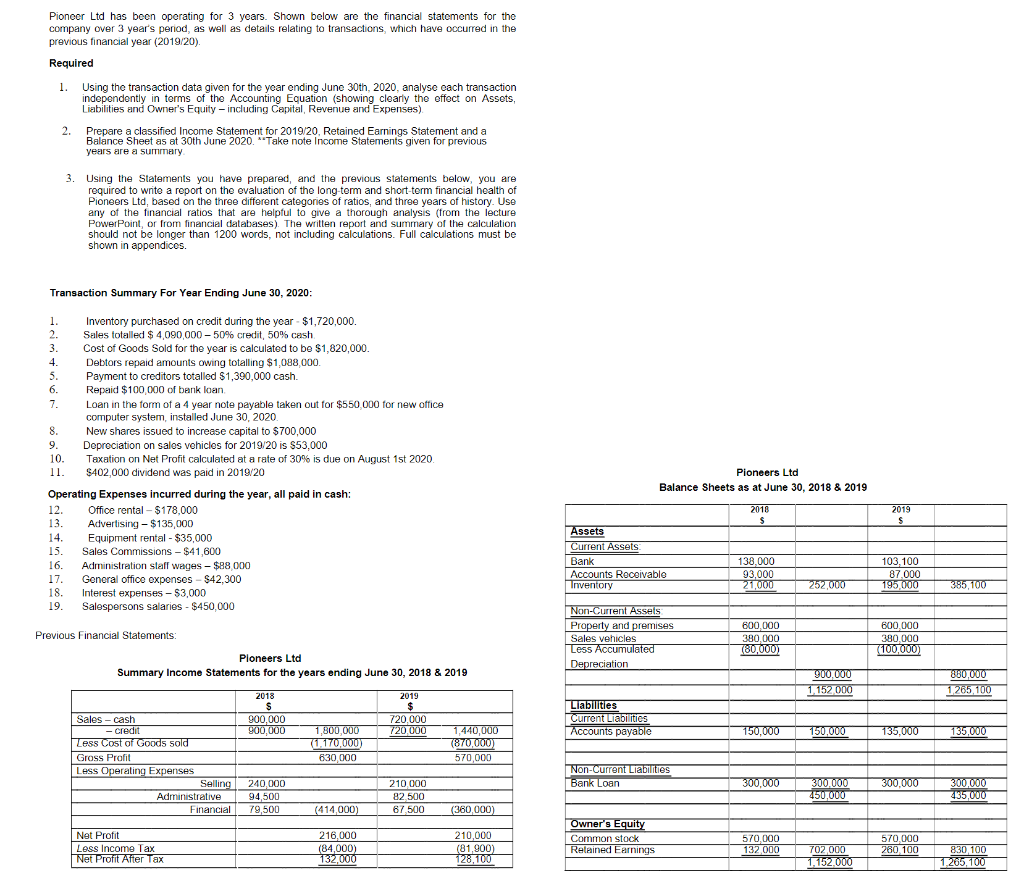

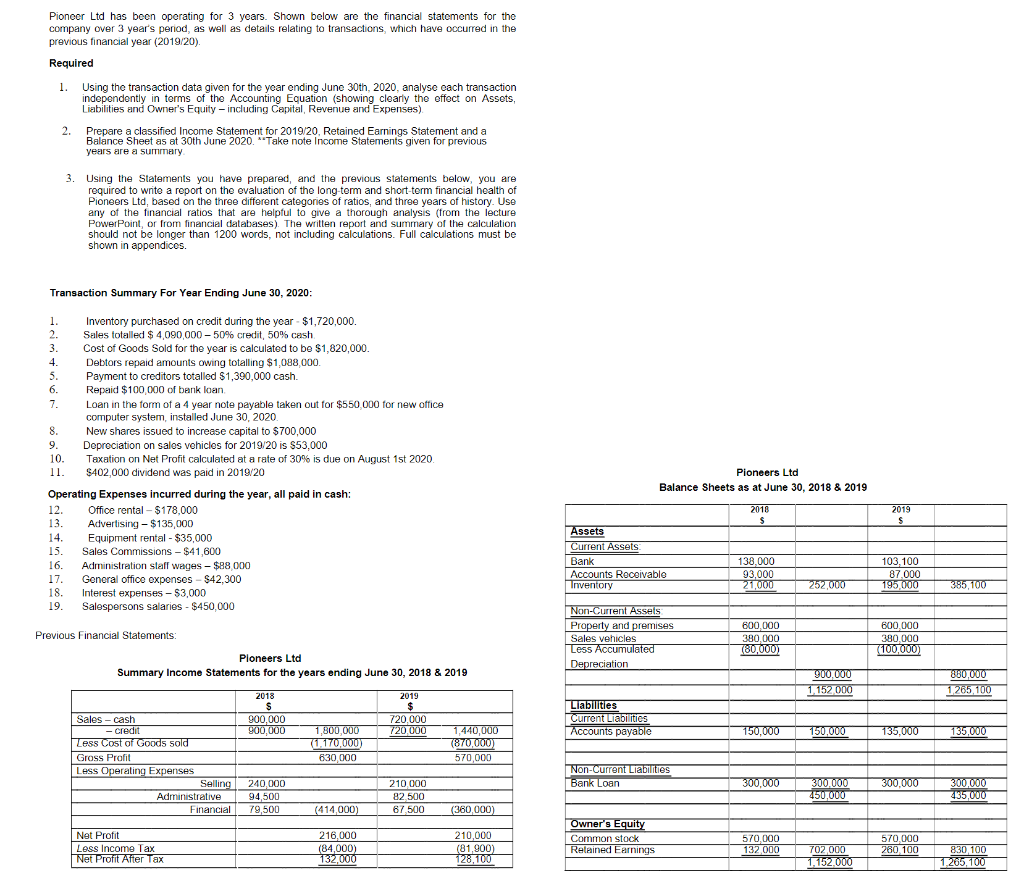

Pioneer Ltd has been operating for 3 years. Shown below are the financial statements for the company over 3 year's period, as well as details relating to transactions, which have occurred in the previous financial year (2019/20). Required 1. Using the transaction data given for the year ending June 30th, 2020, analyse cach transaction independently in terms of the Accounting Equation (showing clearly the effect on Assets, Liabilities and Owner's Equity - including Capital Revenue and Expenses) 2. Prepare a classified Income Statement for 2019/20, Retained Earnings Statement and a Balance Sheet as at 30th June 2020. "Take note Income Statements given for previous years are a summary 3. Using the Statements you have prepared, and the previous statements below, you are required to write a report on the evaluation of the long-term and short-term financial health of Pioneers Ltd, based on the three different categories of ratios, and three years of history. Use any of the financial ratios that are helpful to give a thorough analysis (from the lecture PowerPoint, or from financial databases). The written report and summary of the calculation should not be longer than 1200 words, not including calculations. Full calculations must be shown in appendices. Transaction Summary For Year Ending June 30, 2020: 1. Inventory purchased on credit during the year - $1,720,000. 2. Sales totalled $ 4,090,000 - 50% credit, 50% cash 3. Cost of Goods Sold for the year is calculated to be $1,820,000 4. Debtors repaid amounts owing totalling $1,098,000. 5. Payment to creditors totalled $1,390,000 cash. 6. Repaid $100,000 of bank loan 7. Loan in the form of a 4 year note payable taken out for $550 000 for new office computer system, installed June 30, 2020 8. New shares issued to increase capital to $700,000 9. Depreciation on salos vehiclos for 2019/20 is $53,000 10. Taxation on Net Profit calculated at a rate of 30% is due on August 1st 2020 $402,000 dividend was paid in 2019/20 $ Operating Expenses incurred during the year, all paid in cash: 12. Office rental - $178,000 13. Advertising - $135,000 14. Equipment rental - $35,000 15. Sales Commissions - $41,600 16. Administration staff wages - $88 000 17. General office expenses - S42,300 18. Interest expenses - $3,000 19. Salespersons salaries - $450,000 11. Pioneers Ltd Balance Sheets as at June 30, 2018 8 2019 2018 S 2019 S Assets Current Assets Bank Accounts Receivable Inventory 138,000 93,000 21,000 103, 100 87.000 195.000 252.000 385,100 Previous Financial Statements: Non-Current Assets Property and premises Sales vehicles Less Accumulated Depreciation 600.000 380,000 (80,000) 600,000 380,000 (100,000 Ploneers Ltd Summary Income Statements for the years ending June 30, 2018 & 2019 900,000 1,152 000 800.000 1265 100 2018 S 900.000 900,000 2019 $ 720,000 720.000 Liabilities Current Liabilities Accounts payable 150,000 150.000 135,000 135,000 1.800.000 (1.170,000 630,000 1,440,000 (870,000) 570,000 Sales - cash - Credit Less Cost of Goods sold Gross Profit Less Operating Expenses Selling Administrative Financial Non-Current Liabilities Bank Loan 300,000 300.000 240,000 94,500 79,500 210 000 82.500 67.500 300.000 450,000 300.000 435,000 (414,000) (360,000) Net Profit Less Income Tax Net Profit After Tax 216,000 (84,000) 132,000 210,000 (81,900) 128,100 Owner's Equity Common stock Relained Earnings 570,000 132 000 570,000 260 100 702 000 1.152.000 830 100 1.205,100 Pioneer Ltd has been operating for 3 years. Shown below are the financial statements for the company over 3 year's period, as well as details relating to transactions, which have occurred in the previous financial year (2019/20). Required 1. Using the transaction data given for the year ending June 30th, 2020, analyse cach transaction independently in terms of the Accounting Equation (showing clearly the effect on Assets, Liabilities and Owner's Equity - including Capital Revenue and Expenses) 2. Prepare a classified Income Statement for 2019/20, Retained Earnings Statement and a Balance Sheet as at 30th June 2020. "Take note Income Statements given for previous years are a summary 3. Using the Statements you have prepared, and the previous statements below, you are required to write a report on the evaluation of the long-term and short-term financial health of Pioneers Ltd, based on the three different categories of ratios, and three years of history. Use any of the financial ratios that are helpful to give a thorough analysis (from the lecture PowerPoint, or from financial databases). The written report and summary of the calculation should not be longer than 1200 words, not including calculations. Full calculations must be shown in appendices. Transaction Summary For Year Ending June 30, 2020: 1. Inventory purchased on credit during the year - $1,720,000. 2. Sales totalled $ 4,090,000 - 50% credit, 50% cash 3. Cost of Goods Sold for the year is calculated to be $1,820,000 4. Debtors repaid amounts owing totalling $1,098,000. 5. Payment to creditors totalled $1,390,000 cash. 6. Repaid $100,000 of bank loan 7. Loan in the form of a 4 year note payable taken out for $550 000 for new office computer system, installed June 30, 2020 8. New shares issued to increase capital to $700,000 9. Depreciation on salos vehiclos for 2019/20 is $53,000 10. Taxation on Net Profit calculated at a rate of 30% is due on August 1st 2020 $402,000 dividend was paid in 2019/20 $ Operating Expenses incurred during the year, all paid in cash: 12. Office rental - $178,000 13. Advertising - $135,000 14. Equipment rental - $35,000 15. Sales Commissions - $41,600 16. Administration staff wages - $88 000 17. General office expenses - S42,300 18. Interest expenses - $3,000 19. Salespersons salaries - $450,000 11. Pioneers Ltd Balance Sheets as at June 30, 2018 8 2019 2018 S 2019 S Assets Current Assets Bank Accounts Receivable Inventory 138,000 93,000 21,000 103, 100 87.000 195.000 252.000 385,100 Previous Financial Statements: Non-Current Assets Property and premises Sales vehicles Less Accumulated Depreciation 600.000 380,000 (80,000) 600,000 380,000 (100,000 Ploneers Ltd Summary Income Statements for the years ending June 30, 2018 & 2019 900,000 1,152 000 800.000 1265 100 2018 S 900.000 900,000 2019 $ 720,000 720.000 Liabilities Current Liabilities Accounts payable 150,000 150.000 135,000 135,000 1.800.000 (1.170,000 630,000 1,440,000 (870,000) 570,000 Sales - cash - Credit Less Cost of Goods sold Gross Profit Less Operating Expenses Selling Administrative Financial Non-Current Liabilities Bank Loan 300,000 300.000 240,000 94,500 79,500 210 000 82.500 67.500 300.000 450,000 300.000 435,000 (414,000) (360,000) Net Profit Less Income Tax Net Profit After Tax 216,000 (84,000) 132,000 210,000 (81,900) 128,100 Owner's Equity Common stock Relained Earnings 570,000 132 000 570,000 260 100 702 000 1.152.000 830 100 1.205,100