Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pike Corporation is considering a project to purchase equipment for $1,800,000 that will improve operations. The equipment has a 6-year useful life and will

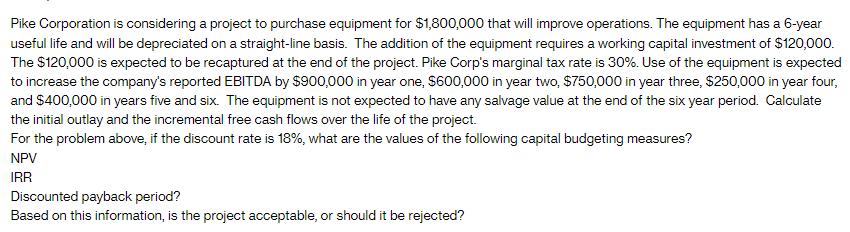

Pike Corporation is considering a project to purchase equipment for $1,800,000 that will improve operations. The equipment has a 6-year useful life and will be depreciated on a straight-line basis. The addition of the equipment requires a working capital investment of $120,000. The $120,000 is expected to be recaptured at the end of the project. Pike Corp's marginal tax rate is 30%. Use of the equipment is expected to increase the company's reported EBITDA by $900,000 in year one, $600,000 in year two, $750,000 in year three, $250,000 in year four, and $400,000 in years five and six. The equipment is not expected to have any salvage value at the end of the six year period. Calculate the initial outlay and the incremental free cash flows over the life of the project. For the problem above, if the discount rate is 18%, what are the values of the following capital budgeting measures? NPV IRR Discounted payback period? Based on this information, is the project acceptable, or should it be rejected?

Step by Step Solution

★★★★★

3.64 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the initial outlay and incremental free cash flows over the life of the project we need to consider the following components 1 Initial Ou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started