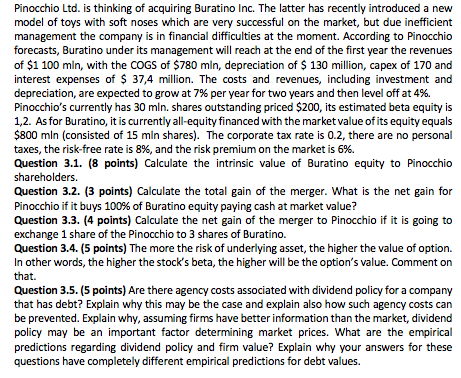

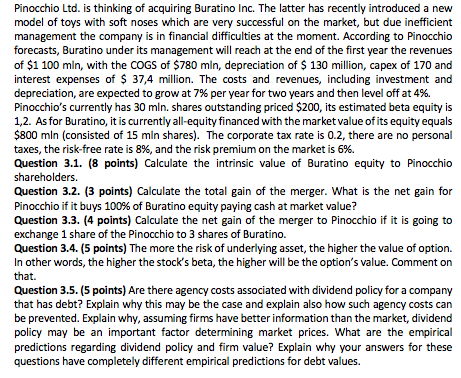

Pinocchio Ltd. is thinking of acquiring Buratino Inc. The latter has recently introduced a new model of toys with soft noses which are very successful on the market, but due inefficient management the company is in financial difficulties at the moment. According to Pinocchio forecasts, Buratino under its management will reach at the end of the first year the revenues of $1 100 mln, with the COGS of $780 mln, depreciation of $ 130 million, capex of 170 and interest expenses of S 37,4 million. The costs and revenues, including investment and depreciation, are expected to grow at 7% per year for two years and then level off at 4%. Pinocchio's currently has 30 mln. shares outstanding priced $200, its estimated beta equity is 1,2. As for Buratino, it is currently all-equity financed with the market value of its equity equals $800 mln (consisted of 15 mln shares. The corporate tax rate is 0.2, there are no personal taxes, the risk-free rate is 8%, and the risk premium on the market is 6%. Question 3.1. (8 points) Calculate the intrinsic value of Buratino equity to Pinocchio shareholders Question 3.2. (3 points) Calculate the total gain of the merger. What is the net gain for Pinocchio if it buys 100% of Buratino equity paying cash at market value? Question 3.3. (4 points) Calculate the net gain of the merger to Pinocchio if it is going to exchange 1 share of the Pinocchio to 3 shares of Buratino Question 3.4. (5 points) The more the risk of underlying asset, the higher the value of option In other words, the higher the stock's beta, the higher will be the option's value. Comment on that Question 3.5. (5 points) Are there agency costs associated with dividend policy for a company that has debt? Explain why this may be the case and explain also how such agency costs can be prevented. Explain why, assuming firms have better information than the market, dividend policy may be an important factor determining market prices. What are the empirical predictions regarding dividend policy and firm value? Explain why your answers for these questions have completely different empirical predictions for debt values