Answered step by step

Verified Expert Solution

Question

1 Approved Answer

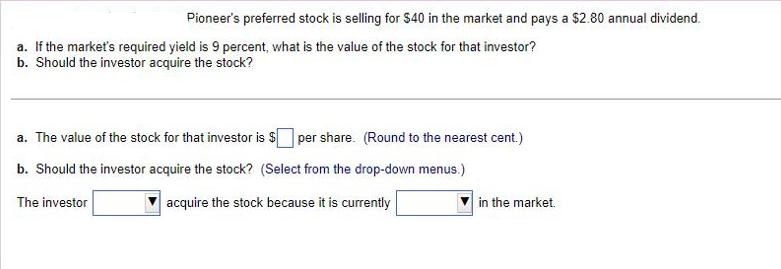

Pioneer's preferred stock is selling for $40 in the market and pays a $2.80 annual dividend. a. If the market's required yield is 9

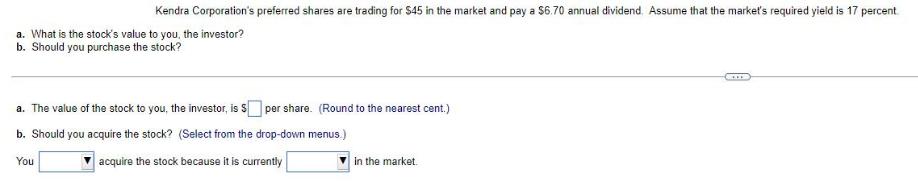

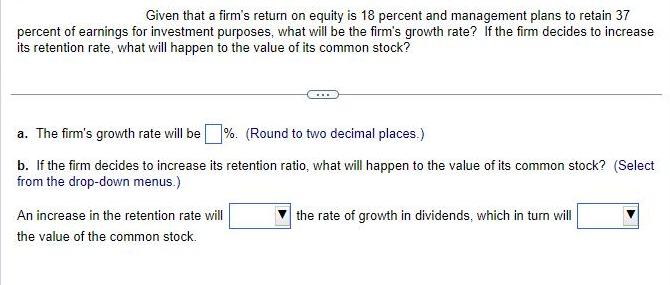

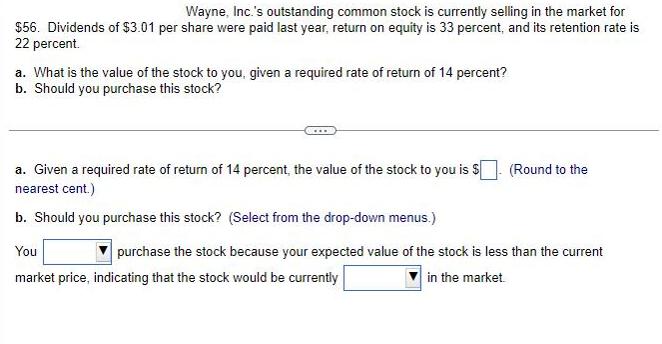

Pioneer's preferred stock is selling for $40 in the market and pays a $2.80 annual dividend. a. If the market's required yield is 9 percent, what is the value of the stock for that investor? b. Should the investor acquire the stock? a. The value of the stock for that investor is $ per share. (Round to the nearest cent.) b. Should the investor acquire the stock? (Select from the drop-down menus.) acquire the stock because it is currently The investor in the market. Kendra Corporation's preferred shares are trading for $45 in the market and pay a $6.70 annual dividend. Assume that the market's required yield is 17 percent a. What is the stock's value to you, the investor? b. Should you purchase the stock? a. The value of the stock to you, the investor, is $ per share. (Round to the nearest cent.) b. Should you acquire the stock? (Select from the drop-down menus.) acquire the stock because it is currently You in the market. *** Given that a firm's return on equity is 18 percent and management plans to retain 37 percent of earnings for investment purposes, what will be the firm's growth rate? If the firm decides to increase its retention rate, what will happen to the value of its common stock? a. The firm's growth rate will be%. (Round to two decimal places.) b. If the firm decides to increase its retention ratio, what will happen to the value of its common stock? (Select from the drop-down menus.) An increase in the retention rate will the value of the common stock. the rate of growth in dividends, which in turn will Wayne, Inc.'s outstanding common stock is currently selling in the market for $56. Dividends of $3.01 per share were paid last year, return on equity is 33 percent, and its retention rate is 22 percent. a. What is the value of the stock to you, given a required rate of return of 14 percent? b. Should you purchase this stock? a. Given a required rate of return of 14 percent, the value of the stock to you is $. (Round to the nearest cent.) b. Should you purchase this stock? (Select from the drop-down menus.) You market price, indicating that the stock would be currently purchase the stock because your expected value of the stock is less than the current in the market.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Pioneers preferred stock a If the market required yield is 5 percent what is the value of the stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started