Answered step by step

Verified Expert Solution

Question

1 Approved Answer

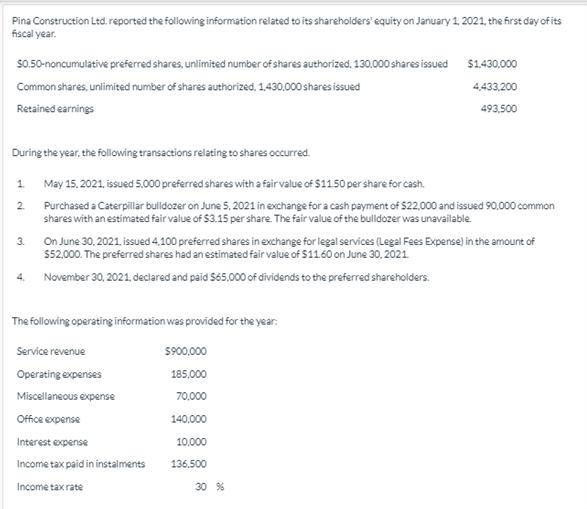

Pina Construction Ltd. reported the following information related to its shareholders' equity on January 1, 2021, the first day of its fiscal year. $0.50-noncumulative

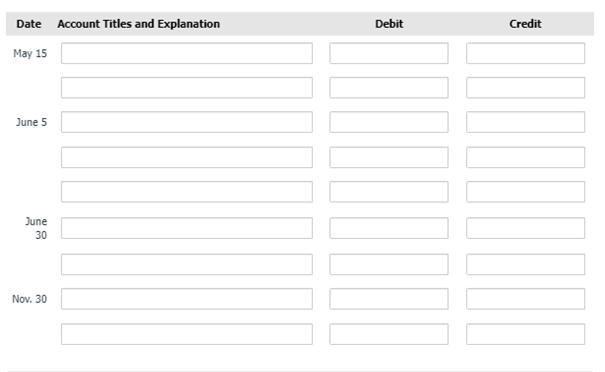

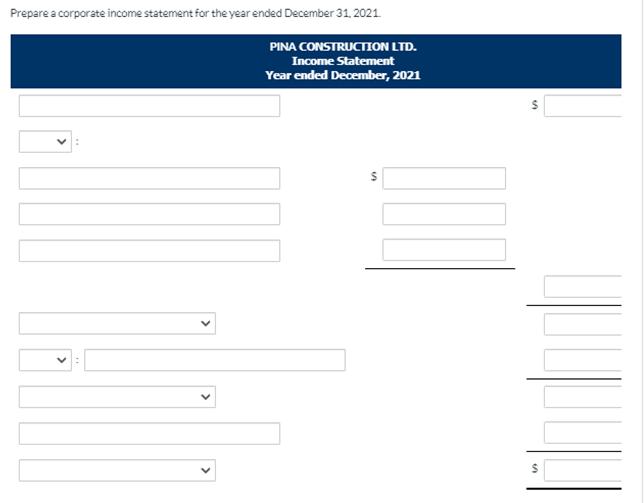

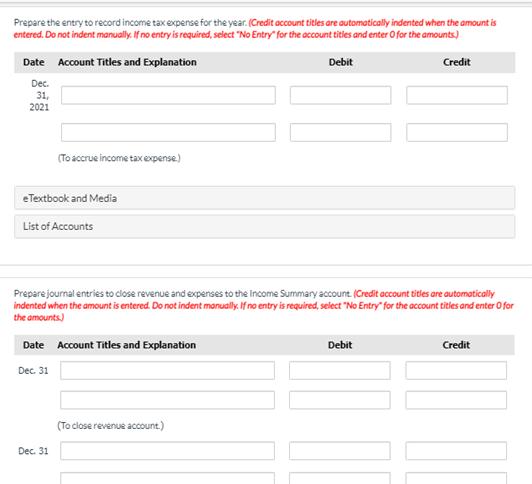

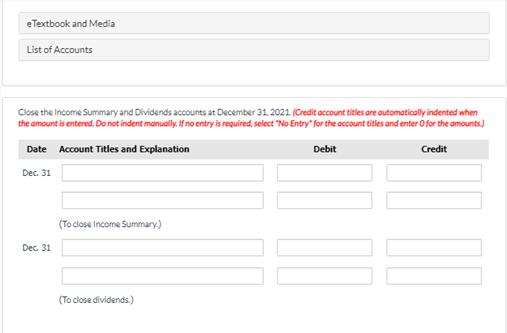

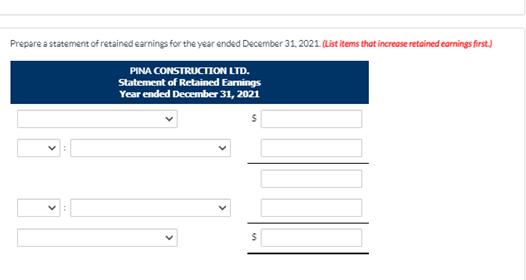

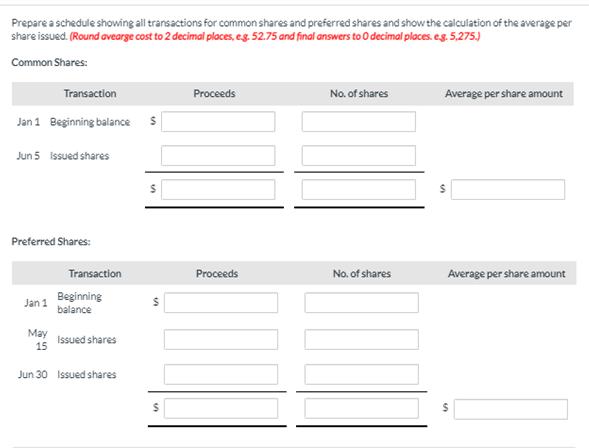

Pina Construction Ltd. reported the following information related to its shareholders' equity on January 1, 2021, the first day of its fiscal year. $0.50-noncumulative preferred shares, unlimited number of shares authorized, 130.000 shares issued $1.430,000 Common shares, unlimited number of shares authorized, 1,430,000 shares issued 4,433,200 Retained earnings 493,500 During the year, the following transactions relating to shares occurred. May 15, 2021, issued 5,000 preferred shares with a fair value of $11.50 per share for cash. Purchased a Caterpillar bulldozer on June 5, 2021 in exchange for a cash payment of $22,000 and issued 90,000 common shares with an estimated fair value of $3.15 per share. The fair value of the bulldozer was unavailable. 1 2. 3. 4 On June 30, 2021, issued 4.100 preferred shares in exchange for legal services (Legal Fees Expense) in the amount of $52,000. The preferred shares had an estimated fair value of $11.60 on June 30, 2021. November 30, 2021, declared and paid $65.000 of dividends to the preferred shareholders. The following operating information was provided for the year: Service revenue $900,000 Operating expenses 185,000 Miscellaneous expense 70,000 140,000 10,000 136.500 Office expense Interest expense Income tax paid in instalments Income tax rate 30 % Date Account Titles and Explanation May 15 June 5 June 30 Nov. 30 Debit Credit Prepare a corporate income statement for the year ended December 31, 2021 PINA CONSTRUCTION LTD. Income Statement Year ended December, 2021 in S lin Prepare the entry to record income tax expense for the year. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts) Debit Date Account Titles and Explanation Dec. 31, 2021 (To accrue income tax expense) eTextbook and Media List of Accounts Prepare journal entries to close revenue and expenses to the Income Summary account. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Date Account Titles and Explanation Dec. 31 Dec. 31 (To close revenue account.) Credit Debit Credit eTextbook and Media List of Accounts Close the Income Summary and Dividends accounts at December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts) Date Account Titles and Explanation Debit Credit Dec. 31 Dec. 31 (To close Income Summary) (To close dividends.) Prepare a statement of retained earnings for the year ended December 31, 2021 (List items that increase retained earnings first.) PINA CONSTRUCTION LTD. Statement of Retained Earnings Year ended December 31, 2021 Prepare a schedule showing all transactions for common shares and preferred shares and show the calculation of the average per share issued. (Round avearge cost to 2 decimal places, e.g. 52.75 and final answers to 0 decimal places. e.g. 5,275.) Common Shares: Jan 1 Beginning balance Transaction Jun 5 issued shares Preferred Shares: Jan 1 May 15 Transaction Beginning balance Issued shares Jun 30 Issued shares $ S Proceeds Proceeds No. of shares No. of shares Average per share amount S Average per share amount

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Common shares transactions 01Jan Beginning Proceed 05Jun issued Shares Preferred Shares ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started