Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pierre is a furniture manufacturer. His financial year ends on 31 March. He provided the following information: At 1 April 20-5 At 31 March

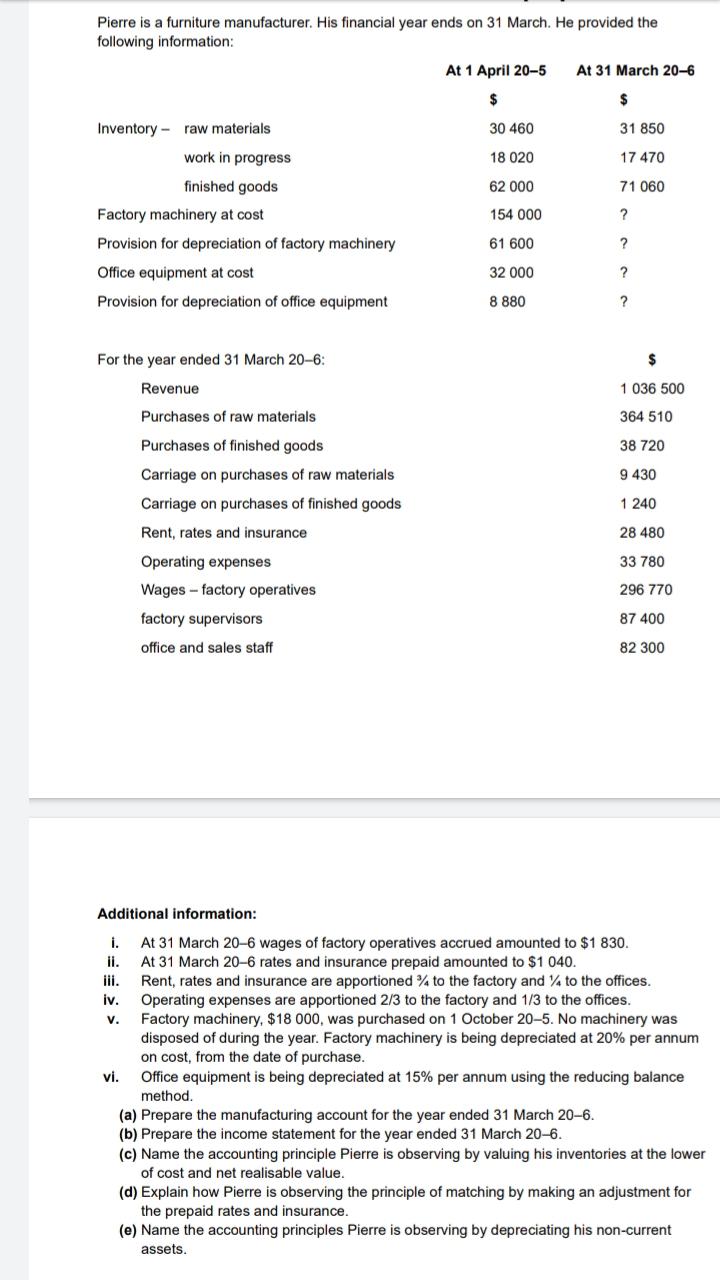

Pierre is a furniture manufacturer. His financial year ends on 31 March. He provided the following information: At 1 April 20-5 At 31 March 20-6 $ $ Inventory raw materials 30 460 31 850 work in progress 18 020 17 470 finished goods 62 000 71 060 Factory machinery at cost 154 000 ? Provision for depreciation of factory machinery 61 600 ? Office equipment at cost 32 000 ? Provision for depreciation of office equipment 8 880 ? For the year ended 31 March 20-6: Revenue Purchases of raw materials Purchases of finished goods Carriage on purchases of raw materials Carriage on purchases of finished goods Rent, rates and insurance Operating expenses Wages-factory operatives factory supervisors office and sales staff 1 036 500 364 510 38 720 9 430 1 240 28 480 33 780 296 770 87 400 82 300 Additional information: i. ii. iii. iv. V. vi. At 31 March 20-6 wages of factory operatives accrued amounted to $1 830. At 31 March 20-6 rates and insurance prepaid amounted to $1 040. Rent, rates and insurance are apportioned to the factory and 1/4 to the offices. Operating expenses are apportioned 2/3 to the factory and 1/3 to the offices. Factory machinery, $18 000, was purchased on 1 October 20-5. No machinery was disposed of during the year. Factory machinery is being depreciated at 20% per annum on cost, from the date of purchase. Office equipment is being depreciated at 15% per annum using the reducing balance method. (a) Prepare the manufacturing account for the year ended 31 March 20-6. (b) Prepare the income statement for the year ended 31 March 20-6. (c) Name the accounting principle Pierre is observing by valuing his inventories at the lower of cost and net realisable value. (d) Explain how Pierre is observing the principle of matching by making an adjustment for the prepaid rates and insurance. (e) Name the accounting principles Pierre is observing by depreciating his non-current assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started