Answered step by step

Verified Expert Solution

Question

1 Approved Answer

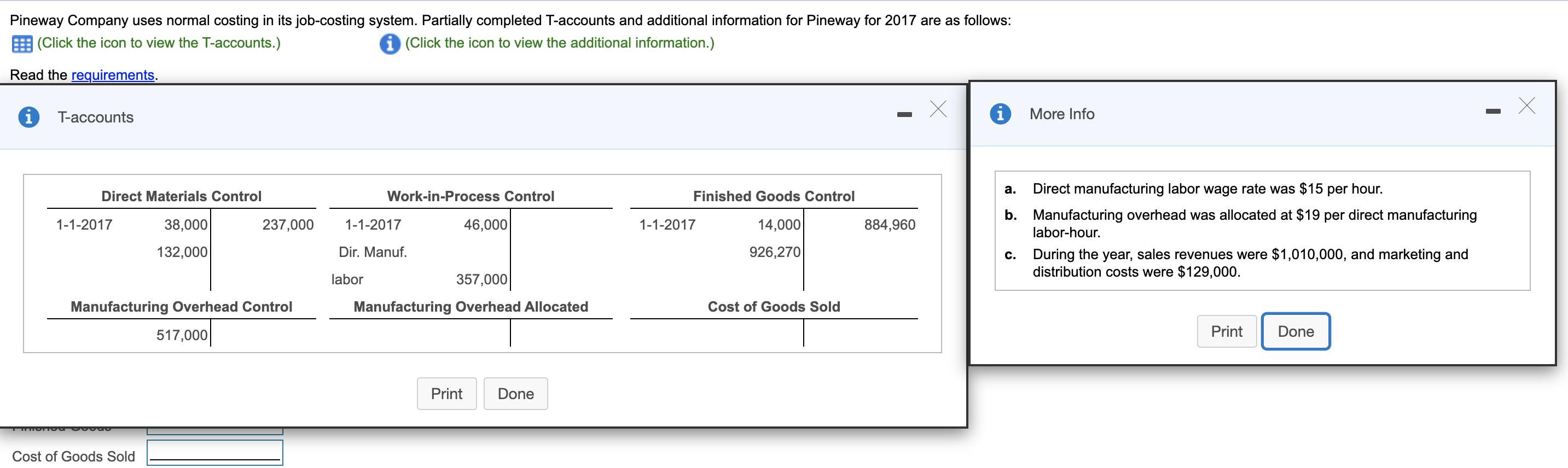

Pineway Company uses normal costing in its job-costing system. Partially completed T-accounts and additional information for Pineway for 2017 are as follows: (Click the

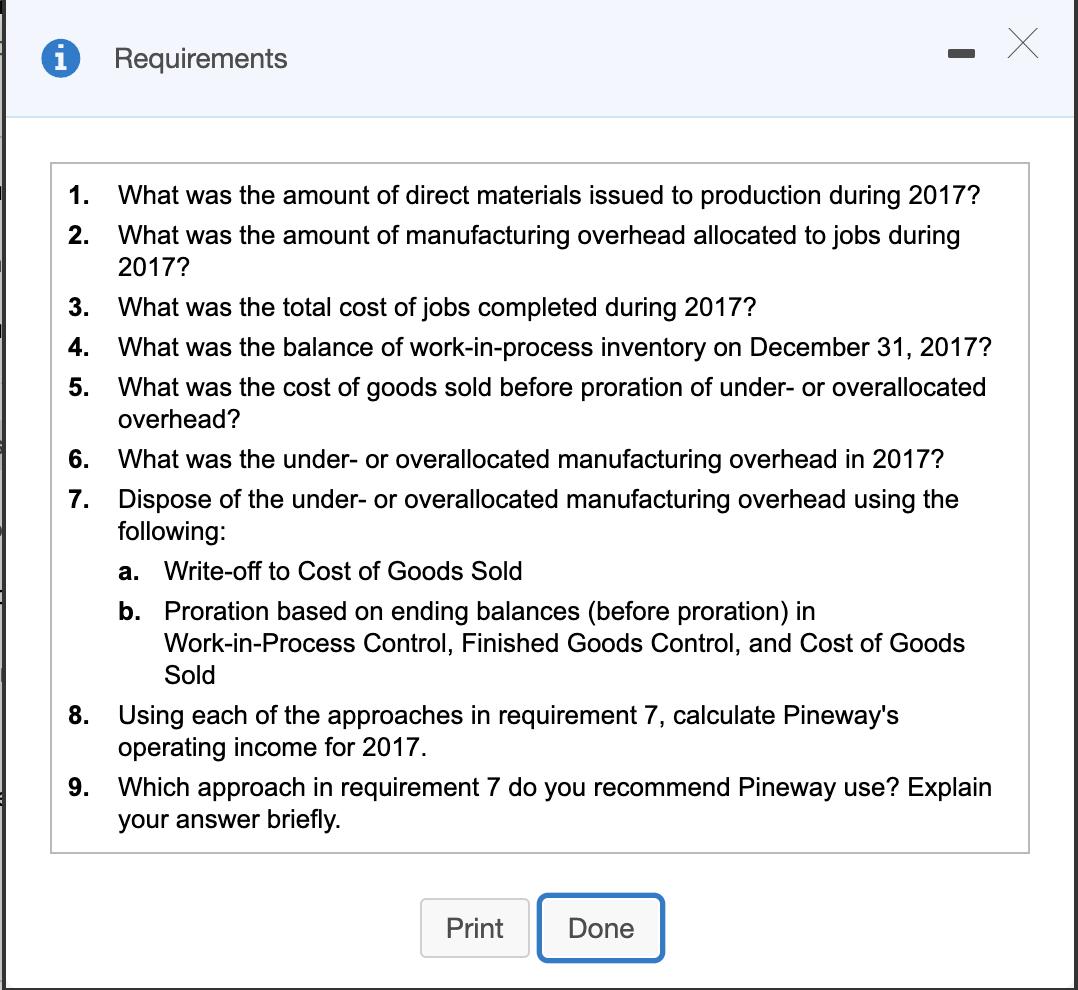

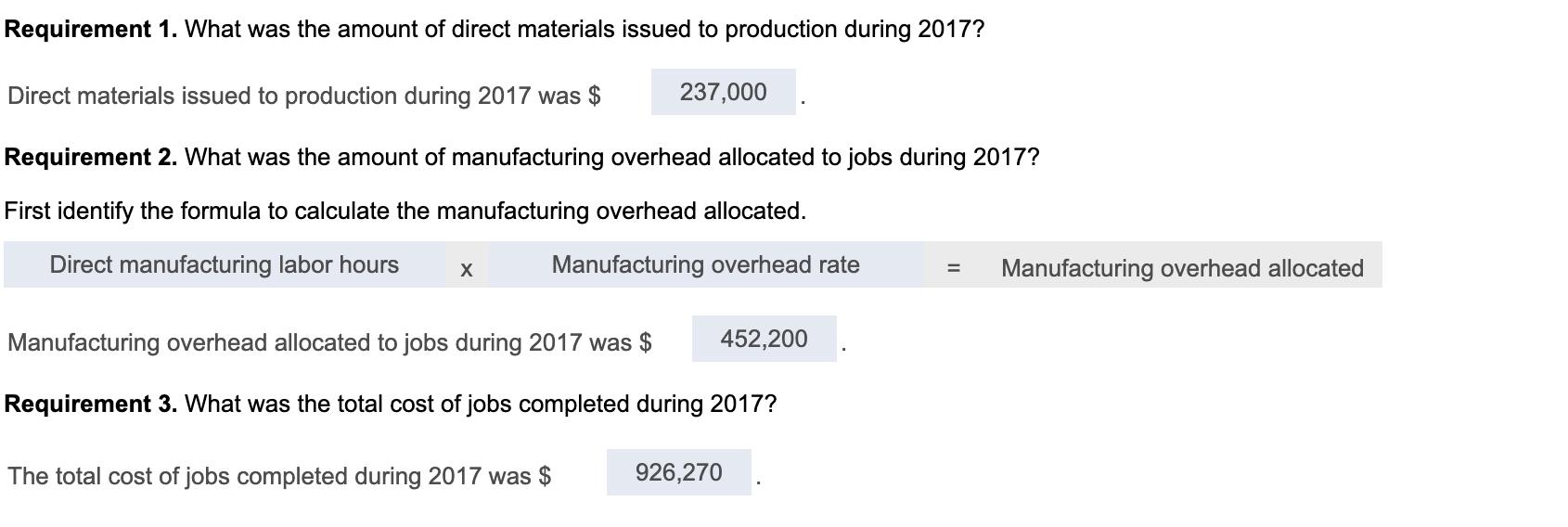

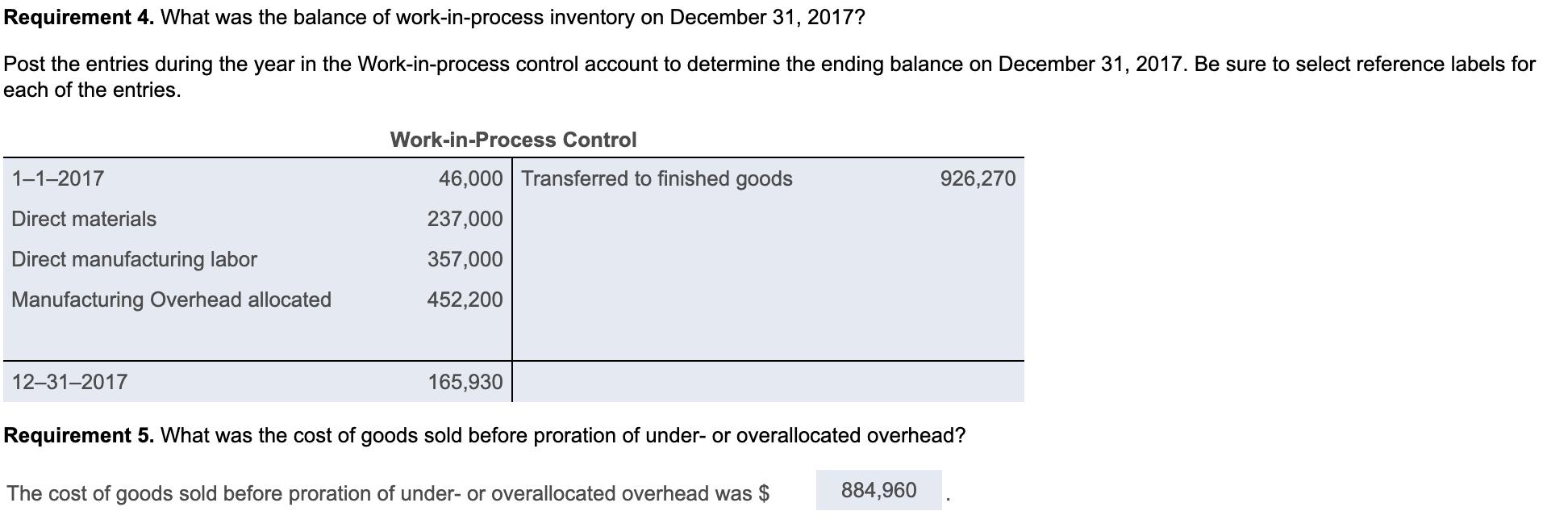

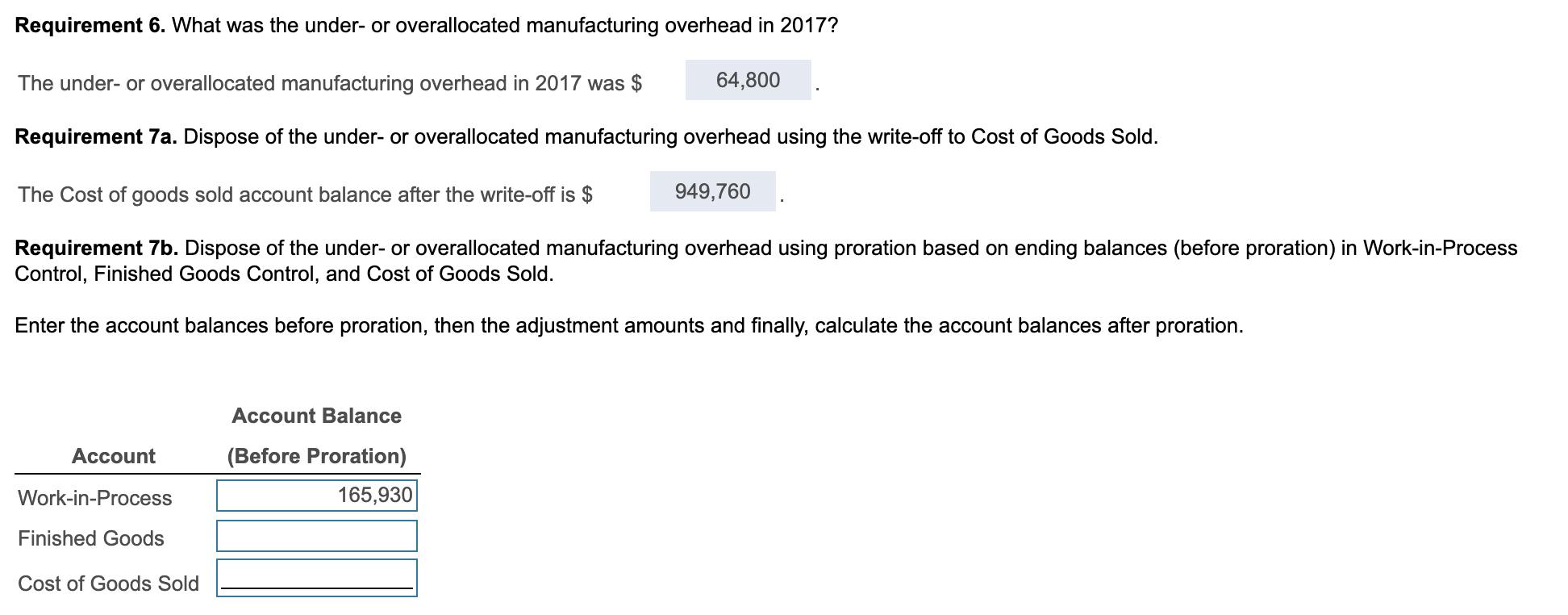

Pineway Company uses normal costing in its job-costing system. Partially completed T-accounts and additional information for Pineway for 2017 are as follows: (Click the icon to view the T-accounts.) (Click the icon to view the additional information.) Read the requirements. T-accounts Direct Materials Control 38,000 132,000 1-1-2017 Manufacturing Overhead Control HOW 0000 Cost of Goods Sold 237,000 517,000 Work-in-Process Control 1-1-2017 Dir. Manuf. labor 357,000 Manufacturing Overhead Allocated 46,000 Print Done Finished Goods Control 14,000 926,270 1-1-2017 Cost of Goods Sold 884,960 X i More Info a. Direct manufacturing labor wage rate was $15 per hour. b. Manufacturing overhead was allocated at $19 per direct manufacturing labor-hour. C. During the year, sales revenues were $1,010,000, and marketing and distribution costs were $129,000. Print Done x i Requirements 1. What was the amount of direct materials issued to production during 2017? 2. What was the amount of manufacturing overhead allocated to jobs during 2017? 3. What was the total cost of jobs completed during 2017? 4. What was the balance of work-in-process inventory on December 31, 2017? 5. What was the cost of goods sold before proration of under- or overallocated overhead? 6. What was the under- or overallocated manufacturing overhead in 2017? Dispose of the under- or overallocated manufacturing overhead using the following: 7. a. Write-off to Cost of Goods Sold b. Proration based on ending balances (before proration) in Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold 8. Using each of the approaches in requirement 7, calculate Pineway's operating income for 2017. 9. Which approach in requirement 7 do you recommend Pineway use? Explain your answer briefly. Print Done Requirement 1. What was the amount of direct materials issued to production during 2017? Direct materials issued to production during 2017 was $ Requirement 2. What was the amount of manufacturing overhead allocated to jobs during 2017? First identify the formula to calculate the manufacturing overhead allocated. Direct manufacturing labor hours Manufacturing overhead rate X 237,000 The total cost of jobs completed during 2017 was $ Manufacturing overhead allocated to jobs during 2017 was $ Requirement 3. What was the total cost of jobs completed during 2017? 452,200 926,270 = Manufacturing overhead allocated Requirement 4. What was the balance of work-in-process inventory on December 31, 2017? Post the entries during the year in the Work-in-process control account to determine the ending balance on December 31, 2017. Be sure to select reference labels for each of the entries. 1-1-2017 Direct materials Direct manufacturing labor Manufacturing Overhead allocated 12-31-2017 Work-in-Process Control 46,000 Transferred to finished goods 237,000 357,000 452,200 165,930 926,270 Requirement 5. What was the cost of goods sold before proration of under- or overallocated overhead? The cost of goods sold before proration of under- or overallocated overhead was $ 884,960 Requirement 6. What was the under- or overallocated manufacturing overhead in 2017? The under- or overallocated manufacturing overhead in 2017 was $ Requirement 7a. Dispose of the under- or overallocated manufacturing overhead using the write-off to Cost of Goods Sold. The Cost of goods sold account balance after the write-off is $ Requirement 7b. Dispose of the under- or overallocated manufacturing overhead using proration based on ending balances (before proration) in Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold. Enter the account balances before proration, then the adjustment amounts and finally, calculate the account balances after proration. Account Work-in-Process Finished Goods Cost of Goods Sold Account Balance (Before Proration) 165,930 64,800 949,760

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started