Answered step by step

Verified Expert Solution

Question

1 Approved Answer

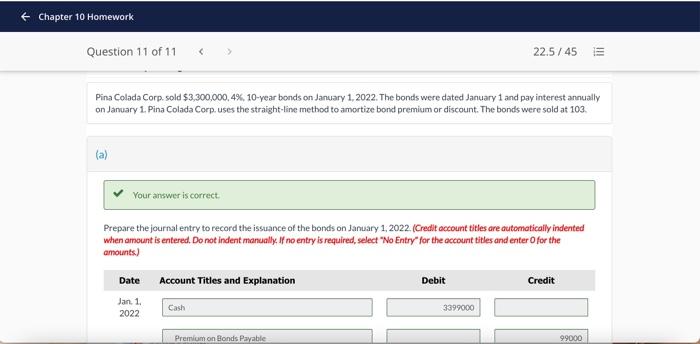

Pina Colada Corp. sold $3,300,000, 4%, 10-year bonds on January 1, 2022. The bonds were dated January 1 and pay interest annually on January 1.

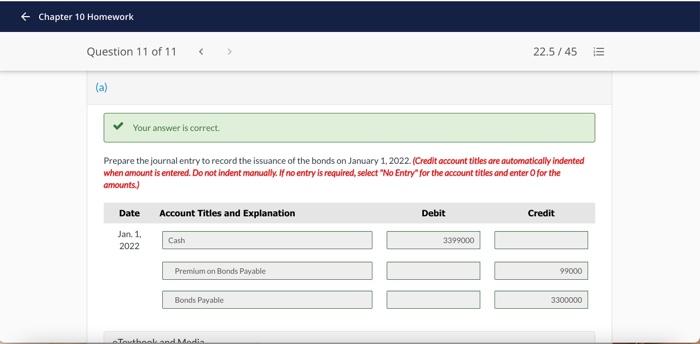

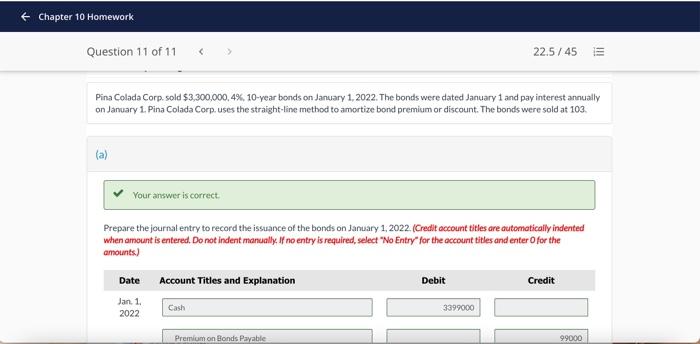

Pina Colada Corp. sold $3,300,000, 4%, 10-year bonds on January 1, 2022. The bonds were dated January 1 and pay interest annually on January 1. Pina Colada Corp. uses the straight-line method to amortize bond premium or discount. The bonds were sold at 103.

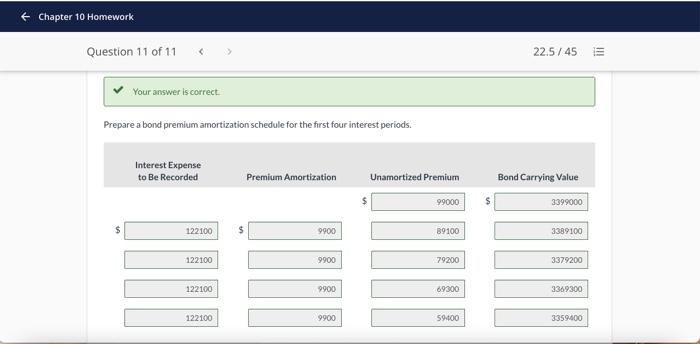

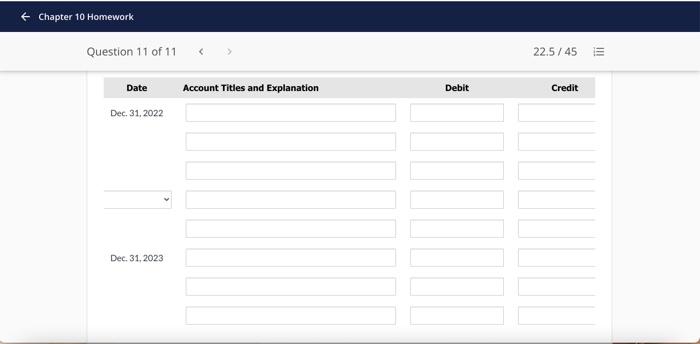

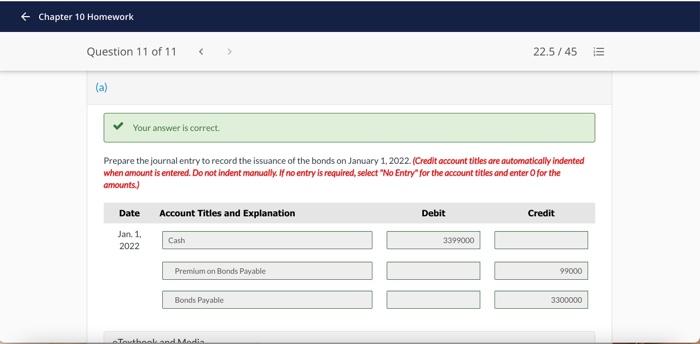

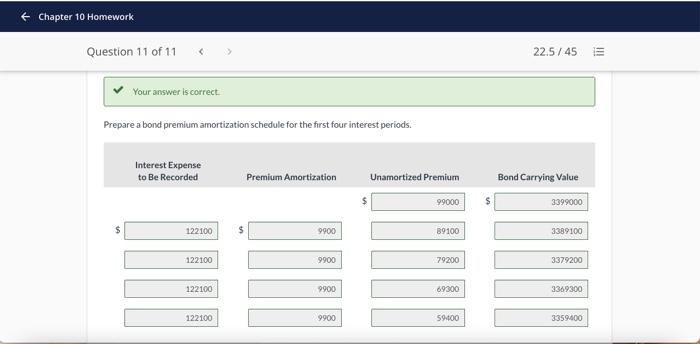

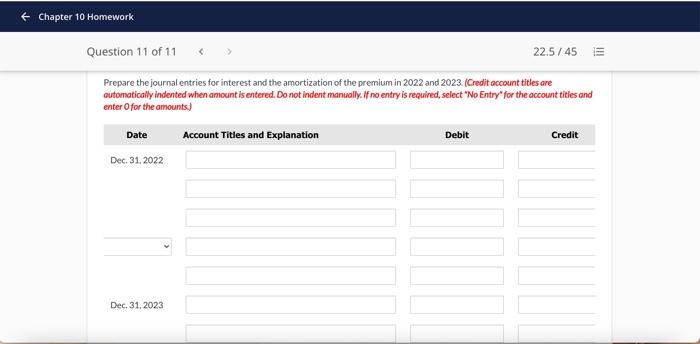

Chapter 10 Homework Question 11 of 11 22.5 / 45 !!! Pina Colada Corp. sold $3,300,000,4%, 10-year bonds on January 1, 2022. The bonds were dated January 1 and pay interest annually on January 1. Pina Colada Corp. uses the straight-line method to amortize bond premium or discount. The bonds were sold at 103. Your answer is correct Prepare the journal entry to record the issuance of the bonds on January 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Date Account Titles and Explanation Debit Credit Jan. 1 2022 Cash 3399000 Premium on Bonds Payable 99000 Chapter 10 Homework Question 11 of 11 22.5/45 III (a) Your answer is correct Prepare the journal entry to record the issuance of the bonds on January 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Date Account Titles and explanation Debit Credit Jan. 1. 2022 Cash 3399000 Premium on Bonds Payable 99000 Bonds Payable 3300000 Toute la Media Chapter 10 Homework Question 11 of 11 225/45 !!! Your answer is correct Prepare a bond premium amortization schedule for the first four interest periods. Interest Expense to Be Recorded Premium Amortization Unamortized Premium Bond Carrying Value 99000 3399000 $ 122100 $ 9900 B9100 3389100 122100 9900 79200 3379200 122100 9900 69300 3369300 122100 9900 59400 3359400 Chapter 10 Homework Question 11 of 11 22.5/45 !!! Prepare the journal entries for interest and the amortization of the premium in 2022 and 2023. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account tities and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec 31, 2022 Dec 31, 2023 Chapter 10 Homework Question 11 of 11 22.5 / 45 !!! Date Account Titles and Explanation Debit Credit Dec. 31, 2022 Dec 31, 2023 cPrepare the journal entries for interest and the amortization of the premium in 2022 and 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started