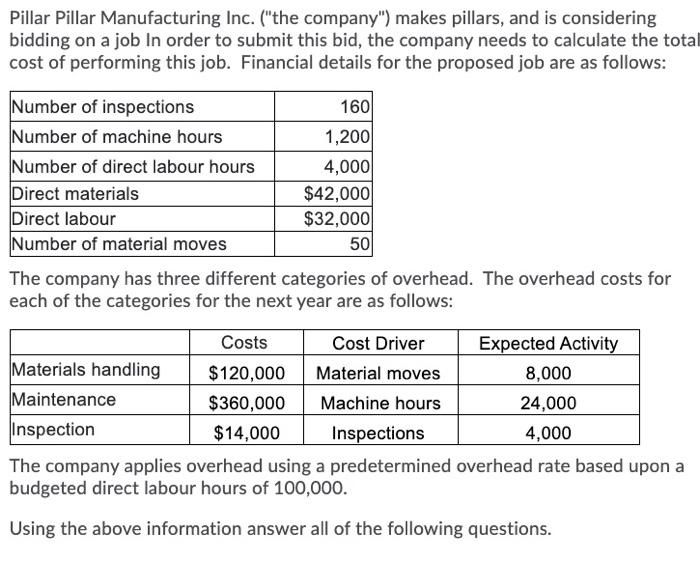

Pillar Pillar Manufacturing Inc. ("the company") makes pillars, and is considering bidding on a job In order to submit this bid, the company needs to calculate the total cost of performing this job. Financial details for the proposed job are as follows: Number of inspections 160 Number of machine hours 1,200 Number of direct labour hours 4,000 Direct materials $42,000 Direct labour $32,000 Number of material moves 50 The company has three different categories of overhead. The overhead costs for each of the categories for the next year are as follows: Costs Cost Driver Expected Activity Materials handling $120,000 Material moves 8,000 Maintenance $360,000 Machine hours 24,000 Inspection $14,000 Inspections 4,000 The company applies overhead using a predetermined overhead rate based upon a budgeted direct labour hours of 100,000. Using the above information answer all of the following questions. If the company used activity-based costing, calculate the total overhead cost that would be assigned for material handling to the job A If the company used activity-based costing, calculate the total overhead cost that would be assigned for maintenance to the job A If the company used activity-based costing, calculate the total overhead cost that would be assigned for inspections to the job A If the company used activity-based costing, calculate the total of material cost + direct labour cost that would be assigned to the job A If the company used activity-based costing, calculate the total cost that would be assigned to the job A If the company allocated overhead to the job using a plantwide overhead rate, calculate the total overhead cost assigned to the job A If the company allocated overhead to the job using a plantwide overhead rate, calculate the total cost assigned to the job A It would not be appropriate to adopt an ABC policy if which of the following were true: a) All products consumed resources in a similar manner. b) All of the other answers are correct. c) The cost of developing individual cost pools was too great. d) The products being produced were quite similar