Answered step by step

Verified Expert Solution

Question

1 Approved Answer

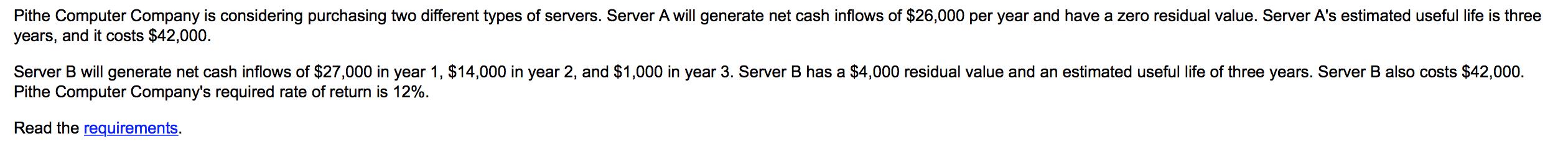

Pithe Computer Company is considering purchasing two different types of servers. Server A will generate net cash inflows of $26,000 per year and have

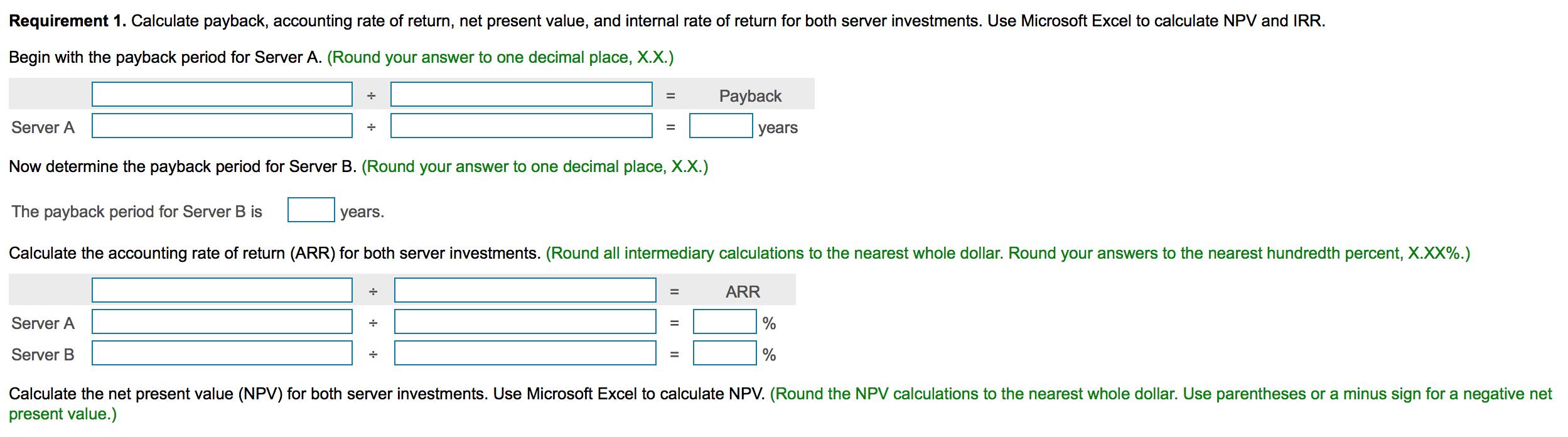

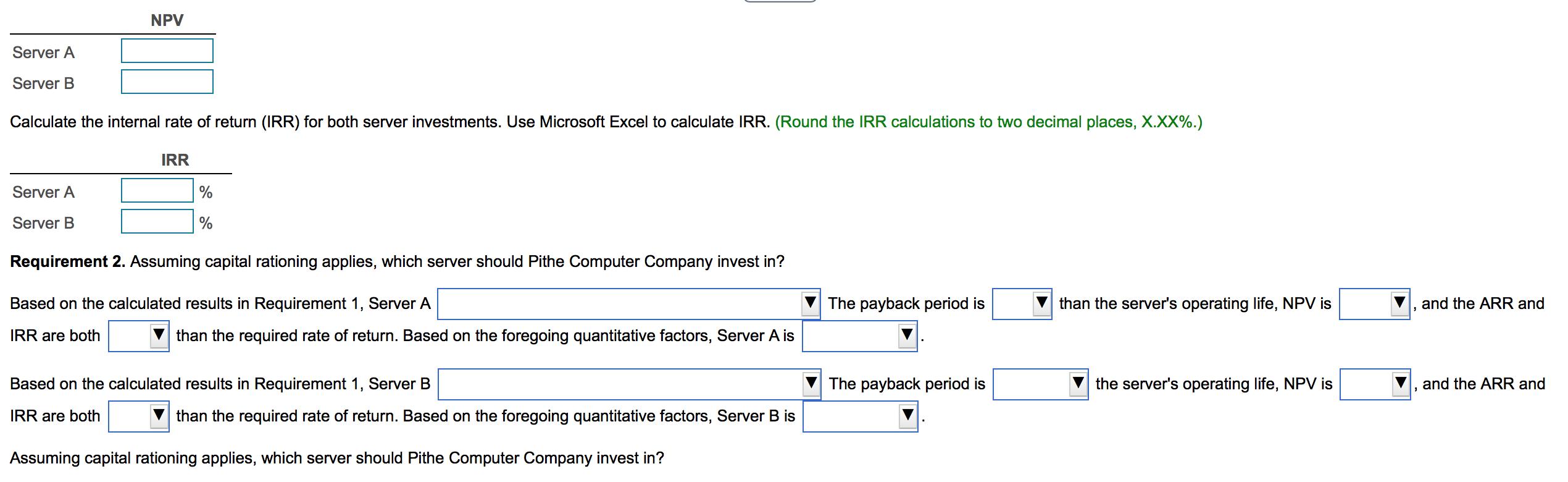

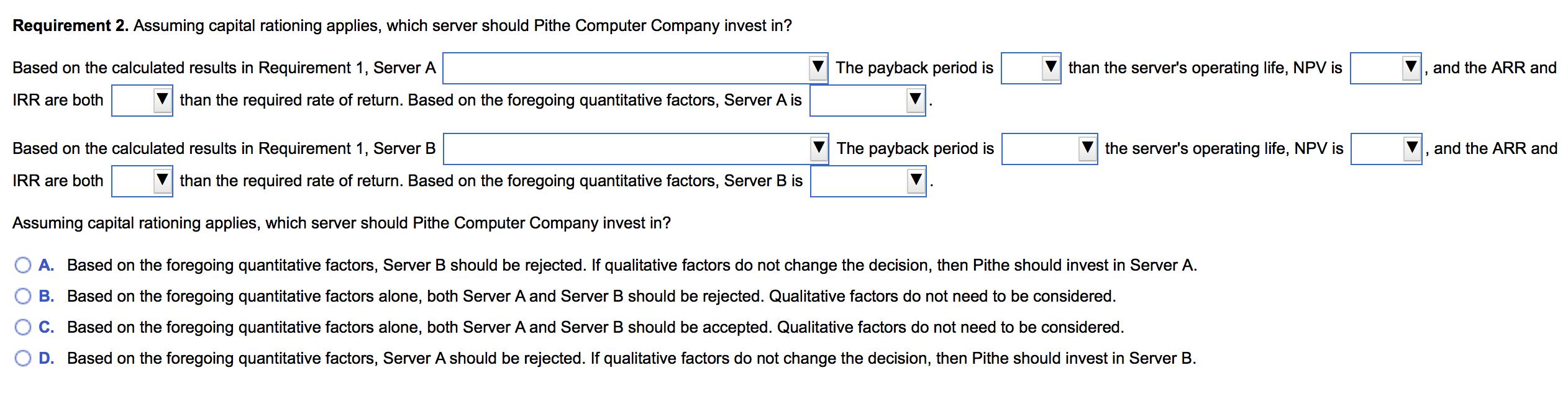

Pithe Computer Company is considering purchasing two different types of servers. Server A will generate net cash inflows of $26,000 per year and have a zero residual value. Server A's estimated useful life is three years, and it costs $42,000. Server B will generate net cash inflows of $27,000 in year 1, $14,000 in year 2, and $1,000 in year 3. Server B has a $4,000 residual value and an estimated useful life of three years. Server B also costs $42,000. Pithe Computer Company's required rate of return is 12%. Read the requirements. Requirement 1. Calculate payback, accounting rate of return, net present value, and internal rate of return for both server investments. Use Microsoft Excel to calculate NPV and IRR. Begin with the payback period for Server A. (Round your answer to one decimal place, X.X.) Server A + Server A Server B years. = + = Now determine the payback period for Server B. (Round your answer to one decimal place, X.X.) The payback period for Server B is Calculate the accounting rate of return (ARR) for both server investments. (Round all intermediary calculations to the nearest whole dollar. Round your answers to the nearest hundredth percent, X.XX%.) = Payback = years ARR % % Calculate the net present value (NPV) for both server investments. Use Microsoft Excel to calculate NPV. (Round the NPV calculations to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) Server A Server B NPV Calculate the internal rate of return (IRR) for both server investments. Use Microsoft Excel to calculate IRR. (Round the IRR calculations to two decimal places, X.XX%.) IRR Server A Server B % % Requirement 2. Assuming capital rationing applies, which server should Pithe Computer Company invest in? Based on the calculated results in Requirement 1, Server A IRR are both than the required rate of return. Based on the foregoing quantitative factors, Server A is Based on the calculated results in Requirement 1, Server B IRR are both than the required rate of return. Based on the foregoing quantitative factors, Server B is Assuming capital rationing applies, which server should Pithe Computer Company invest in? The payback period is The payback period is than the server's operating life, NPV is the server's operating life, NPV is and the ARR and and the ARR and Requirement 2. Assuming capital rationing applies, which server should Pithe Computer Company invest in? Based on the calculated results in Requirement 1, Server A IRR are both than the required rate of return. Based on the foregoing quantitative factors, Server A is Based on the calculated results in Requirement 1, Server B IRR are both than the required rate of return. Based on the foregoing quantitative factors, Server B is The payback period is The payback period is than the server's operating life, NPV is the server's operating life, NPV is Assuming capital rationing applies, which server should Pithe Computer Company invest in? A. Based on the foregoing quantitative factors, Server B should be rejected. If qualitative factors do not change the decision, then Pithe should invest in Server A. B. Based on the foregoing quantitative factors alone, both Server A and Server B should be rejected. Qualitative factors do not need to be considered. C. Based on the foregoing quantitative factors alone, both Server A and Server B should be accepted. Qualitative factors do not need to be considered. D. Based on the foregoing quantitative factors, Server A should be rejected. If qualitative factors do not change the decision, then Pithe should invest in Server B. 3 and the ARR and and the ARR and

Step by Step Solution

★★★★★

3.60 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Step No 1 Payback Periodrefers to the length of time an investment takes to re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started