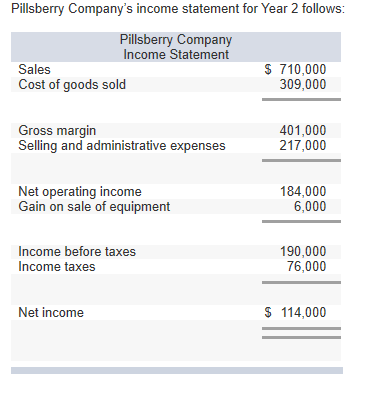

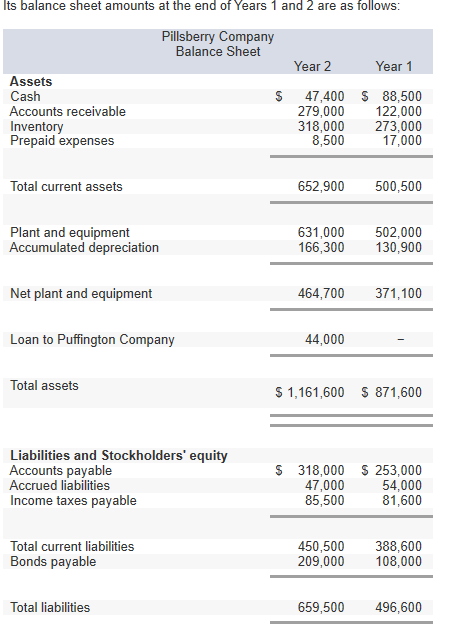

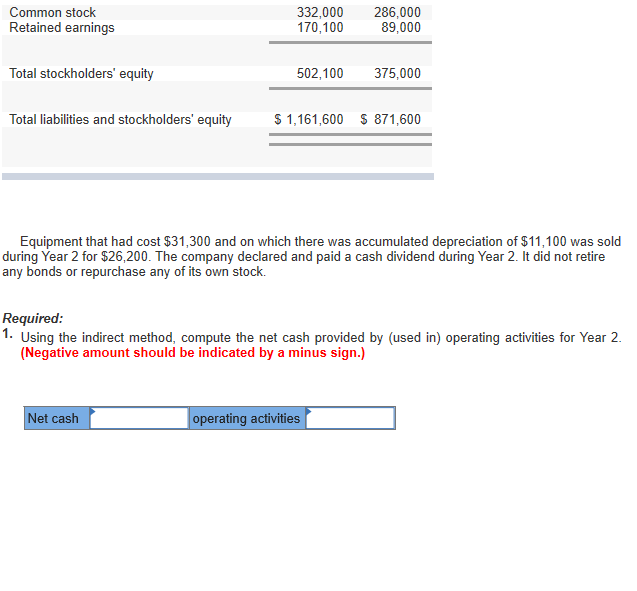

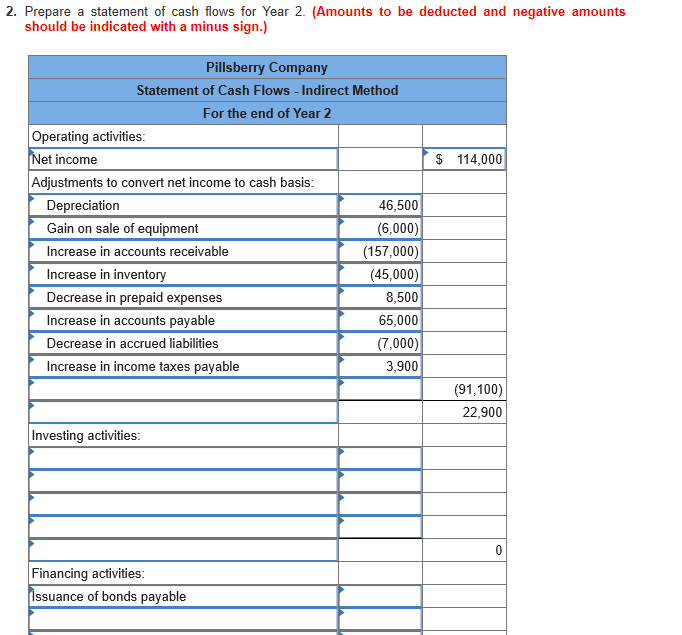

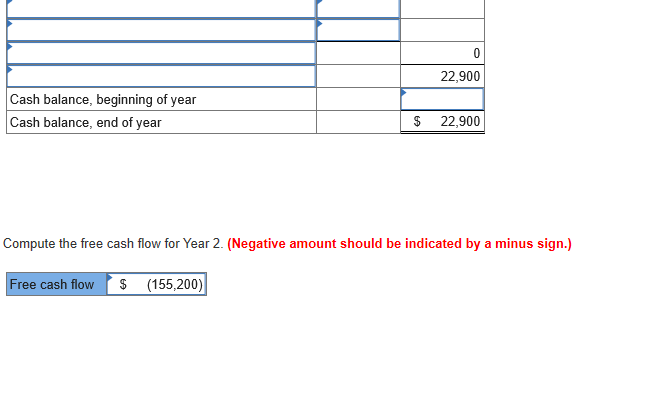

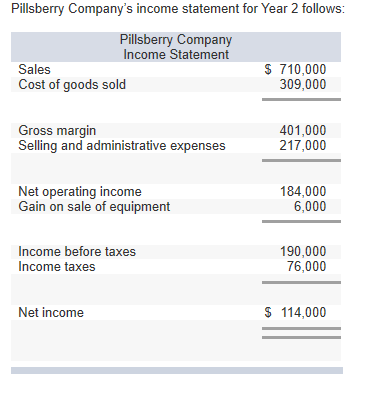

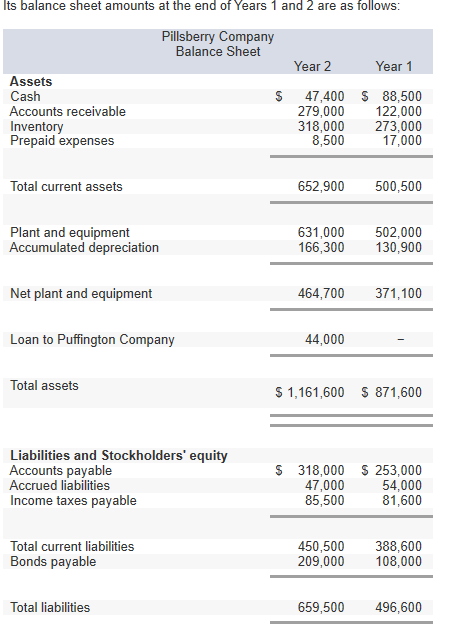

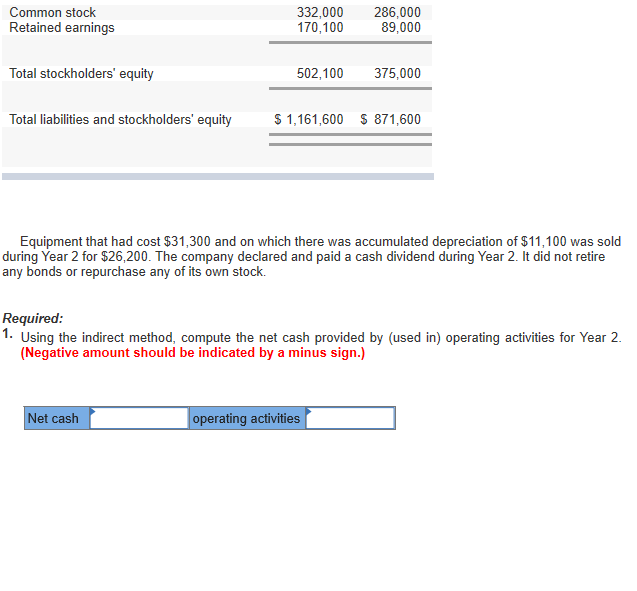

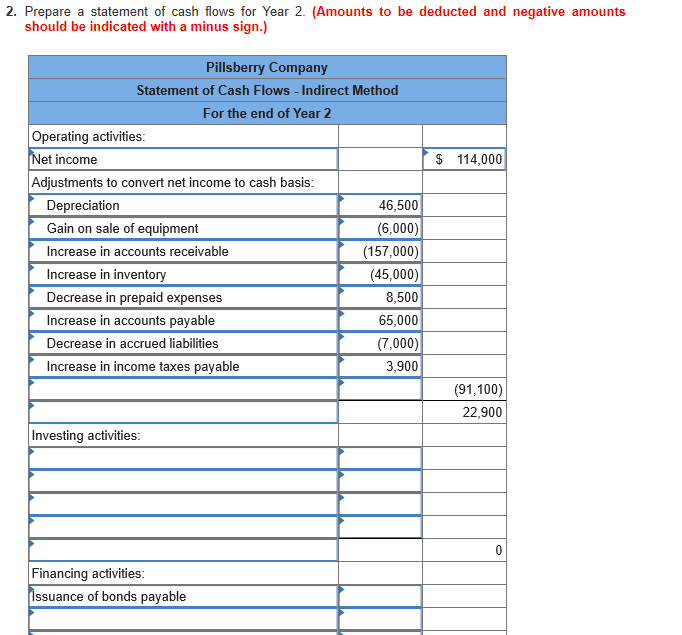

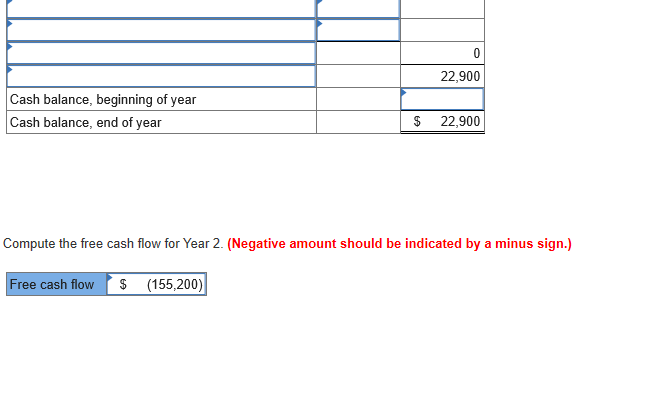

Pillsberry Company's income statement for Year 2 follows: Pillsberry Company Income Statement Sales Cost of goods sold $ 710,000 309,000 Gross margin Selling and administrative expenses 401,000 217,000 Net operating income Gain on sale of equipment 184,000 6,000 Income before taxes Income taxes 190,000 76,000 Net income $ 114,000 Its balance sheet amounts at the end of Years 1 and 2 are as follows: Pillsberry Company Balance Sheet Year 2 Year 1 Assets Cash Accounts receivable Inventory Prepaid expenses 47,400 279,000 318,000 8,500 $ 88,500 122,000 273,000 17,000 Total current assets 652,900 500,500 Plant and equipment Accumulated depreciation 631,000 166,300 502,000 130,900 Net plant and equipment 464,700 371,100 Loan to Puffington Company 44,000 Total assets $ 1,161,600 $ 871,600 $ Liabilities and Stockholders' equity Accounts payable Accrued liabilities Income taxes payable 318,000 47,000 85,500 $ 253,000 54,000 81,600 Total current liabilities Bonds payable 450,500 209,000 388,600 108,000 Total liabilities 659,500 496,600 Common stock Retained earnings 332,000 170,100 286,000 89,000 Total stockholders' equity 502,100 375,000 Total liabilities and stockholders' equity $ 1,161,600 S 871,600 Equipment that had cost $31,300 and on which there was accumulated depreciation of $11,100 was sold during Year 2 for $26,200. The company declared and paid a cash dividend during Year 2. It did not retire any bonds or repurchase any of its own stock. Required: 1. Using the indirect method, compute the net cash provided by (used in) operating activities for Year 2. (Negative amount should be indicated by a minus sign.) Net cash operating activities 2. Prepare a statement of cash flows for Year 2. (Amounts to be deducted and negative amounts should be indicated with a minus sign.) $ 114,000 Pillsberry Company Statement of Cash Flows - Indirect Method For the end of Year 2 Operating activities: Net income Adjustments to convert net income to cash basis: Depreciation 46,500 Gain on sale of equipment (6,000) Increase in accounts receivable (157,000) Increase in inventory (45,000) Decrease in prepaid expenses 8,500 Increase in accounts payable 65,000 Decrease in accrued liabilities (7,000) Increase in income taxes payable 3,900 (91,100) 22,900 Investing activities: Financing activities: Issuance of bonds payable 22,900 Cash balance, beginning of year Cash balance, end of year $ 22,900 Compute the free cash flow for Year 2. (Negative amount should be indicated by a minus sign.) Free cash flow $ (155,200)