Question

Pine inc. adopts the revaluation model for its plant and machinery. The company acquires one item of plant for HK$10,000 on 1 January 2021.

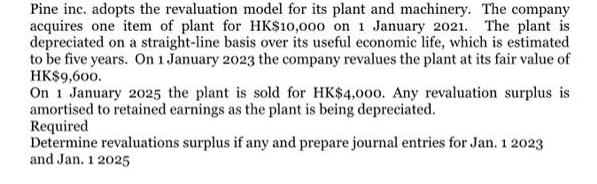

Pine inc. adopts the revaluation model for its plant and machinery. The company acquires one item of plant for HK$10,000 on 1 January 2021. The plant is depreciated on a straight-line basis over its useful economic life, which is estimated to be five years. On 1 January 2023 the company revalues the plant at its fair value of HK$9,600. On 1 January 2025 the plant is sold for HK$4,000. Any revaluation surplus is amortised to retained earnings as the plant is being depreciated. Required Determine revaluations surplus if any and prepare journal entries for Jan. 1 2023 and Jan. 12025

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution Revaluation Surplus On 1 January 2023 the company revalued the plant at its fair value of H...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Calculus For Business, Economics And The Social And Life Sciences

Authors: Laurence Hoffmann, Gerald Bradley, David Sobecki, Michael Price

11th Brief Edition

978-0073532387, 007353238X

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App