Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pitman Company is a small editorial services company owned and operated by Jan Pitman. On October 31, 2019, the end of the current year,

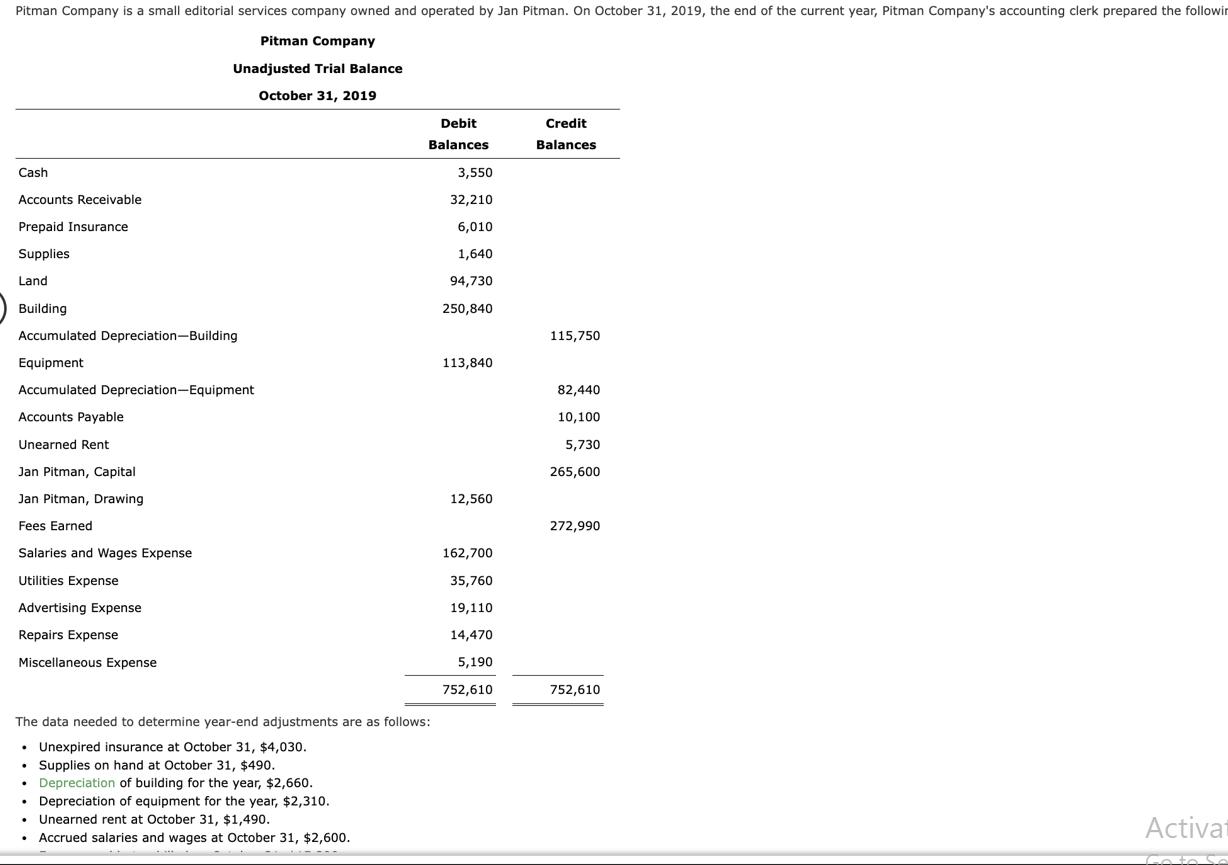

Pitman Company is a small editorial services company owned and operated by Jan Pitman. On October 31, 2019, the end of the current year, Pitman Company's accounting clerk prepared the followin Pitman Company Unadjusted Trial Balance October 31, 2019 Debit Credit Balances Balances Cash 3,550 Accounts Receivable 32,210 Prepaid Insurance 6,010 Supplies 1,640 Land 94,730 Building 250,840 Accumulated Depreciation-Building 115,750 Equipment 113,840 Accumulated Depreciation-Equipment 82,440 Accounts Payable 10,100 Unearned Rent 5,730 Jan Pitman, Capital 265,600 Jan Pitman, Drawing 12,560 Fees Earned 272,990 Salaries and Wages Expense 162,700 Utilities Expense 35,760 Advertising Expense 19,110 Repairs Expense 14,470 Miscellaneous Expense 5,190 752,610 752,610 The data needed to determine year-end adjustments are as follows: Unexpired insurance at October 31, $4,030. Supplies on hand at October 31, $490. Depreciation of building for the year, $2,660. Depreciation of equipment for the year, $2,310. Unearned rent at October 31, $1,490. Accrued salaries and wages at October 31, $2,600. Activa eBook The data needed to determine year-end adjustments are as follows: Unexpired insurance at October 31, $4,030. Supplies on hand at October 31, $490. Depreciation of building for the year, $2,660. Depreciation of equipment for the year, $2,310. Unearned rent at October 31, $1,490. Accrued salaries and wages at October 31, $2,600. Fees earned but unbilled on October 31, $15,290. Required: 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense-Building; Depreciation Expense-E Expense. a. b. C. d. e. f. g. 1. Journalize the adjusting entries using the following additional accounts, Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation Expense-Building, Depreciation Expense-Ed Expense. Pitman Company Adjusted Trial Balance October 31, 2019 eBook 1. Journalize the adjusting entries using the following additional accounts, Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation Expense-Building, Depreciation ExpenseEd Expense. Pitman Company Adjusted Trial Balance October 31, 2019 Debit Balances Credit Balances

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the yearend adjustments for Pitman Company based on the given da...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e6b4bec7bc_956597.pdf

180 KBs PDF File

663e6b4bec7bc_956597.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started