Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PITI stands for principal, interest, taxes, and insurance, the four basic components of most mortgage payments. Typical amortization tables and other payment calculators generally only

PITI stands for principal, interest, taxes, and insurance, the four basic components of most mortgage payments. Typical amortization tables and other payment calculators generally only account for two of these principal and interest so be certain that any payment calculation methods applied include all the components applicable to a client. Private mortgage insurance PM will apply in most cases when the balance on a loan is greater than of the original principal.Private Mortgage InsurancePMI is a type of insurance frequently used with conventional loans. Like other kinds of mortgage insurance, PM protects the lender, not the borrower, in the event that the borrower stops making payments on their loan.Generally, it is arranged by the lender and provided by private insurance companies. PM usually is required on a conventional loan with a down payment of less than of the home's purchase price. In a refinance with a conventional loan where equity is less than percent of the value of your home, PM may be required as well.Paying PMIThere are several different ways to pay for PMI.Some lenders may offer more than one option, while others will not. It is advisable to have clients ask about their options up front when they meet with their lenders.The most common method of payment is through a monthly premium, which normally would be added to the monthly mortgage payment. The premium is shown on the Loan Estimate and Closing Disclosure on page in the Projected Payments section.Another method for paying the PM is with a onetime premium paid at closing. This premium would be shown on the Loan Estimate and Closing Disclosure on page in section BIf paid this way, then when the client goes to sell or refinance, they may not be entitled to a refund of the prepaid premium.A third way to pay is a hybrid of the first two, involving both upfront and monthly premiums.This monthly premium appears on the Loan Estimate and Closing Disclosure on page in the Projected Payments section, while the initial premium is shown on the Loan Estimate and Closing Disclosure on page in section BFactors to Consider when Choosing a Loan with PMILike other kinds of mortgage insurance, PMI can help a buyer qualify for a loan they might not otherwise be able to However, it increases the cost of the loan, and doesn't protect the borrower if they run into problems on their mortgage. Some lenders may offer low down payment conventional loans that do not require PMI.However, these loans likely will demand a higher interest rate, which can be more or less expensive than paying PMI, depending on the borrower's credit score, the down payment amount, the lender, and general market conditions. There may be tax implications making a consultation with a tax advisor worth consideration.Borrowers planning on a low down payment may want to look into other types of loans, such as an FHA loan. For more on FHA and other government loans, see Lesson below.These other types of loans also may be more or less expensive than a conventional loan withPMI, depending on the same factors listed above.Read the scenarios below and then answer the questions that follow each of the different buyer scenarios. A calculator will be helpful. Note that all numbers are approximate and rounded for easier calculation, so select the nearest reasonable answers. You might want to consult an online amortization schedule to compare location, interest rate and credit score impact.All scenarios are based on: Conventional loans Borrowers with credit scores A Dallas zip code Interest information available as of January PMI calculated a that is onehalf of one percent of the original loan amount per year All PMI paid is being wrapped into the monthly premiumBuyer AbigailAbigail is going to buy a $ home. She is putting down and is responsible for the $ annual property taxes spread out evenly over the monthly payments. Her interest rate is for a year loan, so her monthly payment for principal and interest only will be$

Question

Question

Not yet answered

Flag question

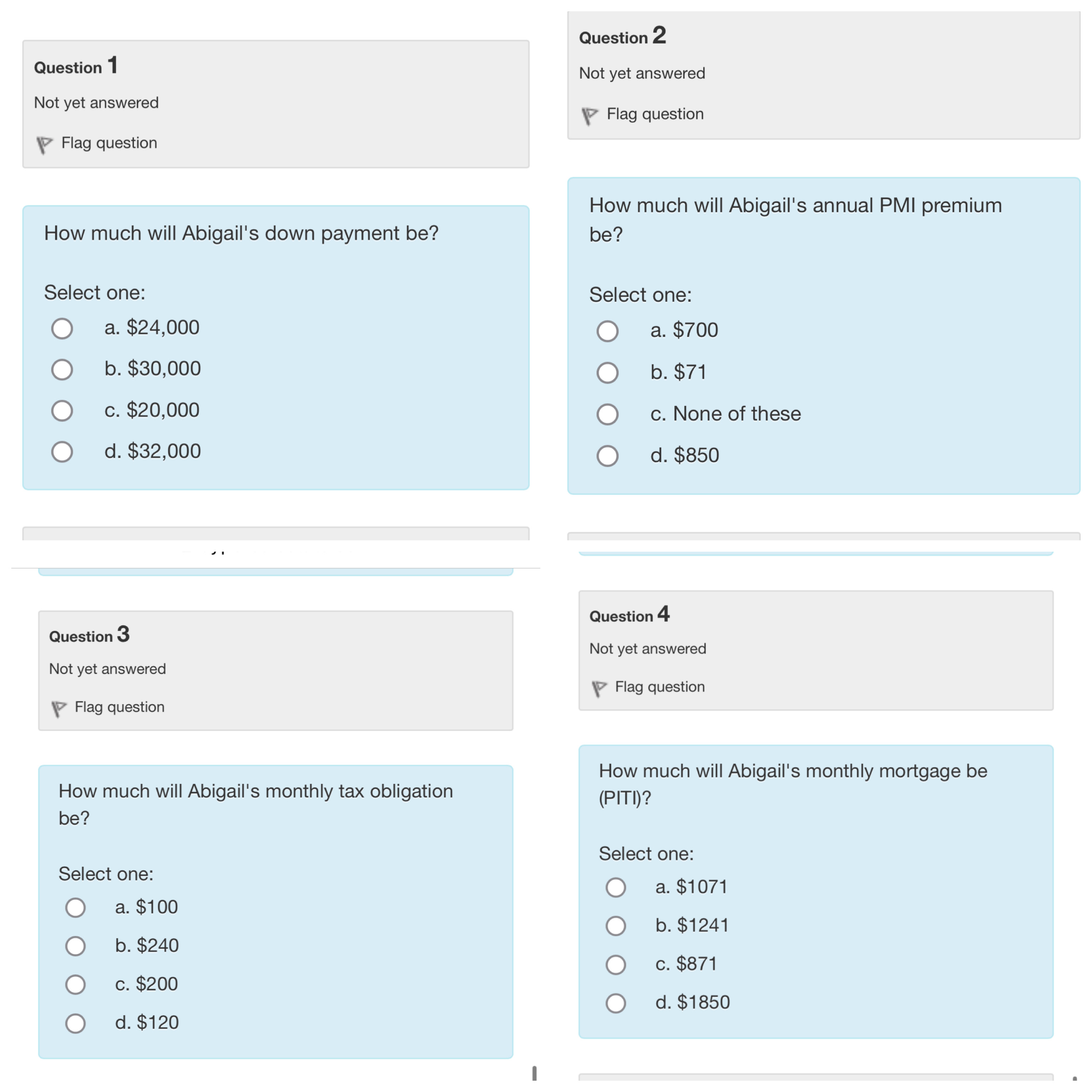

How much will Abigail's down payment be

Select one:

a $

b $

c $

d $

Not yet answered

Flag question

How much will Abigail's annual PMI premium be

Select one:

a $

b $

c None of these

d $

Question

Not yet answered

Flag question

How much will Abigail's monthly tax obligation be

Select one:

a $

b $

c $

d $

Question

Not yet answered

Flag question

How much will Abigail's monthly mortgage be

Select one:

a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started