criticizing them. This is particularly true when the economy is in a recession and bank loan officers are fearful about future business conditions. 1. Based on the 10 percent compensating balance requirement, how much would Pierce Control Systems have to borrow to acquire $10 million in needed funds? 2. Would the cost of the bank loan with the 10 percent compensating balance requirement and a 51/2 percent rate applied to the total loan outstanding be more or less than the 6 percent prime rate loan on $10 million? Work this in terms of total dollar interest payments and compare the two answers. 3. What if 4 pensent interest could be earned on all funds kept in excess of the $10 million under the compensating balance loan arrangement? What would be the net dollar interest cost of the compensating balance loan arrangement? How does this compare to the 6 percent prime interest rate loan total dollar cost? 4. Based on the difference between the 6 percent prime (short-term) interest rate charged by the bank and the 8 percent longer-term interest rate charged by the insurance company, what does this tell you about the likely current shape of the term structure of interest rates? Based on the expectations hypothesis, what might you infer is the next most likely move in interest rates? 5. Assume the following projected interest rates for the prime rate over the next five years; what would be the total interest cost on the $10 million loan over that period? (Disregard the compensating balance alternative for purposes of this question.) How does this compare to the total dollar cost 8 percent insurance company loan? of the five-year, 6. As a second scenario, assume the prime rate would move more dramatic Nly, as shown below: What would be the total dollar cost under the five-year bank loan? How does this compare to the total dollar cost of the five-year insurance company loan? What would be the total dollar cost under the five-year bank loan? How does this compare to the total dollar cost of the five-year insurance company loan? 7. With a probability of 70 percent of the interest rate scenario in question 5 and a 30 percent probability of the interest rate scenario in question 6 , what is the expected value of the dollar interest costs of short-term borrowing? Is this higher or lower than the total dollar interest cost of the five-year insurance company loan? 8. At what relative probability between the two scenarios would the firm be indifferent between short-term and long-term borrowing? 9. Briefly explain how hedging can help the firm reduce the risk associated with the short-term borrowing arrangement

Pierce Control Systems In 20XX, Sam Fenton was extremely pleased to view the online The Globe and Mail and see that the prime rate had fallen to 6 percent. As vice president of finance for Pierce Control Systems, he knew he would have to refinance some major long-term debt coming due and he wanted to consider all the possible options. Pierce Control Systems is a manufacturer of material handling, accessory, and control equipment for the printing industry. Pieroe's products are designed to improve the productivity and cost-efficiency of printing presses. Products include automatic cleaning systems, fountain solution and ink control systems, press and web control systems, and web and material handling systems. The business started eleven years ago and over the past decade has grown to a sales volume of $40 million. Sam Fenton had joined the company in three years after the start. His background included a bachelor's degree in finance and accounting from the University of PEI, two years with Ernst \& Young as an auditor, and a three-year stint with the Bank of Nova Scotia as a loan officer. After eight years with Pierce Control System, he was promoted to vice president of finance in 20XX. At age 36, he was quite prond of his new title and $150,000 salary. The Financing Decision With $10 million in debt coming due, Sam Fenton was considering two options. One was to reborrow the money on a fiveyear basis with Empire Life Insurance Company, a major lender to emerging firms. The loan would carry a flat 8 percent rate over the next five years. The principal would be due at the end of the life of the loan. Sam considered the first option described above as relatively long term in nature. It would ensure that the firm would have adequate financing for the next five years. A second option would be to borrow the money from a bank on a short-term basis. Although banks normally lend funds for 90 to 180-day periods, he intended to ask for a one-year loan. He then would renew the loan each year over the five-year period. The loan officer at Bank of Montreal told Sam that the bank always floats the interest rate on its loans with the prime interest rate. Right now, the prime interest rate was 6 percent or a full 2 percent less than the rate Sam would have to pay on the longer-term insurance company loan. Furthermore, if Sam maintained compensating balances on 10 percent of the loan outstanding, the interest rate charge would be reduced to 1/2 percent below prime, or to 51/2 percent. Clearly, there appeared to be a financial advantage to borrowing the money short term, but Sam also remembered that the prime interest rate could be quite volatile and had reached 20 percent back in 1981 . He would look pretty foolish to his boss, William Pierce III, if he were being forced to pay that kind of interest at sqme point in the future. Sam Fenton was also-concerned about the danger of a future credit crunch in the economy, as was witnessed in 2007 and 2008. At times banks become very hesitant to make loans because of an overabundance of bad loans already on their books and fears of federal regulators criticizing them. This is particularly true when the economy is in a recession and bank loan officers are fearful about future business conditions. 1. Based on the 10 percent compensating balance requirement, how much would Pierce Control Systems have to borrow to acquire $10 million in needed funds? 2. Would the cost of the bank loan with the 10 percent compensating balance requirement and a 51/2 percent rate applied to the total loan outstanding be more or less than the 6 percent prime rate loan on $10 million? Work this in terms of total dollar interest payments and compare the two answers. 3. What if 4 pensent interest could be earned on all funds kept in excess of the $10 million under the compensating balance loan arrangement? What would be the net dollar interest cost of the compensating balance loan arrangement? How does this compare to the 6 percent prime interest rate loan total dollar cost? 4. Based on the difference between the 6 percent prime (short-term) interest rate charged by the bank and the 8 percent longer-term interest rate charged by the insurance company, what does this tell you about the likely current shape of the term structure of interest rates? Based on the expectations hypothesis, what might you infer is the next most likely move in interest rates? 5. Assume the following projected interest rates for the prime rate over the next five years; what would be the total interest cost on the $10 million loan over that period? (Disregard the compensating balance alternative for purposes of this question.) How does this compare to the total dollar cost 8 percent insurance company loan? of the five-year, 6. As a second scenario, assume the prime rate would move more dramatic Nly, as shown below: What would be the total dollar cost under the five-year bank loan? How does this compare to the total dollar cost of the five-year insurance company loan? What would be the total dollar cost under the five-year bank loan? How does this compare to the total dollar cost of the five-year insurance company loan? 7. With a probability of 70 percent of the interest rate scenario in question 5 and a 30 percent probability of the interest rate scenario in question 6 , what is the expected value of the dollar interest costs of short-term borrowing? Is this higher or lower than the total dollar interest cost of the five-year insurance company loan? 8. At what relative probability between the two scenarios would the firm be indifferent between short-term and long-term borrowing? 9. Briefly explain how hedging can help the firm reduce the risk associated with the short-term borrowing arrangement. Pierce Control Systems In 20XX, Sam Fenton was extremely pleased to view the online The Globe and Mail and see that the prime rate had fallen to 6 percent. As vice president of finance for Pierce Control Systems, he knew he would have to refinance some major long-term debt coming due and he wanted to consider all the possible options. Pierce Control Systems is a manufacturer of material handling, accessory, and control equipment for the printing industry. Pieroe's products are designed to improve the productivity and cost-efficiency of printing presses. Products include automatic cleaning systems, fountain solution and ink control systems, press and web control systems, and web and material handling systems. The business started eleven years ago and over the past decade has grown to a sales volume of $40 million. Sam Fenton had joined the company in three years after the start. His background included a bachelor's degree in finance and accounting from the University of PEI, two years with Ernst \& Young as an auditor, and a three-year stint with the Bank of Nova Scotia as a loan officer. After eight years with Pierce Control System, he was promoted to vice president of finance in 20XX. At age 36, he was quite prond of his new title and $150,000 salary. The Financing Decision With $10 million in debt coming due, Sam Fenton was considering two options. One was to reborrow the money on a fiveyear basis with Empire Life Insurance Company, a major lender to emerging firms. The loan would carry a flat 8 percent rate over the next five years. The principal would be due at the end of the life of the loan. Sam considered the first option described above as relatively long term in nature. It would ensure that the firm would have adequate financing for the next five years. A second option would be to borrow the money from a bank on a short-term basis. Although banks normally lend funds for 90 to 180-day periods, he intended to ask for a one-year loan. He then would renew the loan each year over the five-year period. The loan officer at Bank of Montreal told Sam that the bank always floats the interest rate on its loans with the prime interest rate. Right now, the prime interest rate was 6 percent or a full 2 percent less than the rate Sam would have to pay on the longer-term insurance company loan. Furthermore, if Sam maintained compensating balances on 10 percent of the loan outstanding, the interest rate charge would be reduced to 1/2 percent below prime, or to 51/2 percent. Clearly, there appeared to be a financial advantage to borrowing the money short term, but Sam also remembered that the prime interest rate could be quite volatile and had reached 20 percent back in 1981 . He would look pretty foolish to his boss, William Pierce III, if he were being forced to pay that kind of interest at sqme point in the future. Sam Fenton was also-concerned about the danger of a future credit crunch in the economy, as was witnessed in 2007 and 2008. At times banks become very hesitant to make loans because of an overabundance of bad loans already on their books and fears of federal regulators criticizing them. This is particularly true when the economy is in a recession and bank loan officers are fearful about future business conditions. 1. Based on the 10 percent compensating balance requirement, how much would Pierce Control Systems have to borrow to acquire $10 million in needed funds? 2. Would the cost of the bank loan with the 10 percent compensating balance requirement and a 51/2 percent rate applied to the total loan outstanding be more or less than the 6 percent prime rate loan on $10 million? Work this in terms of total dollar interest payments and compare the two answers. 3. What if 4 pensent interest could be earned on all funds kept in excess of the $10 million under the compensating balance loan arrangement? What would be the net dollar interest cost of the compensating balance loan arrangement? How does this compare to the 6 percent prime interest rate loan total dollar cost? 4. Based on the difference between the 6 percent prime (short-term) interest rate charged by the bank and the 8 percent longer-term interest rate charged by the insurance company, what does this tell you about the likely current shape of the term structure of interest rates? Based on the expectations hypothesis, what might you infer is the next most likely move in interest rates? 5. Assume the following projected interest rates for the prime rate over the next five years; what would be the total interest cost on the $10 million loan over that period? (Disregard the compensating balance alternative for purposes of this question.) How does this compare to the total dollar cost 8 percent insurance company loan? of the five-year, 6. As a second scenario, assume the prime rate would move more dramatic Nly, as shown below: What would be the total dollar cost under the five-year bank loan? How does this compare to the total dollar cost of the five-year insurance company loan? What would be the total dollar cost under the five-year bank loan? How does this compare to the total dollar cost of the five-year insurance company loan? 7. With a probability of 70 percent of the interest rate scenario in question 5 and a 30 percent probability of the interest rate scenario in question 6 , what is the expected value of the dollar interest costs of short-term borrowing? Is this higher or lower than the total dollar interest cost of the five-year insurance company loan? 8. At what relative probability between the two scenarios would the firm be indifferent between short-term and long-term borrowing? 9. Briefly explain how hedging can help the firm reduce the risk associated with the short-term borrowing arrangement Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started