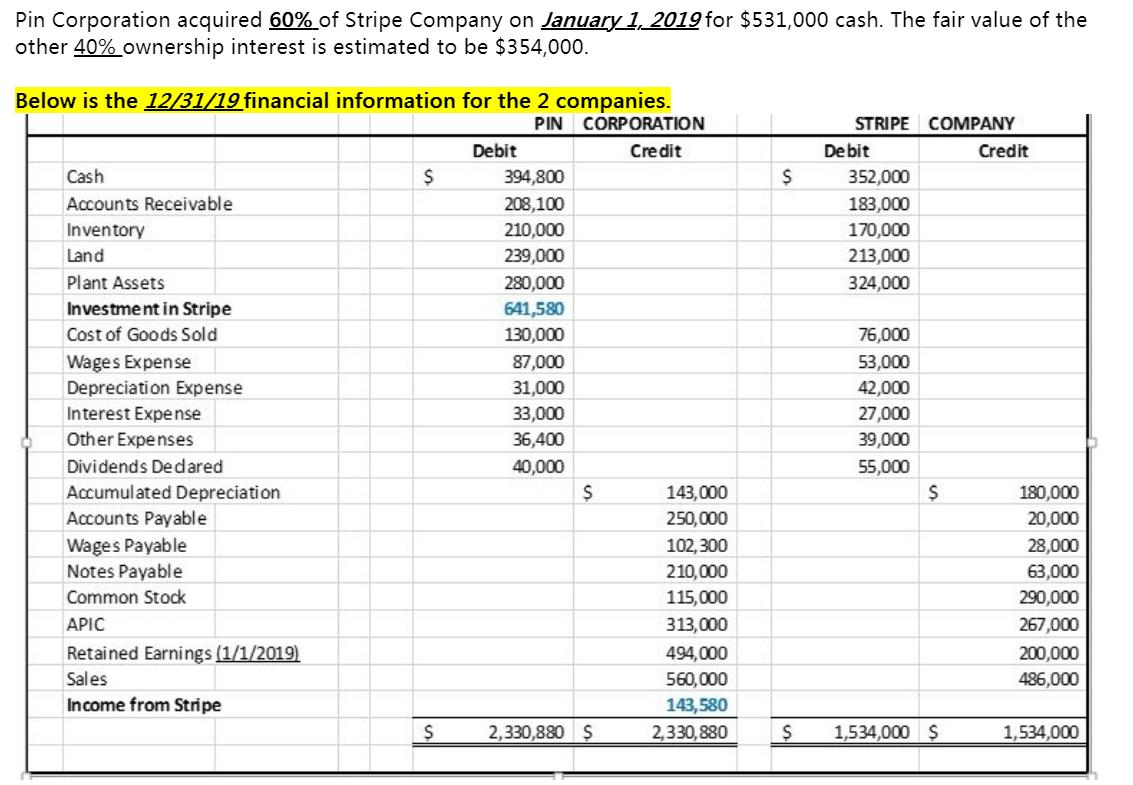

Pin Corporation acquired 60% of Stripe Company on January 1, 2019 for $531,000 cash. The fair value of the other 40% ownership interest is

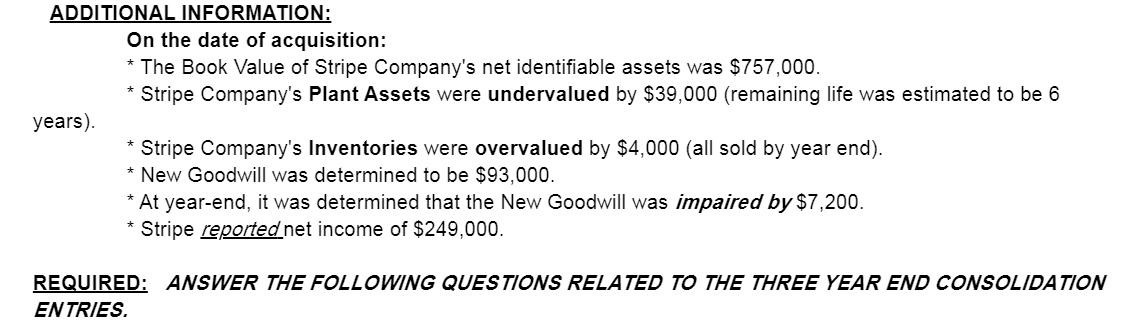

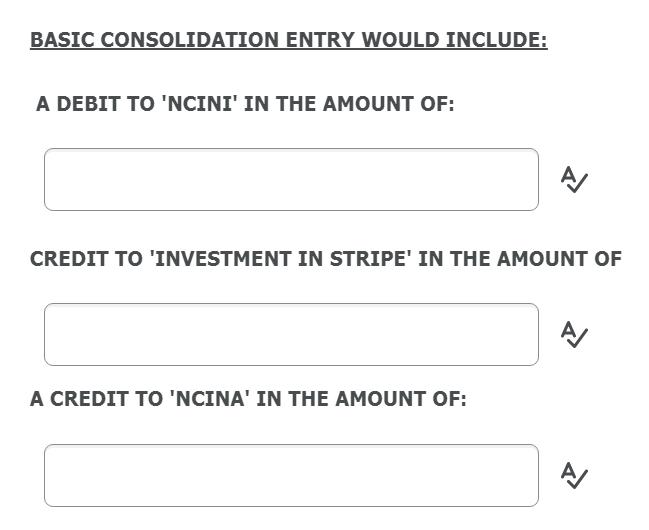

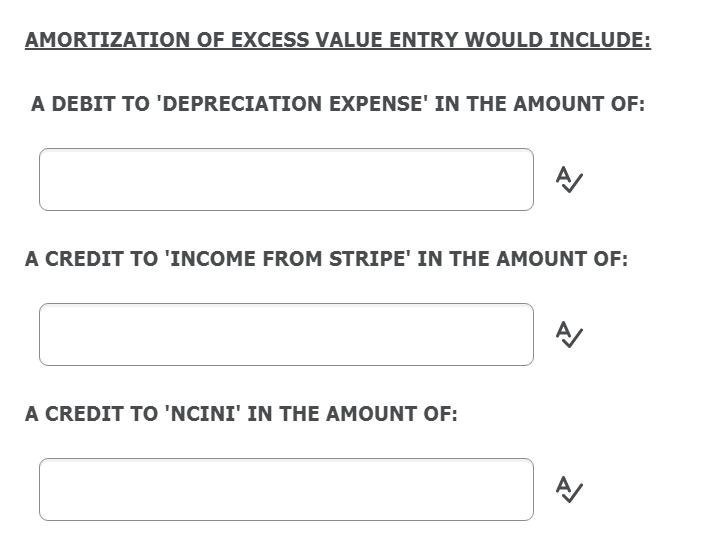

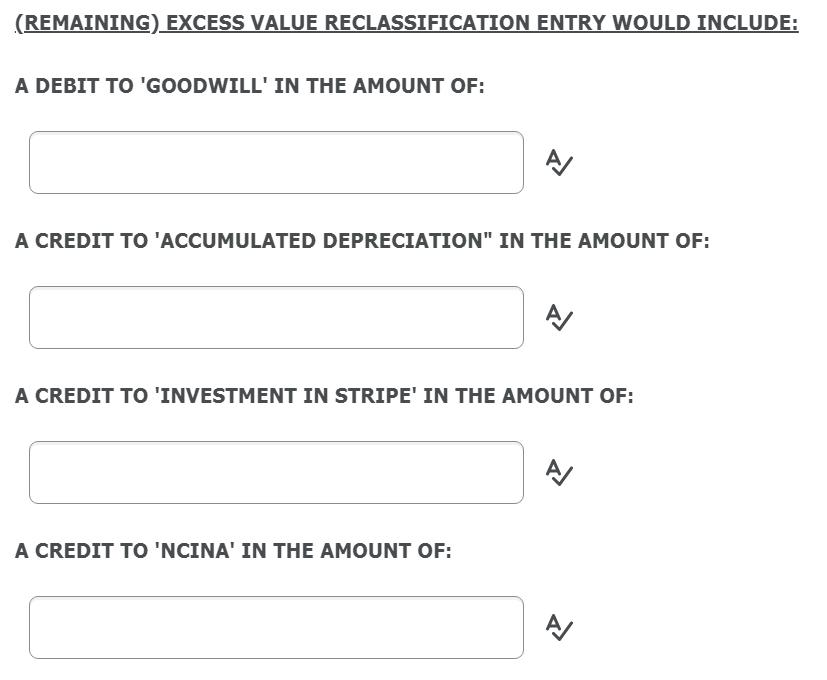

Pin Corporation acquired 60% of Stripe Company on January 1, 2019 for $531,000 cash. The fair value of the other 40% ownership interest is estimated to be $354,000. Below is the 12/31/19 financial information for the 2 companies. PIN CORPORATION STRIPE COMPANY Debit Credit De bit Credit Cash 394,800 352,000 Accounts Receivable 208,100 183,000 Inventory 210,000 170,000 Land 239,000 213,000 Plant Assets 280,000 324,000 Investment in Stripe 641,580 Cost of Goods Sold 130,000 76,000 Wages Expense Depreciation Expense Interest Expense 87,000 53,000 31,000 42,000 33,000 27,000 Other Expenses 36,400 39,000 Dividends Dedared 40,000 55,000 Accumulated Depreciation 143,000 180,000 Accounts Payable 250,000 20,000 Wages Payable Notes Payable 102,300 28,000 210,000 63,000 Common Stock 115,000 290,000 APIC 313,000 267,000 Retained Earnings (1/1/2019) 494,000 200,000 Sales 560,000 486,000 Income from Stripe 143,580 2,330,880 $ 2,330,880 1,534,000 $ 1,534,000 ADDITIONAL INFORMATION: On the date of acquisition: * The Book Value of Stripe Company's net identifiable assets was $757,000. * Stripe Company's Plant Assets were undervalued by $39,000 (remaining life was estimated to be 6 years). * Stripe Company's Inventories were overvalued by $4,000 (all sold by year end). * New Goodwill was determined to be $93,000. * At year-end, it was determined that the New Goodwill was impaired by $7,200. * Stripe reported net income of $249,000. REQUIRED: ANSWER THE FOLLOWING QUESTIONS RELATED TO THE THREE YEAR END CONSOLIDATION EN TRIES. BASIC CONSOLIDATION ENTRY WOULD INCLUDE: A DEBIT TO 'NCINI' IN THE AMOUNT OF: CREDIT TO 'INVESTMENT IN STRIPE' IN THE AMOUNT OF A CREDIT TO 'NCINA' IN THE AMOUNT OF: AMORTIZATION OF EXCESS VALUE ENTRY WOULD INCLUDE: A DEBIT TO 'DEPRECIATION EXPENSE' IN THE AMOUNT OF: A CREDIT TO 'INCOME FROM STRIPE' IN THE AMOUNT OF: A CREDIT TO 'NCINI' IN THE AMOUNT OF: (REMAINING) EXCESS VALUE RECLASSIFICATION ENTRY WOULD INCLUDE: A DEBIT TO 'GOODWILL' IN THE AMOUNT OF: A CREDIT TO 'ACCUMULATED DEPRECIATION" IN THE AMOUNT OF: A CREDIT TO 'INVESTMENT IN STRIPE' IN THE AMOUNT OF: A CREDIT TO 'NCINA' IN THE AMOUNT OF:

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Workings AMOUNT IN Parental Goodwill on Acquisition Purchase Consideration 531000 Less Net Assets Ac...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started