Answered step by step

Verified Expert Solution

Question

1 Approved Answer

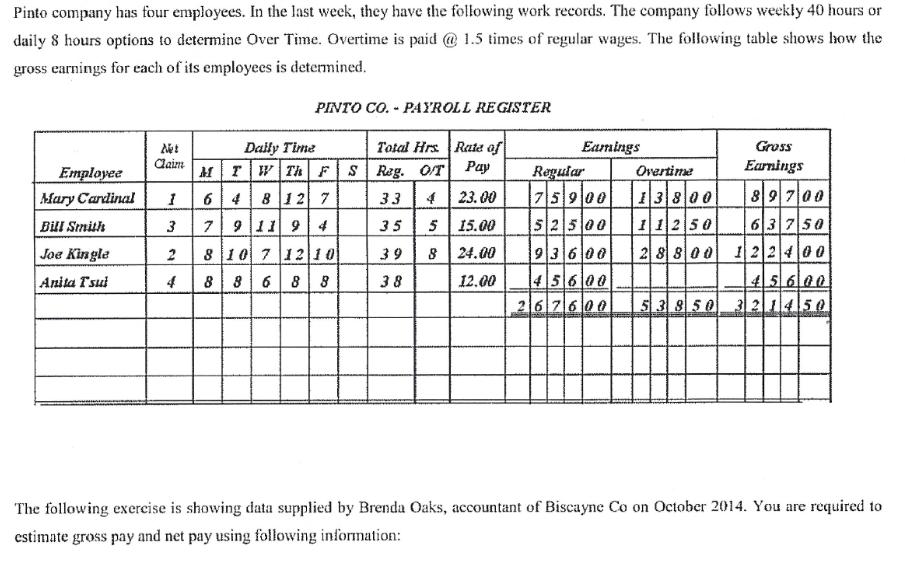

Pinto company has four employees. In the last week, they have the following work records. The company follows weekly 40 hours or daily 8

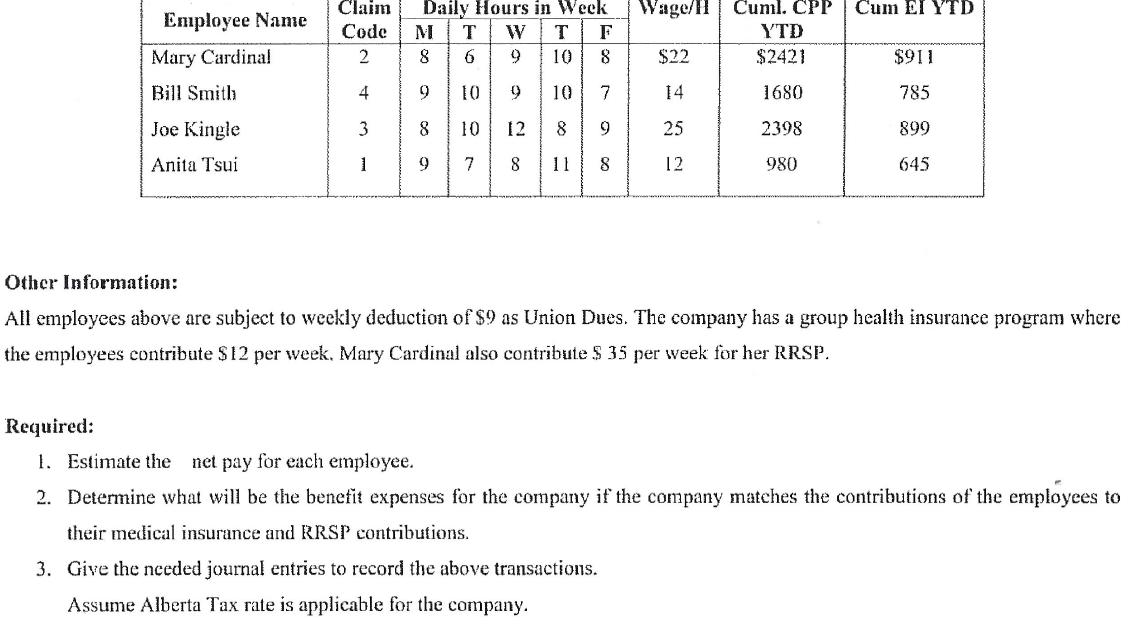

Pinto company has four employees. In the last week, they have the following work records. The company follows weekly 40 hours or daily 8 hours options to determine Over Time. Overtime is paid @ 1.5 times of regular wages. The following table shows how the gross earnings for each of its employees is detenmined. PINTO CO. - PAYROLL REGISTER Total Hrs. Rate of Pay Daily Time Eamings Gross Caim Earnings MTW THFS Rag. O/T 6 4 812 7 7911 9 4 Employee Regular Overtime Mary Cardinal 1 33 23. 00 |5|9100 13800 | 8|9|001 Bill Smith 3 35 5 15.00 52500 11250 6 3750 93600 45600 Joe Kingle 2 8 800 122400 8 10 7 1210 886 8 8 2 39 8 24.00 45 600 53 950 321450 Anita Tsui 4 38 12.00 26 76 00 The following exercise is showing data supplied by Brenda Ouks, accountant of Biscayne Co on October 2014. You are requircd to estimate gross pay and net pay using following information: Claim Daily Hours in Week Wage/H Cuml. CPP Cum EI YTD Employee Name Code M T W T F YTD Mary Cardinal 2 8 6 10 8 $22 $2421 $911 Bill Smith 4 9 10 10 7 14 1680 785 Joe Kingle 3 8 10 12 9 25 2398 899 Anita Tsui 1 9 7 8 11 8 12 980 645 Other Information: All employees above are subject to weekly deduction of $9 as Union Dues. The company has a group health insurance program where the employees contribute S12 per week, Mary Cardinal also contribute $ 35 per week for her RRSP. Required: 1. Estimate the net pay for each employee. 2. Determine what will be the benefit expenses for the company if the company matches the contributions of the employees to their medical insurance and RRSP contributions. 3. Give the nceded journal entries to record the above transactions. Assume Alberta Tax rate is applicable for the company.

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

PAYROLL REGISTER Daily hours in a week Total Hours Rate of the Pay Earnings Gross Earnings CPP Rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

605038a84668c_73129.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started