Answered step by step

Verified Expert Solution

Question

1 Approved Answer

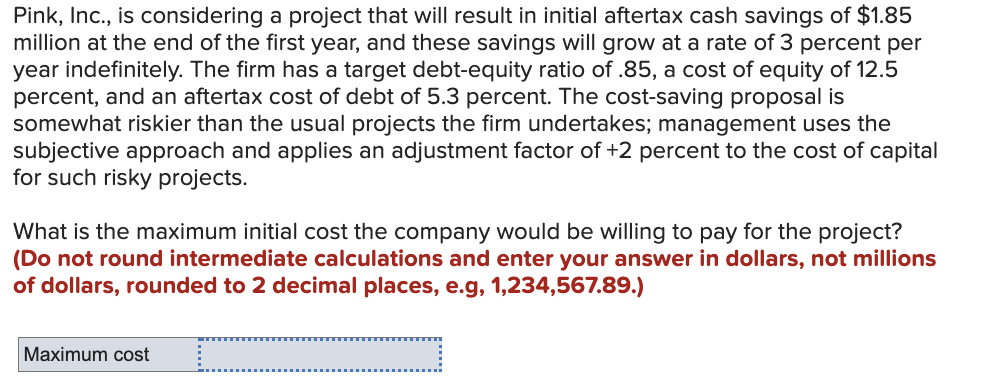

Pink, Inc., Pink, Inc., is considering a project that will result in initial aftertax cash savings of $ 1 . 8 5 million at the

Pink, Inc., Pink, Inc., is considering a project that will result in initial aftertax cash savings of $

million at the end of the first year, and these savings will grow at a rate of percent per

year indefinitely. The firm has a target debtequity ratio of a cost of equity of

percent, and an aftertax cost of debt of percent. The costsaving proposal is

somewhat riskier than the usual projects the firm undertakes; management uses the

subjective approach and applies an adjustment factor of percent to the cost of capital

for such risky projects.

What is the maximum initial cost the company would be willing to pay for the project?

Do not round intermediate calculations and enter your answer in dollars, not millions

of dollars, rounded to decimal places, egis considering a project that will result in initial aftertax cash savings of $ million at the end of the first year, and these savings will grow at a rate of percent per year indefinitely. The firm has a target debtequity ratio of a cost of equity of percent, and an aftertax cost of debt of percent. The costsaving proposal is somewhat riskier than the usual projects the firm undertakes; management uses the subjective approach and applies an adjustment factor of percent to the cost of capital for such risky projects.

What is the maximum initial cost the company would be willing to pay for the project? Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to decimal places, eg

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started