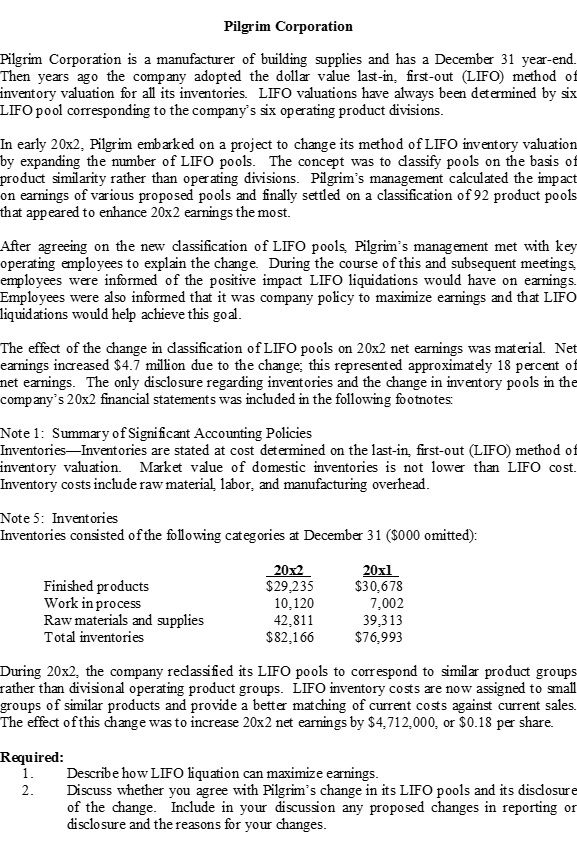

Pilgrim Corporation is a manufacturer of building supplies and has a December 31 year-end. Then ears ago the company adopted the dollar value last-in, first-out (LIFO) method of inventory valuation for all its inventories. LIFO valuations have always been determined by LIFO pool corresponding to the company's six operating product divisions. In early 20x2, Pilgrim embarked on a project to change its method of LIFO inventory valuation by expanding the number of LIFO pools. The concept was to classify pools on the basis of product similarity rather than operating divisions. Pilgrim's management calculated the impact on earnings of various proposed pools and finally settled on a classification of 92 product pools that appeared to enhance 20x2 earnings the most. After agreeing on the new classification of LIFO pools, Pilgrim's management met with key operating employees to explain the change. During the course of this and subsequent meetings, employees were informed of the positive impact LIFO liquidations would have on earnings. Employees were also informed that it was company policy to maximize earnings and that LIFO liquidations would help achieve this goal. The effect of the change in classification of LIFO pools on 20x2 net earnings was material. Net earnings increased exist4.7 million due to the change: this represented approximately 18 percent of net earnings. The only disclosure regarding inventories and the change in inventory pools in the company's20x2 financial statements was included in the following footnotes. During 20x2, the company reclassified its LIFO pools to correspond to similar product groups rather than divisional operating product groups. LIFO inventory costs are now assigned to small groups of similar products and provide a better matching of current costs against current sales. The effect of this change was to increase 20x2 net earnings by exist4, 712,000, or exist0.18 per share. Required Describe how LIFO liquation can maximize earnings. Discuss whether you agree with Pilgrim's change in its LIFO pools and its disclosure of the change. Include in your discussion any proposed changes in reporting or disclosure and the reasons for your changes